Dutch tech giant ASML warned Wednesday of a steep fall in its China business next year, as it booked flat net profits in the third quarter of 2025 compared to the same period last year.

Traders appeared to see the glass half-full, with ASML shares opening more than 3% higher in Amsterdam, buoyed by solid sales and orders for its cutting-edge semiconductor production machines.

ASML has faced growing pressure from US and Dutch export curbs for its most advanced chipmaking tools to China, as Beijing and Western nations are locked in a battle for the key sector.

“We expect China customer demand, and therefore our China total net sales in 2026, to decline significantly compared to our very strong business there in 2024 and 2025,” said CEO Christophe Fouquet in a statement.

The firm announced net profits of 2.13 billion euros ($2.5 billion), after 2.08 billion euros in the third quarter of last year.

Net sales in the third quarter of 2025 came in at 7.5 billion euros. ASML had forecast a figure between 7.4 billion euros and 7.9 billion euros.

“Our third-quarter total net sales… were in line with guidance, reflecting a good quarter for ASML,” said Fouquet.

In July, the firm had warned that geopolitical and trade tensions had clouded the near-term outlook for its growth.

ASML said then that it could not confirm it would be in the black in 2026.

But on Wednesday, Fouquet said, “We do not expect 2026 total net sales to be below 2025,” adding that the firm would give more details on next year’s outlook in January.

“I think we have seen a flow of positive news in the last few months that has helped to reduce some of the uncertainties we discussed last quarter,” said Fouquet.

The CEO said he expected sales in the fourth quarter to come in between 9.2 billion and 9.8 billion euros.

For the full year 2025, the firm predicts a 15% increase in total net sales.

Net bookings, the figure most closely watched in the markets as a predictor of future performance, reached 5.4 billion euros, compared to 5.5 billion in the second quarter.

According to a presentation posted on the firm’s website, sales to China represented 42% of ASML’s overall business in the third quarter, up from 27% in the second quarter.

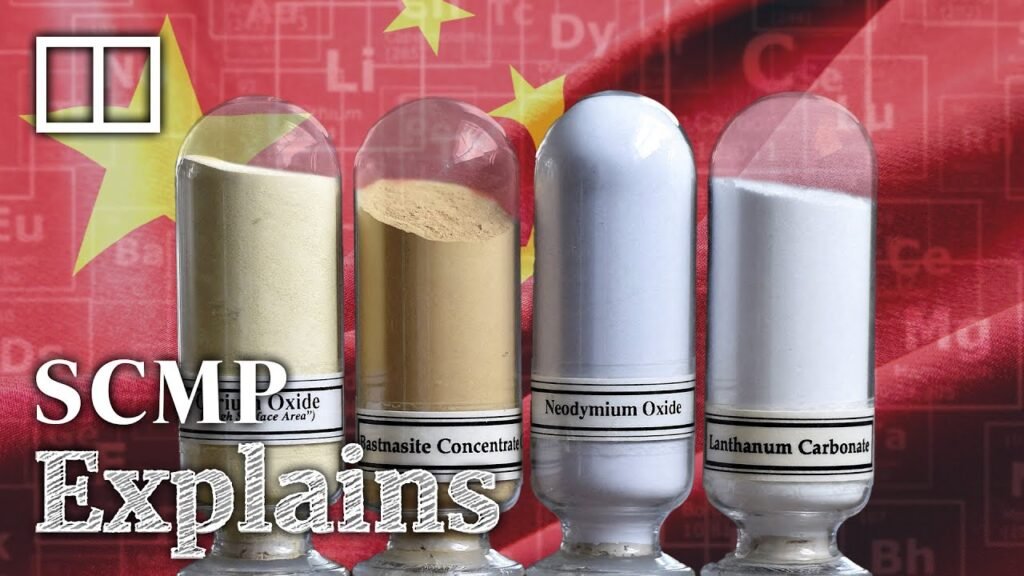

Geopolitical battleground

Longer-term, ASML believes that the rapidly expanding AI market will push up its annual sales to between 44 billion and 60 billion euros by 2030.

ASML is a critical cog in the global economy, as the semiconductors crafted with its tools power everything from smartphones to missiles.

Semiconductors have become something of a global geopolitical battlefield.

Washington has sought to curb exports of high-tech chips to China, worried they could be used to fuel Beijing’s military.

Last week, a US Congressional committee report said five companies, including ASML, had sold $38 billion worth of critical tech to China in 2024, including to firms flagged as US national security threats.

“China is striving with all its might to build a domestic, self-sufficient semiconductor manufacturing industry,” the report said.

Earlier this week, chip-related tensions grew between China and the Netherlands after the Dutch government took control of Chinese-owned chipmaker Nexperia, citing national security concerns.

That meant while the company—based in the Dutch city of Nijmegen—can continue production, the Dutch government can block or reverse its decisions.

Parent company Wingtech said it was appealing to Chinese authorities for support and discussing legal action with international law firms.

© 2025 AFP

Citation:

Dutch tech giant ASML posts stable profits, warns on China sales (2025, October 15)

retrieved 15 October 2025

from https://techxplore.com/news/2025-10-dutch-tech-giant-asml-stable.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.