- The EUR/USD price turns its head to 1.2000 as the US dollar weakens.

- Trump’s criticism of the Fed and shifting rate cut expectations weigh on the dollar.

- The looming tariff deadline and dovish Fed may push the euro further up.

The EUR/USD price extends its winning streak to a sixth consecutive session on Thursday, surging to the highest level since September 2021, above the 1.1700 mark. The rally was primarily driven by dollar weakness amid Trump’s criticism of the Fed Chair and his potential announcement of a replacement, as well as the de-escalation in the Middle East.

–Are you interested in learning more about the next cryptocurrency to explode? Check our detailed guide-

According to a WSJ report, President Trump could name a new Fed Chair as soon as September or October, several months ahead of Powell’s official term ending in May 2026. Such an announcement casts Powell as a “lame duck,” weakening his authority and raising the prospects of an early rate cut. According to CommerzBank analysts, political pressure and division within the Fed may accelerate the odds of monetary policy easing, with markets now expecting another 20-basis-point rate cut by year-end.

The shift in the Fed’s rate expectations has left the US dollar vulnerable. Even though the central bank has not yet pivoted toward cuts, the market narrative continues to evolve. Although the relationship between US dollar interest rate expectations is not always consistent, the persistent dovish drift from the policymakers lends enough room to the euro.

Adding to the dollar’s weakness, the July 9 tariff deadline is looming with little to no progress. Trump’s unpredictable stance on trade policies continues to be a headwind for the USD. In the event of tariff imposition, the dollar may rally further, but it will pose a risk to global growth.

According to ING analysts, the EUR/USD is fundamentally strong enough to test the 1.1800 level, while staying above the 1.1700 area. The probability of hitting the 1.2000 psychological mark is also high.

While the Eurozone data is sparse and the ECB remains sidelined for now, the euro derives its strength from the dollar’s weakness due to political and monetary uncertainty in the US. The markets are now focusing on the US Q1 GDP data and the US Core PCE Index report.

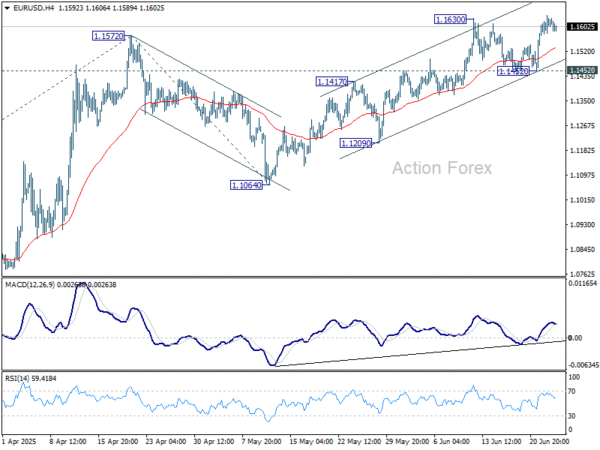

EUR/USD Price Technical Analysis: Buyers Firm for 1.2000

The 4-hour chart for the EUR/USD shows a strong bullish bias with key SMAs (20, 50, 100, and 200) lying one above another. The breakout of the previous swing high, followed by a seizure of the 1.1700 level, poses a greater upside risk, leading to a test of the 1.1800 level. The medium-term target and psychological mark of 1.2000 may be tested earlier than expected.

–Are you interested in learning more about forex indicators? Check our detailed guide-

However, the RSI lies in the extreme overbought zone, which may trigger profit-taking. The pair may pull back to the 1.1700 level ahead of the resistance that has turned into support at 1.1640.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.