TLDR

- Micron quits China’s data center market amid tech war strains.

- U.S.-China chip tensions push Micron to shift its business focus.

- AI boom cushions Micron’s China retreat with record global demand.

- Chinese rivals rise as Micron exits key data center segment.

- Micron repositions globally, balancing risk with new AI opportunities.

Micron Technology’s stock closed sharply higher at $202.53, gaining 5.52% on October 16. Shares fell 2.75% in pre-market trading, settling at $196.97.

Micron Technology, Inc., MU

This shift follows the company’s decision to exit the China-based data center memory chip business.

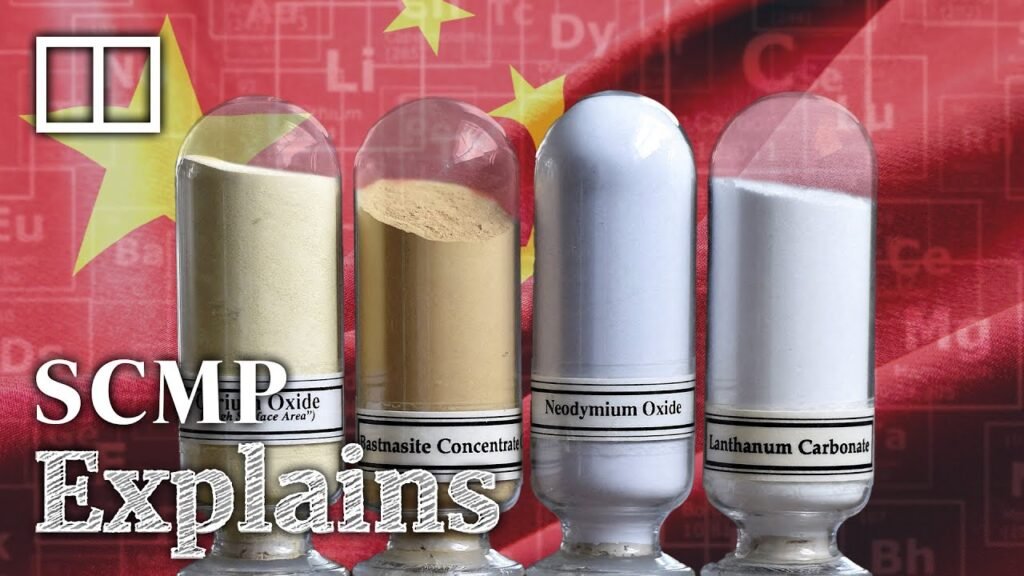

The move reflects a long-brewing geopolitical rift between the U.S. and China over access to technology and national security. Micron had previously faced a ban in 2023 from selling its chips for critical Chinese infrastructure. That restriction continued to affect its data center business, ultimately prompting the current withdrawal.

Micron Shifts Strategy Amid Lingering Ban Impact

Micron decided to stop supplying server chips to data centers in mainland China due to prolonged business disruptions. The company had not regained traction after the 2023 Chinese regulatory ban targeting its chips in sensitive infrastructure. Consequently, Micron saw limited prospects for recovery in that segment.

The ban came after a wave of U.S. restrictions aimed at slowing China’s semiconductor advancement, including sanctions on key Chinese firms. Micron became the first major U.S. chipmaker directly impacted by such Chinese retaliation. While the company maintained compliance with global regulations, the local market hurdles remained unresolved.

Though Micron is exiting Chinese data centers, it will retain sales to some customers operating internationally. Lenovo, with major global data center operations, remains a client for non-China sales. Additionally, Micron will continue selling to Chinese automotive and mobile sectors, which remain unaffected by the ban.

U.S.-China Tech Tensions Shape Micron’s Position

Rising tech tensions since 2018 have reshaped U.S.-China business ties, particularly across the semiconductor industry. The Trump administration began imposing tariffs, and sanctions on Huawei followed soon after. These moves escalated into broader U.S. efforts to limit China’s access to cutting-edge chips.

Since then, companies like Nvidia and Intel have also faced scrutiny from Chinese regulators for alleged national security risks. However, unlike Micron, they have not yet seen bans or significant sales disruption in China. The regulatory focus has nonetheless heightened uncertainty for foreign chipmakers operating in the region.

Micron’s position weakened as Chinese firms like YMTC and CXMT, backed by state support, gained market share. South Korean giants Samsung and SK Hynix also benefited by filling the supply gap. As China expanded data center investments, Micron’s exclusion cost it a major growth opportunity.

Global AI Demand Offsets China Market Exit

Micron gained momentum from surging global demand tied to AI-driven infrastructure growth. Worldwide investment in AI data centers continues to rise, driving up demand for memory chips. This surge has enabled Micron to post record revenue in recent quarters.

The company is also realigning its operations within China, having laid off mobile NAND teams earlier this year. However, it continues to invest in packaging facilities, notably in Xian, showing a balanced approach to China engagement. Micron still views China as a valuable market despite recent exits.

Over 300 Micron employees are part of its China data center division, though job impacts remain unclear. The company reiterated its commitment to serve existing customers and maintain compliance with trade laws. It also emphasized the continued significance of China for the broader chip industry.