- The EUR/USD has been able to hold onto the upper elements of its long-term price range. Yes, the currency pair went into the weekend well below its high around 1.18315 touched last Tuesday, but the broad Forex market saw volumes start to decrease significantly on Thursday and into Friday before going into the weekend.

- The EUR/USD actually finished the week’s trading with a bit of an upwards trend after touching lows around 1.17200 vicinity on Thursday.

- The EUR/USD was certainly effected by the debate and passage of President Trump’s Big Beautiful Bill, which was signed and delivered on Thursday. The spending bill which was also signed by President Trump late last week is likely to create some risk appetite in the broad financial markets tomorrow and Tuesday. How this will be translated into the EUR/USD will be interesting to see.

The ability of the EUR/USD to trade above 1.18000 early last week may be a sign that financial institutions believe there is more upside to achieve. It could be interpreted by some traders that the selloff afterwards happened when some financial institutions thought the currency pair had been overbought, but also might have been an effect of sluggish Forex volume Thursday and Friday because of the U.S holiday being celebrated.

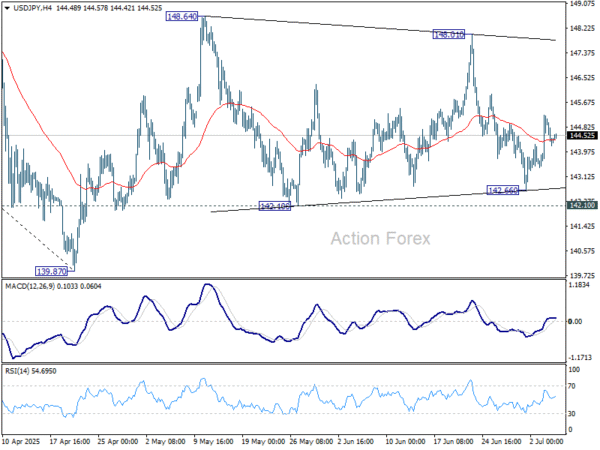

The EUR/USD will be intriguing out of the gates early this week. As volumes return to normal, equilibrium in the EUR/USD will likely be tested and some traders may believe more upside potential is ready to be demonstrated. However, a risk event this coming week looms. The 9th of July tariff deadline will be another test regarding behavioral sentiment. Financial institutions have been down this road before, and perhaps they have already acted on their outlooks regarding what might be said by President Trump and the U.S White House later this week. But are financial institutions correct?

The upside price action in the EUR/USD has been significant since February of this year. The ability to sustain higher elements is clearly being produced. Yes, there have been reversals lower in the EUR/USD on occasion, but the trend upwards has been dominate.

The 9th of July tariff announcements and results will get the attention of traders, but this Wednesday the Federal Reserve’s Meeting Minutes will be published late in the day and this should be monitored.

While the public knows President Trump is having an open debate with Fed Chairman Jerome Powell, it will be interesting to see if FOMC members are being a bit more aggressive overtly regarding disagreements regarding the Federal Funds Rate behind closed doors.

The Fed is scheduled to have its next FOMC meeting in late July.

Interest rate outlooks are a big part of the current value of the EUR/USD, and it appears many financial institutions have already priced in interest rate cuts of at least 25 basis points and perhaps 50.

The EUR/USD showed ability to stay above 1.17000 with relative ease the past week of trading. The upwards momentum may look overdone to some day traders, but they should be careful about betting against the prevailing trend. For those who want to look for pockets of downside price action, quick hitting targets may best be pursued after additional upside action has taken place, but risk management will be needed diligently.

The opening of the EUR/USD will be interesting tomorrow as full volume returns. If the EUR/USD is trading above the 1.17800 realm after the return of North American financial institutions on Monday, this should be considered a bullish signal that additional upside may be targeted. Traders may grow nervous going into the 9th of July because of the coming tariff news from the White House, speculators should be conservative with their wagers as this day draws closer.

Ready to trade our weekly forecast? We’ve shortlisted the best European brokers in the industry for you