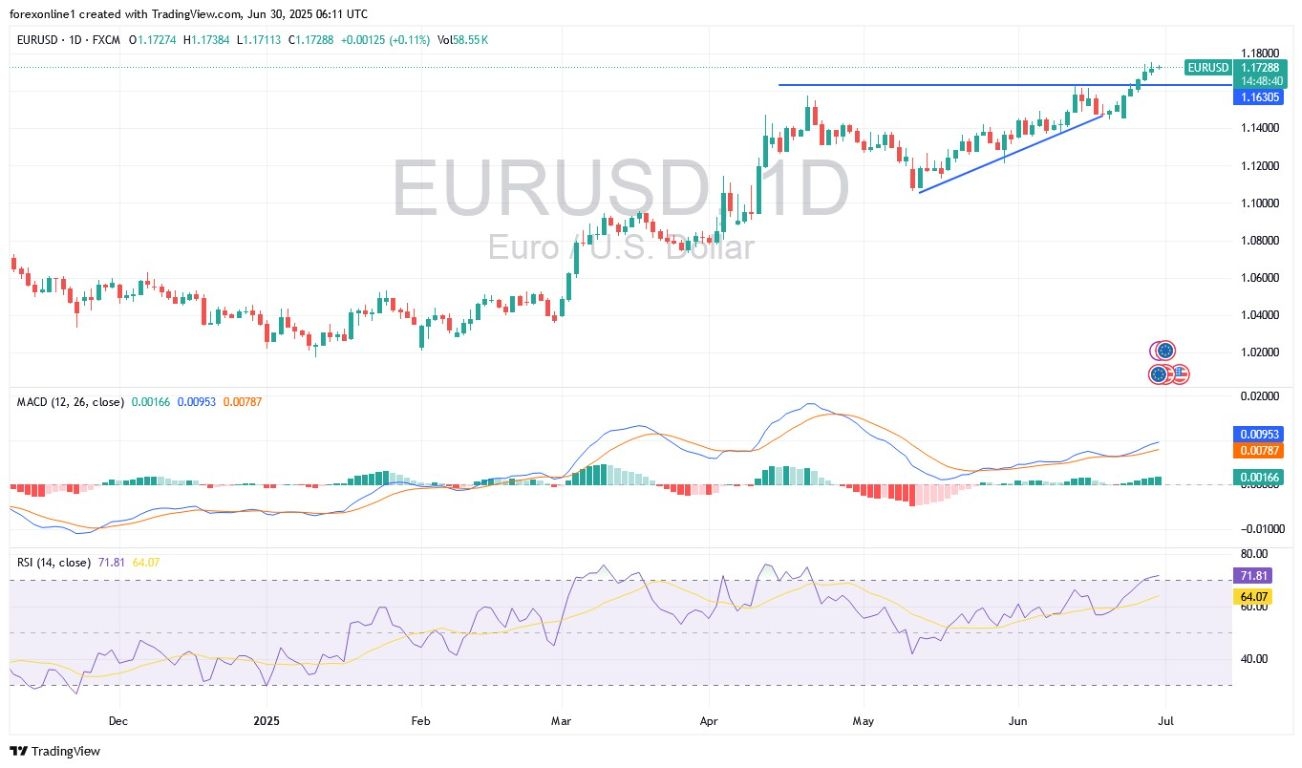

EUR/USD Analysis Summary Today

- Overall Trend: Bullish.

- Today’s EUR/USD Support Levels: 1.1650 – 1.1580 – 1.1400.

- Today’s EUR/USD Resistance Levels: 1.1770 – 1.1840 – 1.2000.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1720 and a stop-loss at 1.1460.

- Sell EUR/USD from the resistance level of 1.1780 with a target of 1.1500 and a stop-loss at 1.1850.

EUR/USD Technical Analysis Today:

