As of late 2025, China’s economy presents a multifaceted picture of targeted growth and persistent challenges, casting a long shadow and bright lights on global technology stocks. While the nation’s economy grew by a respectable 4.8% year-on-year in the third quarter, a moderation from earlier in the year, it remains a significant engine of global growth, largely on track to meet its annual GDP target. This steady, albeit decelerating, performance is underpinned by resilient manufacturing activity and a strategic shift in exports towards high-tech products, making China an indispensable component of global supply chains. However, headwinds such as weak domestic demand, a lingering property market slump, and renewed trade tensions with the United States create a complex environment, signaling both opportunities and risks for the international tech sector.

The immediate implications for global technology stocks are profound and, at times, contradictory. Chinese technology giants have witnessed an impressive rally in 2025, with a basket of major players surging over 40%, fueled by aggressive advancements in AI and investor optimism. This domestic tech boom, however, is juxtaposed against China’s intensified push for “scientific and technological self-reliance,” a policy direction that aims to reduce dependence on Western technologies, particularly in critical areas like semiconductors. This drive, coupled with the ongoing US-China chip rivalry, is fragmenting the global semiconductor ecosystem, increasing costs, and introducing new vulnerabilities across international supply chains, thereby reshaping the competitive landscape for tech companies worldwide.

China’s Economic Tapestry: Policies, Progress, and Pressure Points

China’s economic journey in 2025 is marked by a blend of strategic policy directives and market-driven developments, all of which resonate deeply within the global technology sphere. The nation’s Q3 GDP growth of 4.8% indicates a stable, though slowing, trajectory, contributing significantly to global economic expansion. Manufacturing activity, as evidenced by an increase in the RatingDog China General Manufacturing Purchasing Managers’ Index (PMI) to 51.2 in September 2025, suggests continued expansion. Furthermore, China’s exports have shown resilience, with a notable 8.3% year-on-year increase in September, driven by a strategic pivot towards capital and intermediate goods, including high-tech products. This shift underscores China’s ambition to move up the value chain and solidify its position as a global manufacturing powerhouse.

However, this growth narrative is tempered by significant domestic challenges. Weak domestic demand persists, and the property market continues its slump, with investment plummeting by 13.9% from January to September 2025. Deflationary pressures stemming from property sector consolidation and manufacturing overcapacity are also concerns. Moreover, renewed trade tensions with the United States add another layer of complexity, potentially disrupting trade flows and investment in the technology sector. These internal and external pressures create a volatile backdrop against which global tech companies must navigate their strategies.

Key policy changes, largely guided by the impending 15th Five-Year Plan (2026-2030), are shaping China’s economic future. “Technological self-reliance” and “new quality productive forces” are paramount, with a strong commitment to achieving breakthroughs in hard tech areas such as semiconductors, AI, robotics, and quantum computing. This aggressive push is a direct response to Western export controls and aims to bolster China’s indigenous innovation capabilities. Concurrently, the government is focused on boosting domestic consumption through targeted welfare reforms and city-level consumption drives, while maintaining a supportive monetary and fiscal stance to finance infrastructure projects and foster technology finance. Reforms in market access for both foreign and domestic private investment also signal an effort to develop a unified national market, though the “anti-involution” campaign to address manufacturing overcapacity might weigh on short-term growth.

These developments have led to a fascinating divergence in the tech market. While Chinese tech stocks like Alibaba (NYSE: BABA) and Tencent (HKG: 0700) have experienced a robust rally in 2025, driven by AI ambitions, some major players are simultaneously reporting declining attributable profits due to macroeconomic headwinds and intense price competition. This duality highlights the dynamic and sometimes paradoxical nature of China’s economic influence on the global tech landscape, where rapid technological advancement coexists with significant commercial pressures and strategic decoupling efforts.

Global Tech’s Shifting Fortunes: Winners and Losers in the Chinese Economic Arena

The intricate dance of China’s economic performance and policy shifts creates a clear divide between potential winners and losers in the global technology sector, with companies like Nvidia at the epicenter of these dynamics.

Nvidia (NASDAQ: NVDA), a titan in the semiconductor industry, finds itself in a particularly precarious position. On one hand, China’s aggressive push for AI and advanced computing creates immense demand for high-performance chips, a market Nvidia has historically dominated. However, the intensified focus on “technological self-reliance” and the ongoing US-China chip rivalry, characterized by stringent US export controls, directly impact Nvidia’s ability to sell its cutting-edge AI GPUs to the Chinese market. While Nvidia is adapting by developing specialized, less powerful chips for China to comply with regulations, these alternatives may not fully capture the market potential and could face increasing competition from indigenous Chinese chipmakers supported by state funding. This strategic pivot is crucial, but it also highlights the challenges of navigating a bifurcated global tech landscape, potentially limiting Nvidia’s growth in what was once a key market.

