- The euro has fallen just a bit during the trading session on Friday, as we are trying to sort out where to go next in this pair.

- Keep in mind that the markets are of course aware of the fact that the Federal Reserve may cut rates, and if they do in fact continue to cut rates in the Euro cannot take advantage of that, this tells me that the Euro might be in some trouble.

Technical Analysis

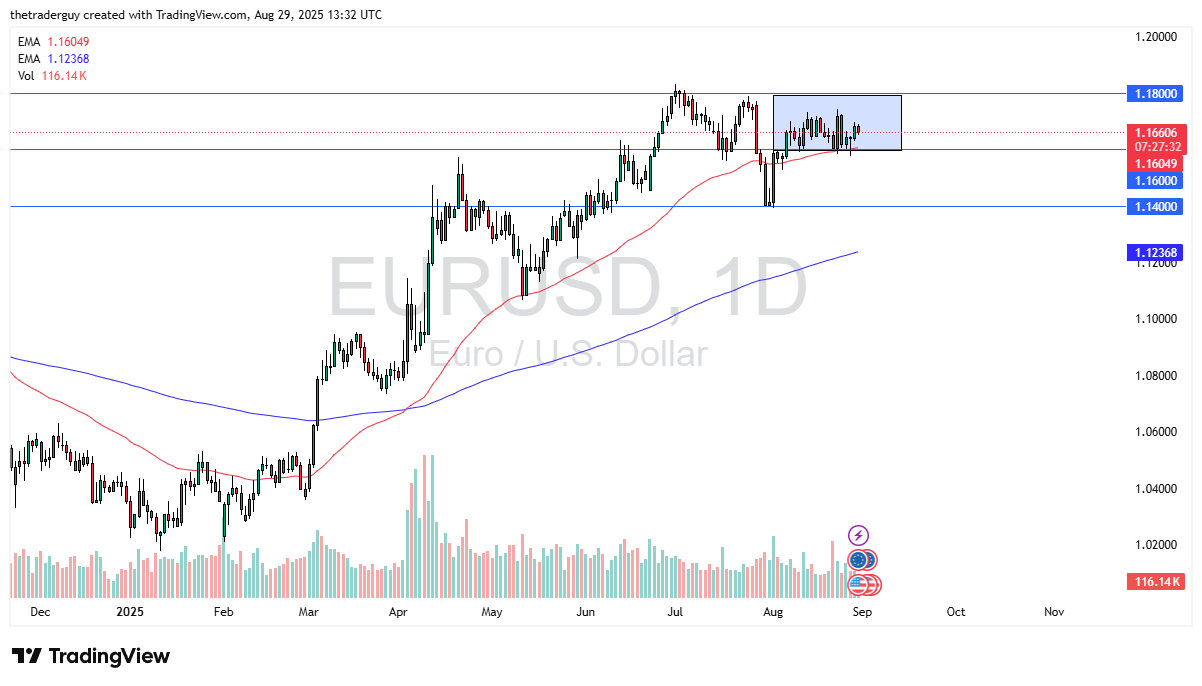

The technical analysis for this market is somewhat mixed at the moment, despite the fact that it had been so positive previously. Because of this, it looks as if we might be in the beginning of a new phase, but it’ll be interesting to see whether or not traders start to push things in the opposite direction. After all, the 1.18 level has been very resistant, and I think it will continue to be thought of as important. If we were to break above there, that would obviously be very bullish for the euro, but I would also have to see the US dollar failing against other currencies.

On the downside, we have the 1.16 level offering support, especially with the 50 Day EMA sitting there. With that being the case, the market is likely to continue to look at that as a significant floor, and if we were to break down below there, it opens up the possibility of a massive selloff down to the 1.14 level. Anything below there then would almost certainly kick off a major downtrend, sending this market to much lower levels. With all that being said, I think you’ve got a situation where things remain somewhat back and forth, which is interesting considering that the Federal Reserve is expected to cut rates twice this year, which in theory, should send the US dollar lower.

Sometimes, it’s worth noting what the market won’t do, and in this case, it will not break out to the upside with any significant momentum. Are we getting close to a trend change and US dollar strength?

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.