- The EUR/USD price sees a fresh buying wave as geopolitical tensions de-escalate.

- The ECB’s shift of tone may provide an additional boost to the euro.

- Market participants are eyeing the FOMC meeting this week.

The EUR/USD price maintains a strong bullish momentum despite the Middle East tension that weighed on the pair on Friday. The price stays above the mid-1.1500 area through the early European session.

-If you are interested in forex day trading then have a read of our guide to getting started-

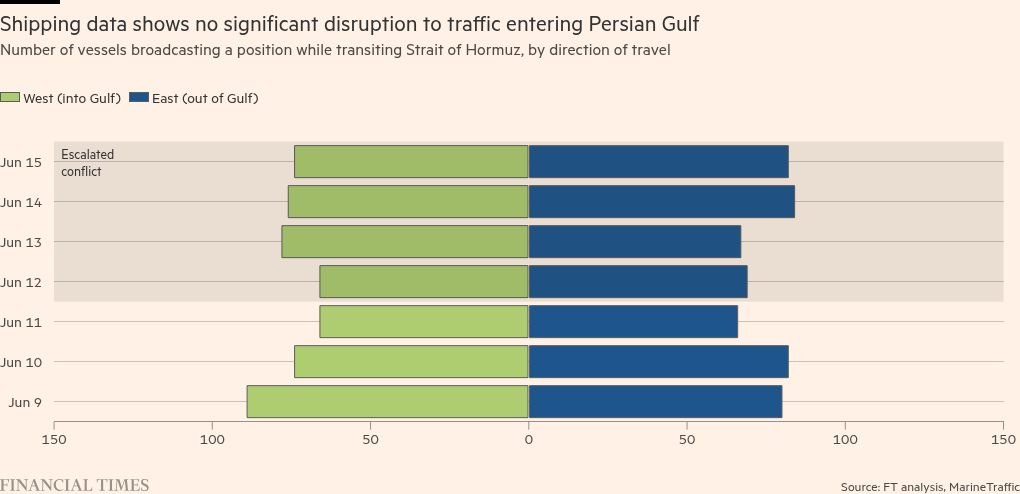

After a renewed strike between Israel and Iran, US President Trump urged both countries to make peace. Earlier, the markets saw a turmoil amid Israel’s attacks on Iranian nuclear and military facilities, killing many. The retaliatory attack by Iran also killed civilians in Israel. Global stocks plummeted on Friday.

However, European stocks have started the day on a positive note, as the probability of heading to the peace is higher for now. The US dollar comes under pressure as the risk appetite improves.

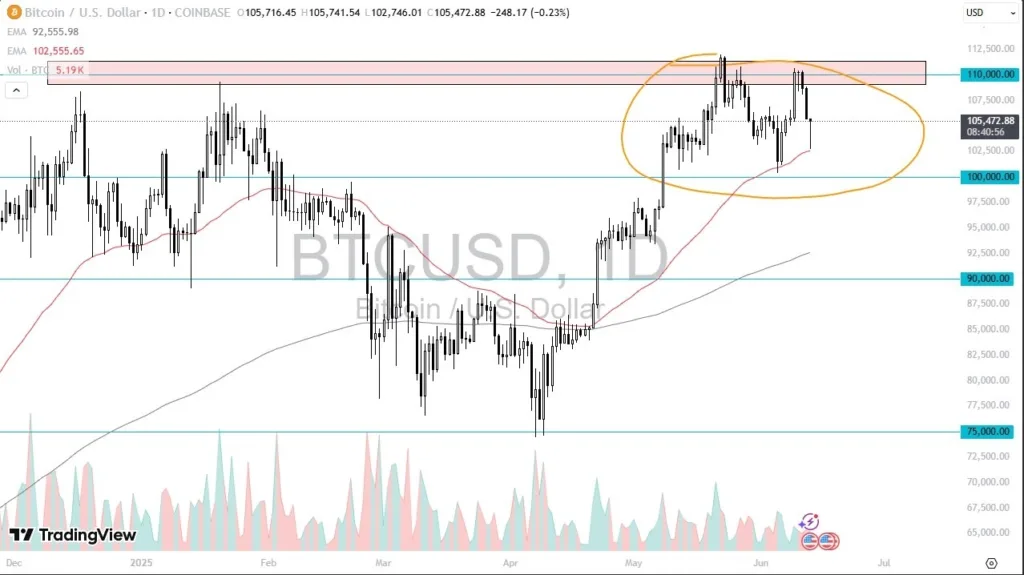

On the trade front, last week’s US-China trade talks boosted the risk sentiment. More negotiations will be carried later that could result in reaching mutually agreed terms. Hence, the risk assets may see a rally.

This week’s most important event is the FOMC meeting, where markets expect no change in the interest rates. However, the policy statement by the Fed Chair is key to watch, as clues about future guidance to the rate cuts can be found.

On the other hand, the ECB’s Nagel commented today that the central bank is flexible and is not going to signal a pause or a rate cut due to the higher amount of uncertainty. He also said that the ECB has already accomplished its objectives and there will be no rate cuts in the summer.

Key Events Ahead

There is no major event due today. Hence, market participants will be watching geopolitical developments and trade talks for fresh impetus.

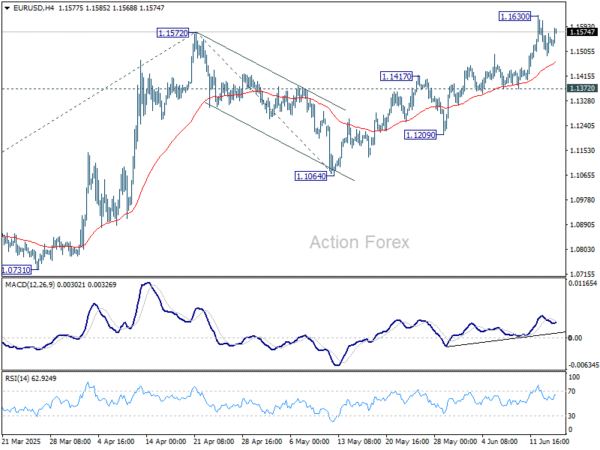

EUR/USD Technical Price Analysis: Downside Limited by 20-SMA

The 4-hour chart shows a stubborn support by the 20-period SMA that limits the downside potential of the pair. However, the chart also shows a bearish pinbar with a multi-year high at 1.1632. It suggests the pair has a strong resistance at the level.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Hence, the pair is expected to play between the 20-SMA and the pinbar high. The RSI is at 65.0 for now, gradually reaching the overbought zone. So, the pair may see a retracement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.