Bullish view

- Buy the EUR/USD pair and set a take-profit at 1.1800.

- Add a stop-loss at 1.1500.

- Timeline: 1-3 days.

Bearish view

- Sell the EUR/USD pair and set a take-profit at 1.1500.

- Add a stop-loss at 1.1800.

The EUR/USD exchange rate continued its strong rally as it jumped to the highest level since October 2021. It has jumped to a high of 1.1665, up sharply from a low of 1.0180.

US Dollar Index Slips

The EUR/USD pair has soared as the US Dollar Index (DXY) plunged to a low of $97.65, its lowest level since February 2022. It has tumbled by over 11% from the year-to-date high of $110.15.

The pair surged as the market reacted to the Federal Reserve Chair’s testimony in Congress. In it, he explained why the bank was hesitant to cut interest rates as Donald Trump has demanded.

He maintained his view that Trump’s policies on tariffs would lead to high inflation in the coming months. He cited the recent report, which showed that the headline consumer inflation rose from 2.3% in April to 2.4% in May, while the core CPI remained unchanged at 2.8%.

Still, Powell noted that the potential trade agreements with top trading partners would reduce the inflation outlook, and trigger interest rate cuts. As a result, Morgan Stanley analysts anticipate that the bank will deliver at least seven cuts in 2026.

One catalyst for next year’s cuts will be that Donald Trump will appoint a new Federal Reserve Chair, who will share his view about interest rates.

The EUR/USD pair rose as geopolitical risks eased following the ceasefire between Iran and Israel, and the upcoming talks between the US and Iran. The US dollar often falls when there are geopolitical risks because it is often seen as a safe-haven currency.

Looking ahead, the US will publish the latest GDP, durable goods orders, and initial jobless claims data on Thursday. It will also publish the latest personal consumption expenditure report on Friday.

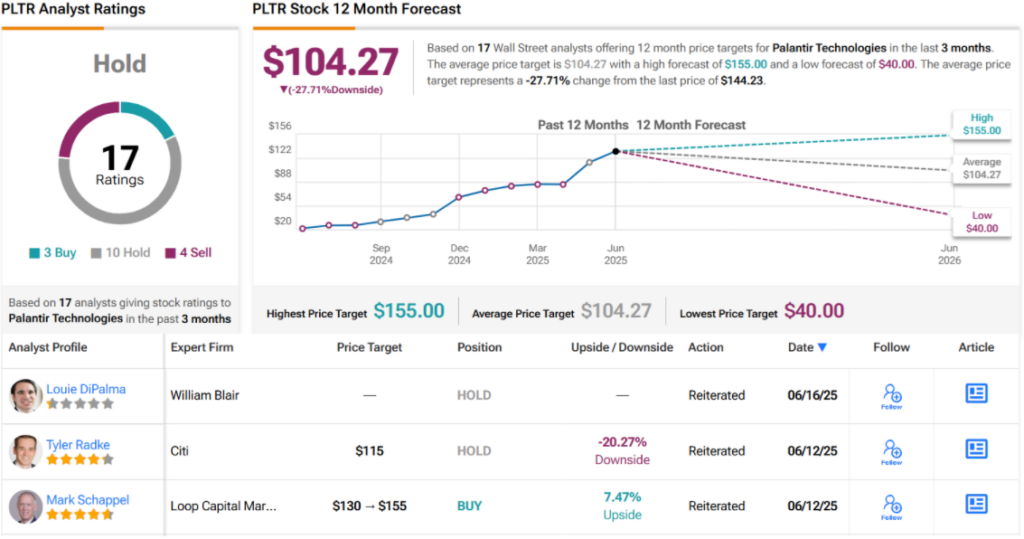

EUR/USD Technical Analysis

The weekly chart shows that the EUR/USD exchange rate has jumped in the past few months. It jumped from a low of 1.0180 in January to a high of 1.1660, its highest level in years.

The pair has moved above the important resistance level at 1.1200, the highest point in September last year. It has also remained above the 50-week moving average, while the MACD and the Relative Strength Index (RSI) continued rising.

Therefore, the pair will likely continue rising as bulls target the next point at 1.1800. A drop below the support at 1.1400 will invalidate the bullish view.

Ready to trade our free Forex signals? Here are the top brokers in Europe to choose from.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.