- The euro has gone back and forth during the trading session on Friday, as we continue to hover just above the 1.16 level.

- This is a pair that had recently formed a bit of a double top, only to plunge toward the 1.14 level.

- The 1.14 level is a large, round, psychologically significant figure, so the fact that we bounced from there was probably not a huge surprise.

Now that we are above the 1.16 level, it does make a certain amount of sense that the market still seemed somewhat bullish, but we have that huge “wipeout candle” from July 28 that was in reaction to the trade negotiations between the United States and the European Union. Until we get above there, you have to wonder whether or not we are still in the process of trying to make a “lower high.”

Structure Shifting?

The question is whether or not the structure of this market is shifting overall, but I think it’s also early to make that decision. Ultimately, if we were to turn around and break down below the 50 Day EMA, I think that would spook a lot of traders out there, perhaps sending this market down to the 1.14 level again. Anything below would be a very negative sign and therefore I think you have got a situation where people will be watching for the next couple of days.

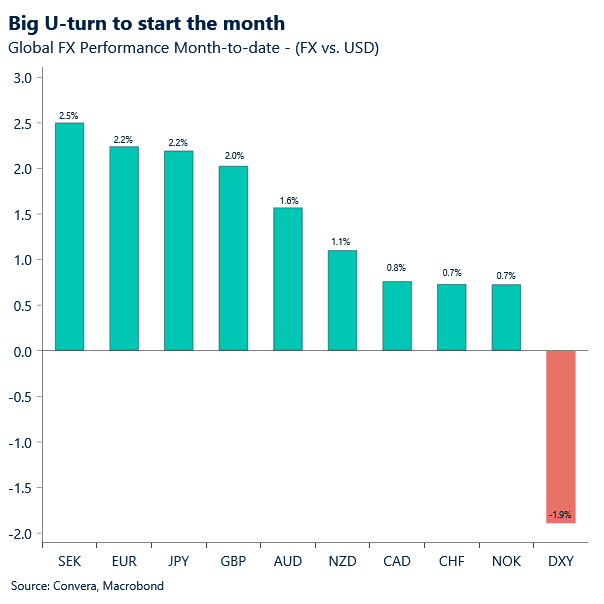

On the other hand, if we were to break above the 1.17 level, then it’s possible that we could go looking to the 1.18 level. The 1.18 level is an area that has been significant resistance multiple times, as we formed a bit of a “double top” at that level. Ultimately, this is a situation where we continue to bounce around and try to figure out where we are going from a longer-term standpoint. Ultimately, this is a market that will probably continue to be choppy, but that’s not a huge surprise considering that’s how the euro quite often behaves. With that being said, it’s probably worth noting that this is also a great proxy for with the US dollar might do against other currencies.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.