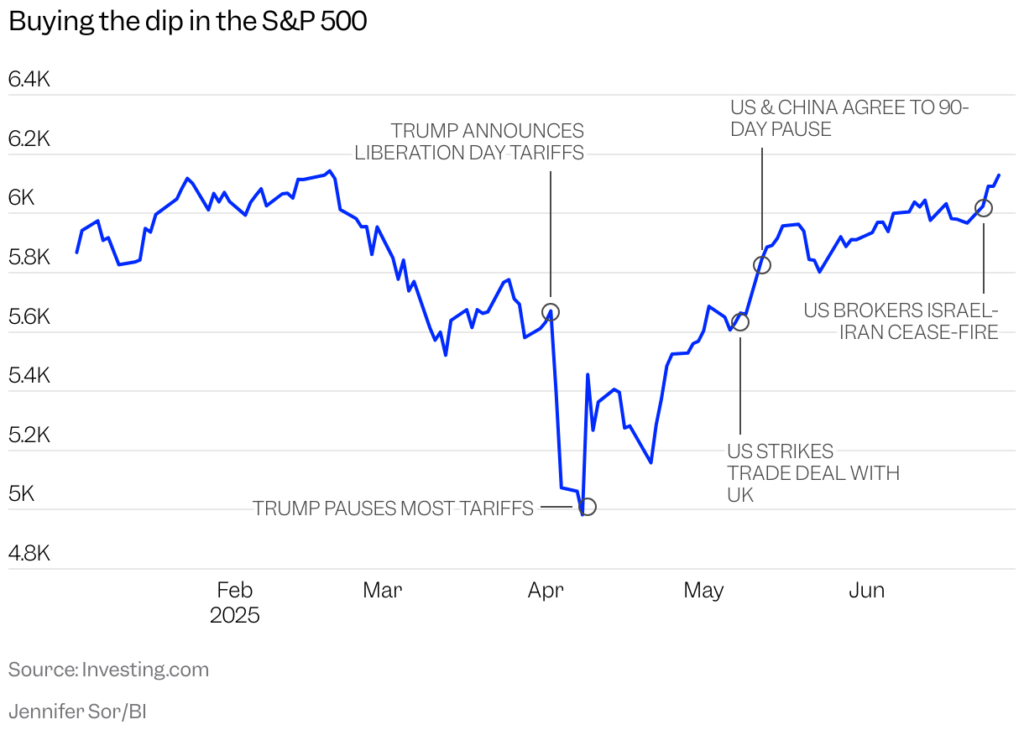

Until the announcement of key US jobs figures later this week, the EUR/USD pair remains stable near its three-and-a-half-year high, hovering around the 1.1735 resistance level at the time of writing. According to performance across reliable trading platforms, the US dollar has remained on the defensive due to increasing concerns about Federal Reserve policy. Speculation is growing that the administration will seek to undermine the US central bank’s independence, directly or indirectly pushing for an imminent interest rate cut.

The EUR/USD exchange rate has reached the 1.1753 resistance level, the highest for this prominent forex pair in 45 months. Based on recent performance, the EUR/USD pair has achieved seven consecutive daily gains, which could make it vulnerable to a limited correction. According to currency market experts, the Euro is still likely to see further strength, but short-term overbought conditions may slow the pace of any additional progress. The next level to watch is 1.1780. Technical indicators, led by the 14-day RSI (Relative Strength Index) and the MACD (Moving Average Convergence Divergence) lines, are stable around overbought levels.

Forex experts note that fair value estimates for the EUR/USD have risen to around 1.1450 from 1.10 amid a decline in US bond yields. Recently, geopolitical risks have been drastically discounted, and more importantly, divisions within the FOMC (Federal Open Market Committee) have fueled positive speculation. This justifies a more optimistic view for the EUR/USD, though not necessarily a forecast for the psychological resistance level of 1.20.

Overall, the financial markets’ enthusiasm for an early Federal Reserve rate cut might be misplaced, and the EUR/USD could stabilize around 1.15-1.16, awaiting crucial inflation information.

US Central Bank Policies Will Affect EUR/USD Path:

According to recent forex market trading, the focus has been on the Federal Reserve, the prospect of earlier monetary policy easing, and the potential for further interest rate cuts. Recently, economic calendar data showed a decrease in US initial jobless claims to 236,000 in the last week, down from 246,000 previously, while continuing jobless claims saw another increase to 1.97 million from 1.94 million, the highest figure since late 2021. US Q1 GDP was revised down from 0.2% to -0.5%, but durable goods orders recorded a larger-than-expected increase.

Trading Tips:

We advise selling EUR/USD from every upward level, but without taking risks, and closely monitoring the factors influencing currency prices to seize the best trading opportunities.

Additionally, other rumours have spread about an imminent move to name a successor to Federal Reserve Chair Jerome Powell, effectively introducing a “shadow Fed” into play, which could undermine official guidance before May 2026, when Powell’s term as chair ends. For now, expectations of President Trump picking a more dovish chair will keep downward pressure on FOMC pricing and the US dollar.

In this regard, it is said that the leading candidates for the next Fed Chair are former Federal Reserve Governor Kevin Warsh, National Economic Council Director Kevin Hassett, current Federal Reserve Governor Christopher Waller, and Treasury Secretary Scott Bessent. Overall, the current concern for the future of US central bank policies will remain a pressure factor on any gains for the US dollar.

Today, the EUR/USD price will be influenced by the announcement of German Retail Sales and German Import Price Index readings at 9:00 AM Egypt time. Later, the German CPI (Consumer Price Index) reading will be released. On the US side, the Chicago PMI (Purchasing Managers’ Index) reading will be announced at 4:45 PM Egypt time, and throughout the day, there will be statements from members of the US Federal Reserve Board.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.