EUR/USD Analysis Summary Today

- Overall Trend: Downward bias.

- Today’s Support Levels: 1.1720 – 1.1650 – 1.1580.

- Today’s Resistance Levels: 1.1800 – 1.1870 – 1.1930.

EUR/USD Trading Signals:

- Sell EUR/USD from the 1.1820 resistance level. Target: 1.1600. Stop-loss: 1.1900.

- Buy EUR/USD from the 1.1640 support level. Target: 1.1810. Stop-loss: 1.1600.

Technical Analysis of EUR/USD Today:

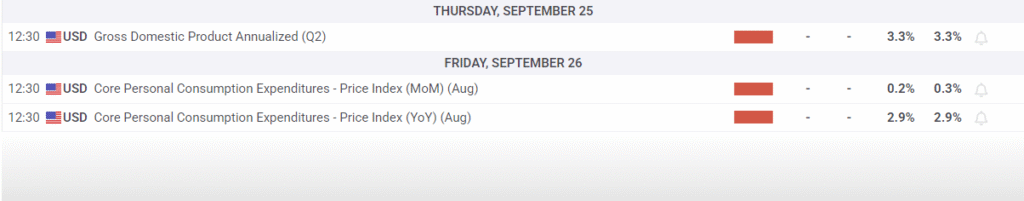

As previously predicted, renewed selling of the Euro/US Dollar (EUR/USD) may be possible as bulls fail to advance further above the 1.18000 resistance level. This was confirmed by yesterday’s trading, as the Euro/US Dollar (EUR/USD) price fell from the 1.1820 resistance level, with losses, to the 1.1728 support level, where it stabilized at the beginning of today’s session, Thursday, September 25, 2025. The Forex market is awaiting the announcement of a series of important US economic releases, led by the US GDP growth rate, followed by the weekly unemployment claims number and the durable goods orders figures, all at 3:30 PM Cairo time.

Reasons for the Euro’s Renewed Decline

According to forex currency trading experts, the EUR/USD pair retreated from its four-year high of 1.1920, which it tested following the US rate cut. The euro’s drop resumed after weaker-than-expected German economic indicators negatively affected the value of the single European currency. The German IFO Business Climate Index fell by 1.2 points to 87.7 in September, reaching its lowest level since May and missing market forecasts of 89.3. This decline followed mixed Eurozone PMI results, which showed continued private sector growth in September, driven by a strong services sector, while the manufacturing sector contracted.

Meanwhile, investors followed comments from Federal Reserve Chairman Jerome Powell, who reiterated his cautious stance on US interest rate cuts amid continued inflationary pressures from tariffs and a weak labor market. Financial market expectations currently indicate a greater than 90% chance of a US interest rate cut by the Fed in October, with investors awaiting the US Personal Expenditures Price Index (PEPI) due out Friday.

German bond yields fell… What happened?

According to trusted trading platforms, German bond yields fell as economic data wavered and the Federal Reserve adopted a cautious outlook, which affected market performance. The yield on German 10-year bonds reached 2.73%, retreating after having risen to a two-week high of 2.762% on Monday. This retreat came as investors assessed new economic data and its implications for European Central Bank policy. The German IFO Business Climate Index’s decline to 87.7, missing expectations, reflected lower business confidence in both current conditions and future expectations.

Meanwhile, the Purchasing Managers’ Index (PMI) survey showed that Germany’s services sector expanded at its fastest pace since May 2024, while manufacturing contracted more sharply than expected. In the United States, Federal Reserve Chairman Jerome Powell reiterated his cautious stance on interest rate hikes, taking into account persistent inflationary pressures from tariffs and signs of a slowing labor market. Also, geopolitical tensions escalated after US President Donald Trump expressed confidence in Ukraine’s ability to reclaim all Russian-occupied territory.

Technical Outlook for the Euro Dollar:

Based on the daily chart, the EUR/USD pair is emerging from the neutral zone amid a bearish bias that will intensify if bears succeed in advancing towards the support levels of 1.1690 and 1.1600, respectively. The 14-day Relative Strength Index (RSI) is currently approaching a break above the 50-line, increasing the bearish technical momentum. Meanwhile, the MACD lines are trending downwards, awaiting further selling pressure. A strong EUR/USD bullish scenario on the daily chart should prompt bulls to move towards the resistance levels of 1.1820 and 1.1900, followed by the psychological resistance of 1.2000, respectively.

Trading Tips:

We still recommend selling the euro against the US dollar with every strong upward bounce, but never take risks and be careful. Obvioulsy, the US dollar is awaiting the announcement of the Federal Reserve’s preferred inflation reading at the end of the week.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.