Bearish view

- Sell the EUR/USD pair and set a stop-loss at 1.1400.

- Add a stop-loss at 1.1635.

- Timeline: 1-2 days.

Bullish view

- Buy the EUR/USD pair and set a take-profit at 1.1635.

- Add a stop-loss at 1.1400.

The EUR/USD exchange rate rose and is hovering at its highest point since November 2021 as the dollar retreat continued. It was trading at 1.1551 on Monday as traders waited for the upcoming Federal Reserve interest rate decision and a statement by Christine Lagarde.

Fed decision and geopolitical risks

The EUR/USD exchange rate has been in a strong rally in the past few weeks even as the interest rate divergence between the US and the European Union widened.

The European Central Bank (ECB) has slashed interest rates eight times since last year, bringing them to 2%. On the other hand, the Federal Reserve has maintained a cautious tone by leaving interest rates unchanged this year, irking Donald Trump, who wants a full point cut.

The main catalyst for the EUR/USD pair will be the upcoming Federal Reserve interest rate decision, which will come out on Wednesday. Economists polled by Reuters and Bloomberg expect the bank to maintain its interest rate unchanged between 4.25% and 4.50%.

The bank is observing the impact of Donald Trump’s tariffs on inflation. Data released last week showed that the headline consumer price index rose slightly to 2.4% in May, while core inflation remained at 2.8%.

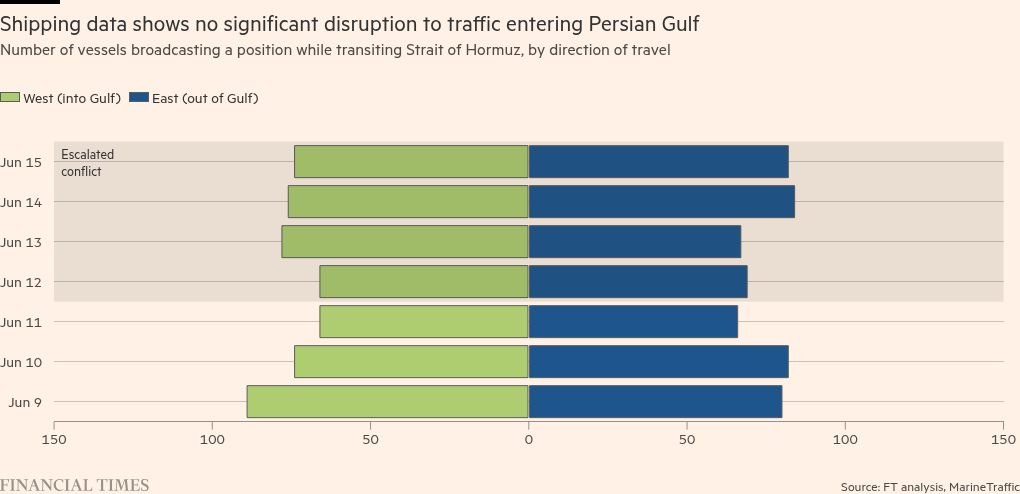

There are chances that inflation may keep going up after Israel attacked Iran’s nuclear facilities last week. These attacks pushed the price of crude oil up sharply, with Brent and West Texas Intermediate (WTI) rising to over $70. The EUR/USD pair will react to the developments in the region.

The other potential catalyst for the EUR/USD exchange rate will be a speech by Christine Lagarde, the head of the ECB. She will possibly hint that the bank will maintain rates unchanged for a while.

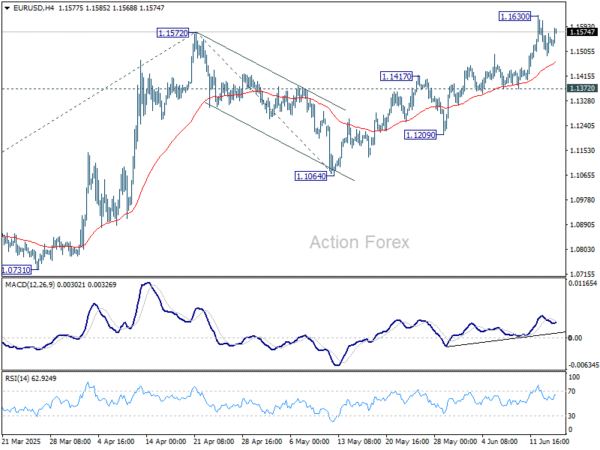

EUR/USD technical analysis

The daily chart shows that the EUR/USD exchange rate has been in a strong uptrend in the past few months. It moved to a multi-year high of 1.1630 as the US dollar index dropped.

The pair has moved above all moving averages, a sign that bulls are in control. Also, it has formed a double-top pattern at 1.1570 and a neckline at 1.1065, its lowest swing on May 12.

Therefore, while the uptrend may continue, the pair may retreat in the next few days. If this happens, the next point to watch will be at 1.1400. A move above the resistance at 1.1630 will invalidate the bearish view.

Ready to trade our free trading signals? We’ve made a list of the best European brokers to trade with worth using.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.