- The EUR/USD outlook remains supported as Eurozone PMI data showed contraction in manufacturing but resilience in services.

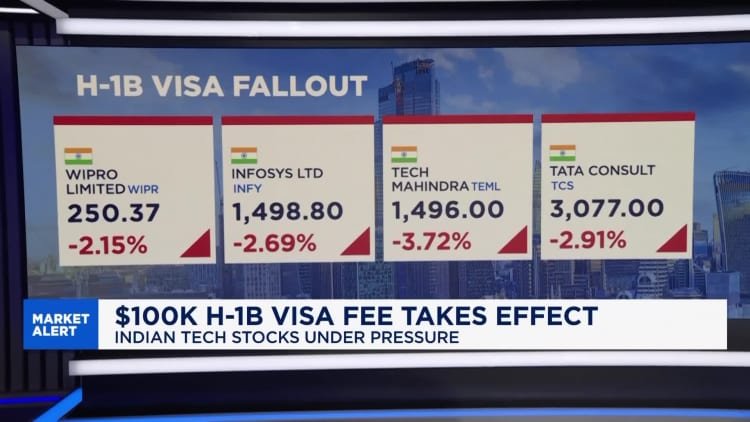

- Fed officials remain divided on further cuts, keeping dollar strength in play.

- Market focus turns to U.S. GDP and PCE inflation for direction in EUR/USD.

The EUR/USD outlook remains steady near the 1.1800 handle on Tuesday after bouncing from the intraday lows of 1.1775, with traders balancing mixed Eurozone PMI readings against expectations of US PMIs and the Fed speech.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The preliminary Eurozone data revealed contraction in manufacturing, while services accelerated above the forecast. Germany mirrored the divergence, while the French manufacturing and services sectors contracted, raising concerns about the country’s second-largest economy. Such an uneven recovery provides short-term support to the euro but underscores structural headwinds.

On the US side, the markets are digesting the Fed’s rate cut last week. Although the rate cut briefly weakened the dollar, hawkish commentary from the Fed Chair capped the upside in EUR/USD. The Fed remains split, with seven members seeing no further cuts in 2025, while ten members favor a 50-basis-point rate cut by the end of 2025.

Key Events Ahead

- US PMI (Tuesday): PMI readings due today could shape the pair’s trend.

- US GDP data (Thursday): Consensus at 3.3% annualised growth.

- US PCE Price Index (Friday): Fed’s preferred inflation gauge, expected unchanged at 2.6% YoY.

- Fed speeches: Jerome Powell, Michelle Bowman, Raphael Bostic, Stephen Miran, and Beth Hammack could shift rate expectations.

- Eurozone economic data: Follow-up business sentiment and consumer confidence will provide clarity on whether the services momentum can offset manufacturing weakness.

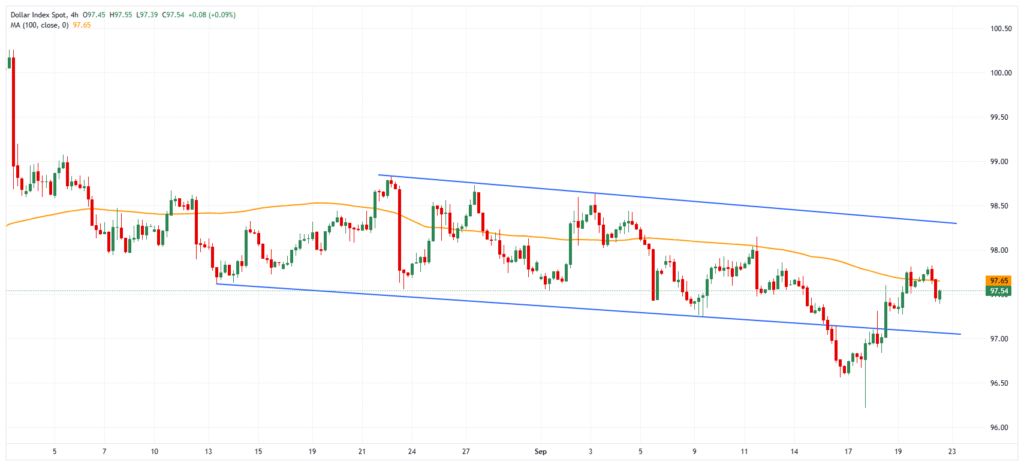

EUR/USD technical outlook: Downside appears limited

The 4-hour chart for the EUR/USD shows consolidation above the confluence of 20- and 50-period MAs. However, a strong bearish pinbar could limit the gains and keep pressure on the buyers. The RSI remains above the 50.0 level, indicating a gradual bullish trend.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

The immediate support lies at 1.1775, which could help maintain the bullish momentum ahead of 1.1700 and then 1.1650. On the upside, the immediate resistance is located at 1.1830, followed by 1.1900 and then 1.1930.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.