Key Highlights

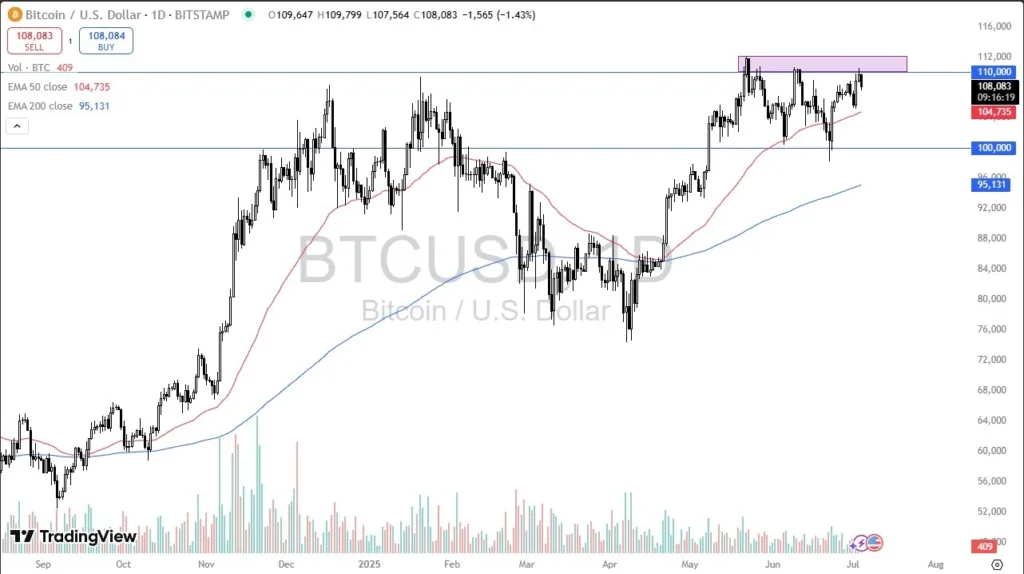

- EUR/USD started a fresh increase above the 1.1720 resistance.

- A short-term contracting triangle is forming with resistance at 1.1795 on the 4-hour chart.

- GBP/USD started a downside correction from the 1.3800 zone.

- USD/JPY could aim for a fresh increase if it clears the 145.35 resistance.

EUR/USD Technical Analysis

The Euro started another increase after it cleared 1.1650 against the US Dollar. EUR/USD even surpassed the 1.1720 resistance zone and tested 1.1830.

Looking at the 4-hour chart, the pair traded as high as 1.1829 and is currently consolidating gains. There was a minor decline below the 1.1800 level and the pair tested the 23.6% Fib retracement level of the upward move from the 1.1453 swing low to the 1.1829 high.

The pair settled above the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour). On the upside, the pair could face resistance near the 1.1800 level. There is also a short-term contracting triangle forming with resistance at 1.1795 on the same chart.

The next key resistance sits near the 1.1830 level. A close above the 1.1830 level could set the pace for another increase. In the stated case, the pair could even clear the 1.1850 resistance. The next major stop for the bulls could be near the 1.1920 resistance.

On the downside, immediate support is near the 1.1750 level. The next key support sits near 1.1720. Any more losses could send the pair toward the 1.1650 support zone.

Looking at GBP/USD, the pair failed to extend gains above the 1.3800 resistance and recently started a consolidation and correction phase.

Upcoming Economic Eventbs:

- Euro Zone Sentix Investor Confidence for July 2025 – Forecast 0.2, versus 0.2 previous.

- Euro Zone Retail Sales for May 2025 (YoY) – Forecast +1.2%, versus +2.3% previous.