- The EUR/USD forecast is strongly bullish despite a mild pullback from YTD highs.

- A weaker dollar amid dovish Fed expectations keeps the Euro bullish.

- Markets are eyeing US Q1 GDP and US Core PCE Index data for further impetus.

The EUR/USD price is trading slightly lower on Wednesday during the early New York session, after posting a two-day rally to fresh YTD highs. Despite the pullback, the pair remains close to the highest level since November 2021, supported by global risk sentiment, weaker oil prices, and the US dollar.

–Are you interested in learning more about the next cryptocurrency to explode? Check our detailed guide-

The ceasefire between Iran and Israel, announced by President Trump, sparked broader optimism across financial markets. As a result, the safe-haven demand for the dollar lost traction. Although both sides are at peace, the stability is still too fragile. Both sides can resume hostilities if provoked. However, the markets have so far welcomed the de-escalation, favoring riskier assets, such as the Euro.

The subdued dollar boosts the Euro. The Dollar Index remains depressed around mid-97.00, close to a three-year low, as it is pressured by dovish Fed expectations. Although the Fed Chair Jerome Powell maintained a cautious stance in his testimony before Congress on Tuesday, the markets are still expecting a 50 bps cut by the end of 2025.

On the European side, macroeconomic data is steady but not strong enough to drive markets. French Consumer Confidence remained unchanged at 88.0, while Spain’s Q1 GDP confirmed a growth of 0.6% q/q and 2.8% y/y.

The US Consumer Confidence Index fell from 98.4 to 93.0, revealing concerns for jobs and economic growth. As markets digest Powell’s second round of testimony today, the upcoming US data, including Q1 GDP and the Core PCE Index, are key to watch.

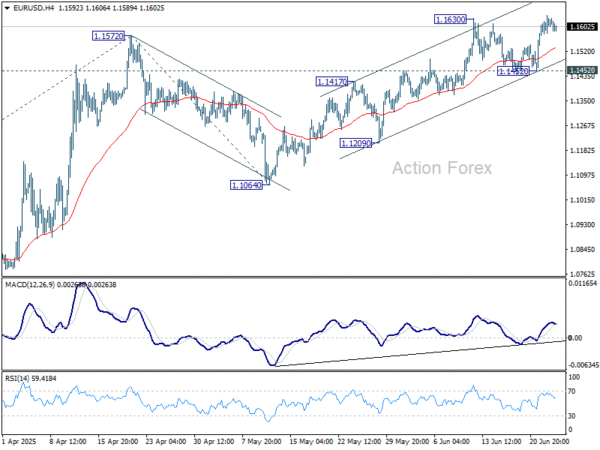

EUR/USD Technical Forecast: Buyers Aiming for 1.1700

The EUR/USD 4-hour chart displays a consolidating pattern near the multi-month high. The uptrend is intact as the price stays well above the 20-period SMA. Moreover, the bullish crossover of the 20-SMA and 50-SMA also presents room for upside. The RSI is also off the overbought zone but above 50.0 and sloping upwards.

–Are you interested in learning more about forex indicators? Check our detailed guide-

Overall, the pair is now trading within a broad range of 1.1450 to 1.1650. The price is expected to remain within these two levels unless a catalyst emerges to push it further higher towards the 1.1700 mark. The path of least resistance lies on the upside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.