- The EUR/USD outlook turns bullish as the sentiment shifts after ceasefire.

- Falling crude oil prices may provide more support to the EU economy.

- Markets now await Fed Chair’s testimony before Congress for further policy clues.

The EUR/USD pair staged an impressive comeback, gaining 1.3% from Monday lows to trade near 1.1600 level on Tuesday. The price has marked fresh three-month top. The rally was triggered by a shift in risk sentiment as US President Trump announced a ceasefire between Iran and Israel after around two weeks of conflict.

–Are you interested in learning more about next cryptocurrency to explode? Check our detailed guide-

Markets welcomed the de-escalation despite the reports of a missile fired from Iran earlier on Tuesday. The US dollar and crude oil experienced a sell-off. The Dollar Index dropped to 98.00 level while WTI fell more than 3% to fall to $66.00 area. This oil price decline is favorable for the Eurozone, a net oil importer, as it may help easing inflationary pressure further.

Adding more to the Euro’s bullish momentum, the German IFO Business Climate report showed a mild improved across all indices in June. The Expectations Index surged to 90.7 from previous 88.9, which shows a sign of economic stability in the Eurozone’s economy.

However, the rally may exhaust as it’s already overextended, starting from first week of March. The UOB analysts predict the price to stay within a familiar range of 1.1480 to 1.1660, alerting that strong overbought conditions may limit further gains unless Fed offers a dovish surprise.

All eyes are now on Fed Chair Jerome Powell’s testimony before Congress. The recent comments from Fed officials like Waller and Bowman suggest that a rate cut may come as early as July, turning markets cautious. According to CME FedWatch tool data, the probability of a rate cut in July is only 20%. It leaves room for repositioning if Powell hints further dovish policy.

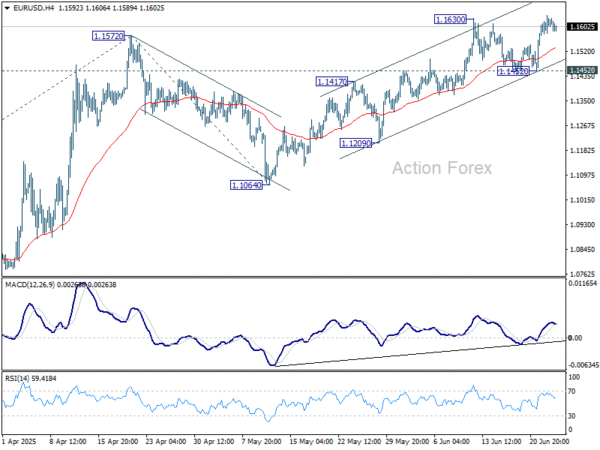

EUR/USD Technical Outlook: Consolidating Near highs

The EUR/USD 4-hour chart shows a consolidation near 1.1600 level. The buyers may exhaust as the RSI shows nearly overbought conditions. The price moved well above the key moving averages yesterday. Staying above the SMA conjunction area around 1.1500 may keep the bullish momentum intact.

–Are you interested in learning more about forex indicators? Check our detailed guide-

The pair may head to 1.1632, which is the yearly high ahead of 1.1700 (round number). On the flip side, 1.1550 provides immediate support ahead of 1.1500 area. The price may range here before a breakout.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.