Potential Winners:

- Chinese Domestic Semiconductor and AI Companies: Firms like Huawei-affiliated entities and other indigenous chip manufacturers stand to gain significantly from China’s self-reliance initiatives. Heavy state investment and preferential policies are fostering rapid development in areas like AI chips and Extreme Ultraviolet (EUV) lithography. Companies like Alibaba (NYSE: BABA) and Tencent (HKG: 0700), with their substantial AI investments and development of large language models, are also positioned to benefit from the domestic AI boom. Their rally in 2025 is a testament to this trend.

- Companies Focused on “New Consumption” Trends: As China emphasizes boosting domestic consumption, companies catering to “new consumption” trends – trendy toy brands, jewelers blending traditional craftsmanship with modern aesthetics, and budget-friendly tea chains – could see increased demand. E-commerce platforms that facilitate these trends also stand to benefit.

- Manufacturers of Robotics and Automation Equipment: With China at the forefront of automation and a thriving robotics industry, companies supplying components or complete robotic systems for industrial automation and other applications within China could experience robust demand.

Potential Losers:

- Foreign High-End Semiconductor Manufacturers (beyond Nvidia): Other non-Chinese companies specializing in advanced logic and memory chips, especially those subject to US export controls, will likely face similar restrictions and a shrinking market share in China as the nation prioritizes domestic alternatives. This could include companies like Intel (NASDAQ: INTC) or AMD (NASDAQ: AMD) in specific high-performance segments.

- Global Software and IT Services Companies (in sensitive areas): While China’s overall IT services market is growing, the push for indigenous software and data sovereignty might create barriers for foreign providers, particularly in areas deemed critical for national security or data management.

- Luxury Goods and High-End Discretionary Spending Companies (if domestic demand remains soft): While “new consumption” is emerging, overall weak domestic demand and deflationary pressures could impact companies reliant on high-end discretionary spending, especially if consumer confidence doesn’t fully recover.

The overarching theme is a strategic realignment. Companies that can adapt to China’s self-reliance goals, either by offering compliant products, localizing production, or focusing on less-sensitive sectors, will be better positioned. Those heavily reliant on unrestricted access to China’s high-tech markets, particularly in advanced semiconductors, face significant headwinds and the need for substantial strategic pivots.

Wider Significance: A New Era of Tech Geopolitics

China’s economic trajectory and its impact on global tech stocks are not isolated events but rather integral components of broader industry trends, signaling a new era of tech geopolitics and supply chain recalibration. This complex interplay is reshaping the competitive landscape, influencing regulatory frameworks, and drawing parallels to historical economic shifts.

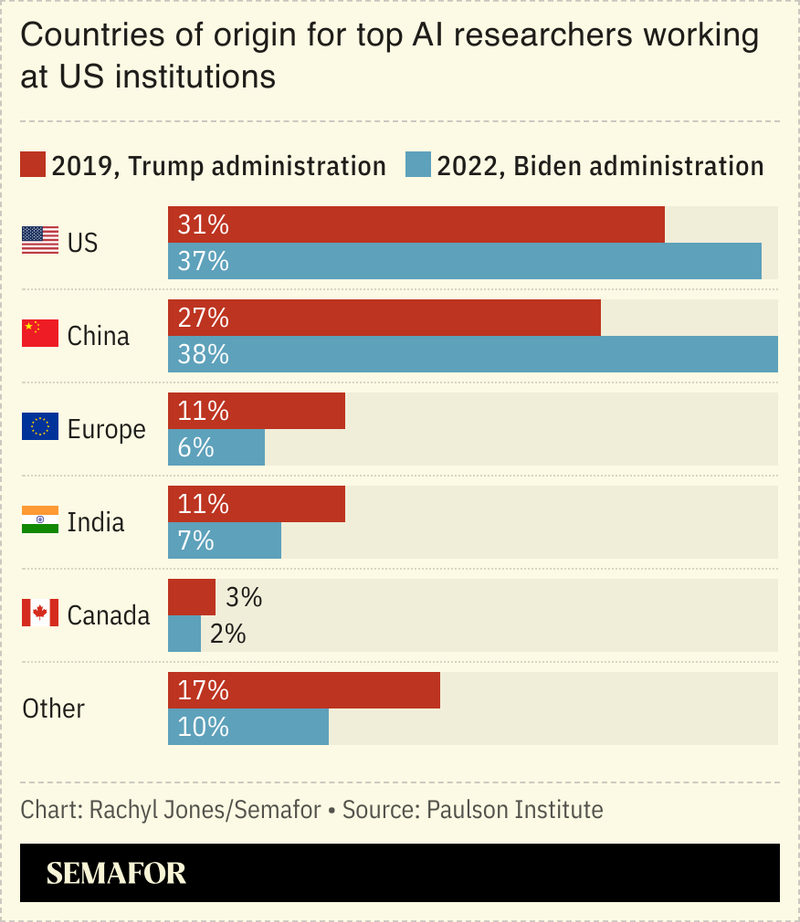

This event fits squarely into the accelerating trend of technological decoupling between the United States and China. China’s “scientific and technological self-reliance” initiative is a direct response to US export controls, creating a parallel ecosystem for critical technologies like semiconductors and AI. This bifurcation forces global tech companies to navigate two distinct and often conflicting regulatory environments, leading to increased R&D costs, fragmented markets, and the need for region-specific product development. The ripple effects are profound: competitors of companies like Nvidia (NASDAQ: NVDA) in other nations might see opportunities in markets where US restrictions don’t apply, while partners in global supply chains must contend with the complexities of “de-risking” and establishing redundant manufacturing capabilities outside China.

