Key Highlights

- EUR/USD extended gains above the 1.1650 resistance.

- The pair is now consolidating below the 1.1750 resistance on the 4-hour chart.

- GBP/USD rallied above the 1.3650 and 1.3720 levels.

- USD/JPY might find bids near the 143.50 support zone.

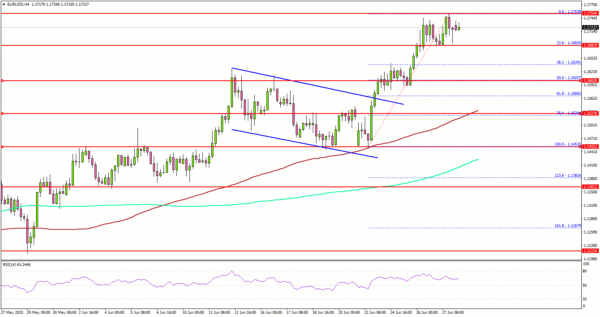

EUR/USD Technical Analysis

The Euro started a steady increase above the 1.1650 level against the US Dollar. EUR/USD cleared many hurdles to enter a positive zone.

Looking at the 4-hour chart, the pair started an upward move by clearing a bullish flag pattern with resistance at 1.1565. It settled above the 1.1650 level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour).

The pair even cleared the 1.1720 level and tested the 1.1750 zone. It is now consolidating gains. On the downside, immediate support is near the 1.1680 level. The next key support sits near 1.1640.

Any more losses could send the pair toward the 1.1600 support zone. If the bulls remain active above the stated support levels, there could be a fresh increase. On the upside, the pair could face resistance near the 1.1750 level.

The next key resistance sits near the 1.1780 level. The first major resistance sits at 1.1800. A close above the 1.1800 level could set the pace for another increase. In the stated case, the pair could even clear the 1.1880 resistance. The next major stop for the bulls could be near the 1.1950 resistance.

Looking at GBP/USD, the pair gained pace for an upside break above the 1.3650 and 1.3720 resistance levels. The next key hurdle sits at 1.3800.

Upcoming Economic Events:

- German Consumer Price Index for June 2025 (YoY) (Prelim) – Forecast +2.1%, versus +2.1% previous.

- German Consumer Price Index for June 2025 (MoM) (Prelim) s– Forecast +0.2%, versus +0.1% previous.

- ECB’s President Lagarde speech.