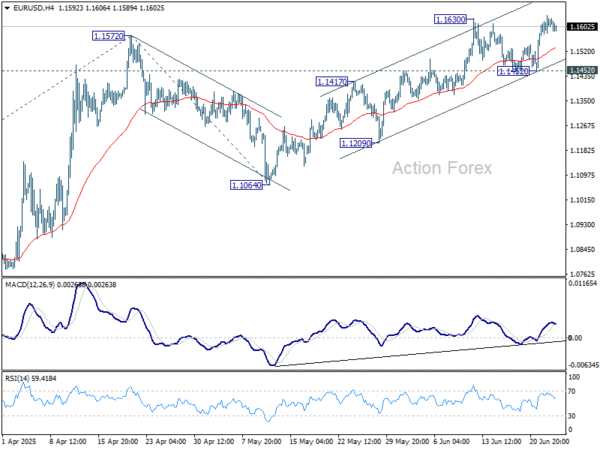

Daily Pivots: (S1) 1.1575; (P) 1.1608; (R1) 1.1643; More…

Intraday bias in EUR/USD stays mildly on the upside at this point. Sustained trading above 1.1630 will pave the way to 61.8% projection of 1.0176 to 1.1572 from 1.1064 at 1.1927. Outlook will stay bullish as long as 1.1452 support holds, in case of retreat.

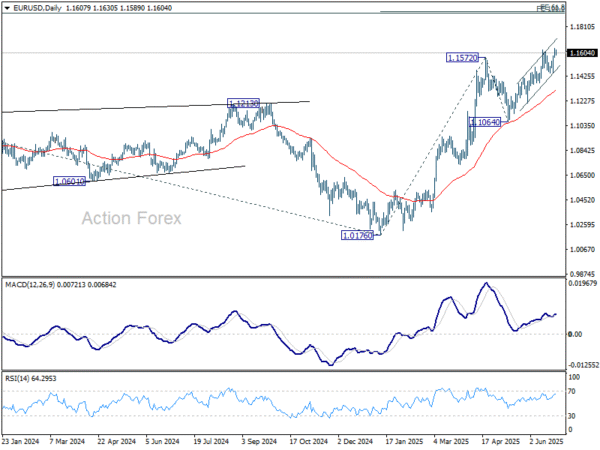

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 1.1604 support holds.

Visited 1 times, 1 visit(s) today