By Niket Nishant

Emerging market stocks and currencies rose on Monday, as wagers on a weaker dollar and potential Federal Reserve rate cuts drove investors abroad, while optimism around trade negotiations buoyed sentiment.

An MSCI index of emerging market equities CBOE:EFS rose 1.52%, to hover near its highest level since June 2021, while the currencies gauge (.MIEM00000CUS) crept 0.14% higher, near its two-week high.

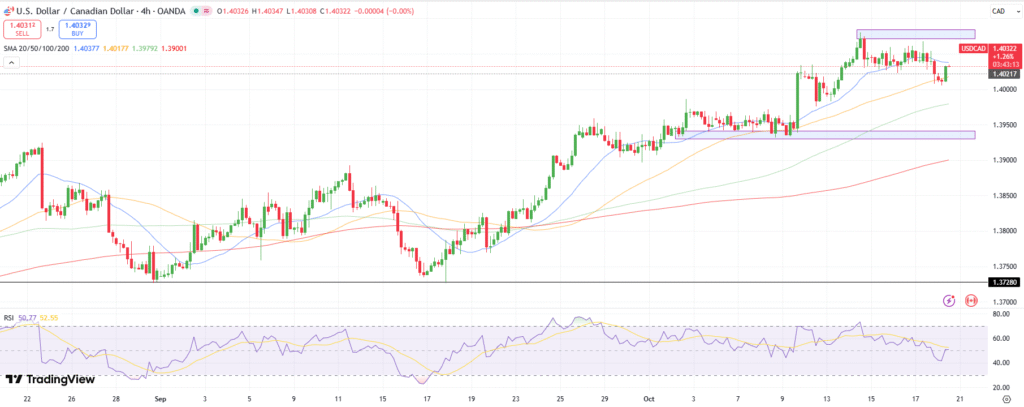

“Concerns about the health of regional banks and the broader quality of credit in the U.S. remain very central for FX markets,” economists at ING wrote in a note.

Investors wager that the strain in the U.S. banking industry could spur sharper interest rate cuts by the Federal Reserve and a shift toward higher-yielding assets abroad.

Expectations that the dollar DXY will decline further has added to the appeal of emerging market currencies.

The moves kick off a pivotal week featuring a raft of central bank policy decisions, including out of Turkey and Hungary. Later on Monday, Romania’s central bank is also expected to release minutes from its governing council meeting earlier this month.

Poland’s blue-chip WIG20 GPW index hit its highest in nearly two months and was last up 1.67% as investors assessed data on wages and producer inflation.

Investors will also be awaiting developments from a meeting between U.S. President Donald Trump and Russian President Vladimir Putin to discuss the war in Ukraine, with any hint of a ceasefire likely to fuel risk appetite.

“Central and Eastern Europe FX has a good constellation of conditions for further rally with a potential boost from a Ukraine-Russia ceasefire,” ING added.

SPLIT PERFORMANCE

Elsewhere, equities in Seoul KOSPI and Taipei TWSE:TAIEX hit all-time highs, while China’s blue-chip CSI300 index 3399300 climbed 0.53% and the Shanghai Composite Index

000001 rose 0.63%.

Trump on Friday expressed hope for a “fair deal” with Beijing and reaffirmed plans to meet with his Chinese counterpart Xi Jinping later this month, offering some relief to investors.

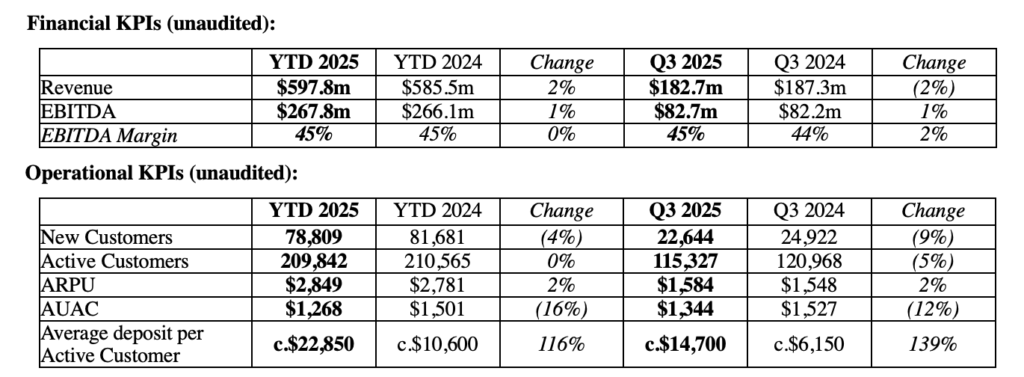

However, China’s economic growth slowed to the weakest pace in a year in the third quarter due to fragile domestic demand. Traders will be on the look out for details on any fiscal stimulus as officials review a proposed five-year roadmap for the economy.

Selectivity also remains key, as countries with strong macro fundamentals and credible policy regimes are expected to benefit more.

An outflow from Turkey’s risk assets continued, with the main BIST 100 share index XU100 down 0.63% and set for its third consecutive session in the red if current levels hold.

Investors are monitoring the market impact of a politically sensitive court ruling that could reshape the country’s opposition leadership.

India’s stock benchmarks Nifty NIFTY and Sensex

SENSEX rose about 0.63% each against the backdrop of ongoing trade negotiations with the U.S.