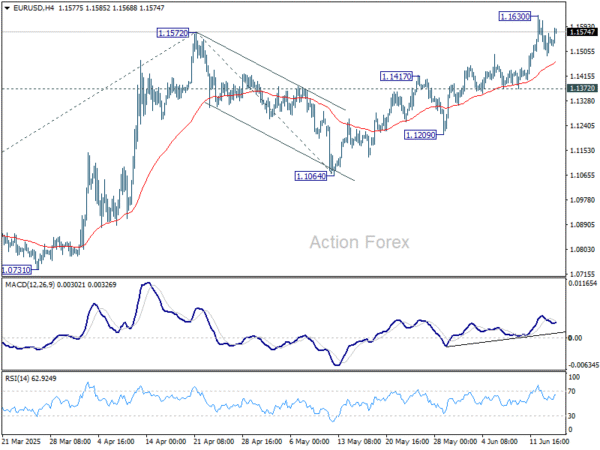

Daily Pivots: (S1) 1.1491; (P) 1.1552; (R1) 1.1616; More…

Intraday bias in EUR/USD remains neutral and more consolidations could be seen below 1.1630 temporary top. Further rise is expected as long as 1.1372 support holds. Break of 1.1572 will extend the rally from 1.0176. Next target is 61.8% projection of 1.0176 to 1.1572 from 1.1064 at 1.1927. However, break of 1.1372 support will indicate short term topping, and turn bias to the downside for deeper pullback.

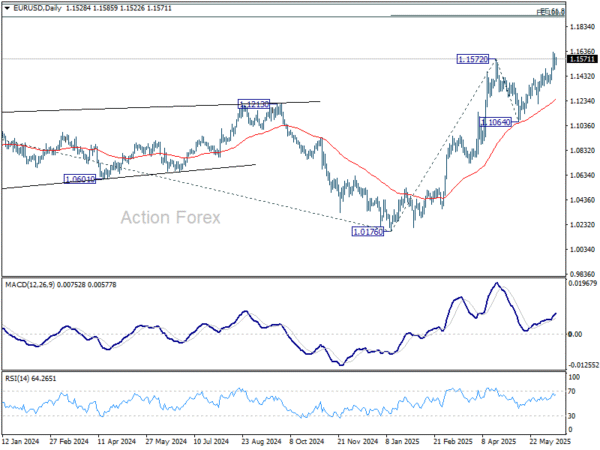

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 1.1604 support holds.