- As expected this past Thursday the ECB lowered its Main Refinancing Rate by another 25 basis points to an interest rate of 2.25%. The European Central Bank made it clear this is likely the last interest rate cut for a while and they will now try to allow economic results over the mid-term determine their next actions.

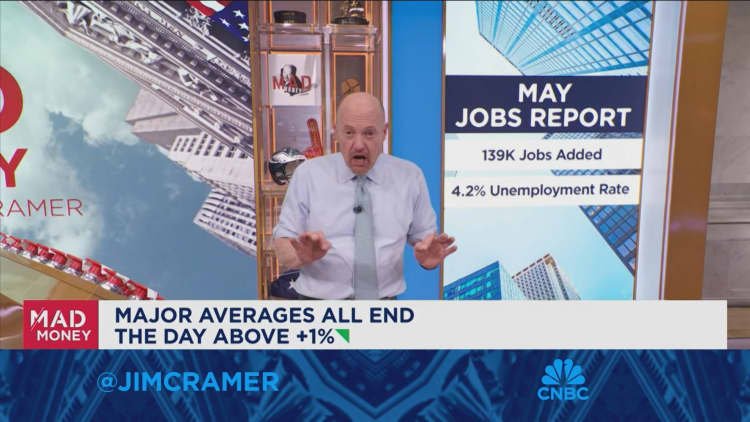

- Meaning the ECB is now going to wait on the U.S Fed to act. Friday’s U.S jobs numbers came in slightly better than expected, but analysts are arguing about interpretations.

- The EUR/USD moved lower going into the weekend, but did this after touching mid-term highs on Thursday which saw the 1.15000 level coming into sight. Consumer Price Index data will come from the U.S this Wednesday and this will affect sentiment in Forex.

- Forex trading remains unsteady and trends have been difficult for short-term wagers. Financial institutions appear to still be leaning into a weaker USD outlook.

- Over the mid-term the EUR/USD has certainly recovered value, but its move upwards has been filled by bursts of volatility which have left vulnerable day traders open to a Forex market that has not been easy to navigate. A one month chart of the EUR/USD does show upwards movement, but not an easily accomplished trend.

Whether the U.S Fed will actually cut interest rates in July remains unclear. Many analysts believe the U.S central bank should act with a rate cut, but the Fed continues to preach uncertainty. However, inflation data from the U.S has been tame and this is allowing President Trump to campaign for the Fed to act. Financial institutions may be leaning into sentiment that an interest rate is going to happen, but the choppy results in the broad Forex market and the EUR/USD continue to produce headwinds when it appears too much buying has occurred.

Speculators hoping to take advantage of financial institutions and existing sentiment are not finding it easy. The EUR/USD went into this weekend near the 1.13945 ratio which opens the door to consideration of the 1.14000 level. However, since the EUR/USD closed with a downwards trend, day traders should be careful of looking for a quick fix upwards on early Monday. Instead they should allow the market to open and examine risk sentiment after the European markets open in order to grasp short-term sentiment. U.S inflation via CPI this coming Wednesday will be important.

After being in the White House for over four months President Trump’s rhetoric may not be hitting financial institutions with the same influence it did early on. Experienced traders understand near-term volatility will be seen via Trump influence, but mid-term outlook appears to be rather calm. If U.S inflation numbers this coming Wednesday and Thursday are calm and meet expectations, this will give another dose of power to Trump’s loud voice for lower U.S interest rates.

- The EUR/USD has certainly seen strong tests lower, but over the mid-term the currency pair has fought back and stayed within a realm that continues to cling to the 1.14000 level.

- The price of the EUR/USD since the second week of April has traversed current levels now being traded.

- Technical traders may want to continue to look at support levels as places to wager on upside, but make sure they do not get too greedy about higher ratios being sustained.

Trading the EUR/USD since the second week of April has been a test of willpower. A rather consistent price range has formed. Last week’s highs which came within sight of 1.15000 were not surprising. But the lower move should have been expected too. Financial institutions still likely believe additional upside is possible, but they are going to need some additional impetus to sustain momentum higher. If U.S CPI and PPI data coming this week demonstrates it is under control this could be a needed push.

If the U.S Fed begins to signal it will consider an interest rate cut in a stronger fashion perhaps this will help ignite EUR/USD buying, but the Fed will also have to say it is considering deeper cuts as long as inflation remains under control. For the moment the U.S Fed appears unwilling to take a pro-active stance. The EUR/USD appears able to move higher, but until support levels incrementally increase and prove durable a range fight may continue in the near-term.

Ready to trade our weekly forecast? We’ve shortlisted the best European brokers in the industry for you