Regulatory and policy implications are paramount. China’s impending 15th Five-Year Plan underscores a commitment to “high-quality development” and “new quality productive forces,” prioritizing indigenous innovation and industrial upgrading. This means increased state support for domestic tech champions and potentially more stringent requirements for foreign companies operating within China, particularly concerning data localization and technology transfer. Simultaneously, the US continues to refine its export control policies, further tightening the screws on advanced technology transfers to China. This regulatory tit-for-tat creates an unpredictable environment for global tech firms, necessitating constant vigilance and agile compliance strategies.

Historically, this situation echoes past periods of technological competition, such as the Cold War era’s space race or the US-Japan semiconductor rivalry of the 1980s. However, the current scenario is unique due to the deeply intertwined nature of global supply chains and the pervasive role of digital technologies across all sectors. Unlike previous eras, where technological leadership was primarily a national endeavor, today’s tech giants are multinational, making the disentanglement process far more disruptive and costly. The pervasive overcapacity in China’s manufacturing sector, coupled with its “anti-involution” campaign, further complicates matters, potentially leading to increased global competition and pricing pressures in various industrial sectors.

Ultimately, this signifies a structural shift in the global technology landscape. The pursuit of technological sovereignty by both major powers is not merely a political maneuver but a fundamental reordering of how technology is developed, produced, and deployed worldwide. Companies that fail to recognize and adapt to this new geopolitical reality risk being caught in the crossfire, highlighting the urgent need for strategic foresight and robust risk management in an increasingly fragmented global market.

What Comes Next: Navigating a Fragmented Future

The evolving economic landscape in China and its profound implications for global tech stocks suggest a future characterized by both significant challenges and emerging opportunities. Navigating this fragmented environment will require strategic agility and a keen understanding of both short-term market dynamics and long-term geopolitical shifts.

In the short-term, we can anticipate continued volatility in global tech stock performance, particularly for companies with substantial exposure to the Chinese market or those heavily reliant on advanced semiconductor technologies. The ongoing US-China chip rivalry will likely intensify, leading to further adjustments in supply chains and product offerings. Companies like Nvidia (NASDAQ: NVDA) will continue to develop region-specific products to comply with export controls, potentially impacting their average selling prices and profit margins. We may also see increased M&A activity within China as domestic tech firms consolidate and scale up to meet national self-reliance goals. Investors should watch for further policy announcements from both Beijing and Washington regarding technology trade and industrial subsidies, as these will directly influence market sentiment and corporate strategies.

Long-term possibilities point towards a more bifurcated global technology ecosystem. China’s aggressive investment in indigenous AI, robotics, and semiconductor capabilities will likely lead to the emergence of highly competitive domestic champions, potentially reducing the market share available for foreign firms in the long run. This could force global tech companies to implement significant strategic pivots, such as diversifying their manufacturing bases outside China, increasing R&D investments in other regions, or even forming new partnerships to access alternative markets. The emphasis on “new quality productive forces” in China suggests a sustained focus on advanced manufacturing and high-tech industries, creating opportunities for companies that can align with these strategic priorities, perhaps through localized joint ventures or technology licensing agreements.

Market opportunities may emerge in unexpected areas. As China focuses on boosting domestic consumption and “new consumption” trends, companies catering to these evolving consumer preferences could find fertile ground. Furthermore, the global push for supply chain resilience might open doors for tech companies in other developing economies, fostering new hubs for manufacturing and innovation. Challenges, however, include increased R&D costs due to duplication of efforts, potential for intellectual property disputes in a bifurcated system, and the difficulty of maintaining global standards in a fragmented regulatory environment. Potential scenarios range from a gradual, managed decoupling to a more rapid and disruptive fragmentation, with each outcome having distinct implications for profitability, market access, and technological innovation across the globe.

Comprehensive Wrap-Up: A New Geoeconomic Reality

The impact of China’s economy on global tech stocks, exemplified by the experiences of companies like Nvidia, underscores a fundamental shift in the geoeconomic landscape. The past year has highlighted a complex interplay of China’s sustained, albeit moderating, economic growth, its unwavering commitment to technological self-reliance, and the persistent challenges of weak domestic demand and geopolitical tensions. This confluence of factors is not merely a cyclical market event but a structural reordering that demands strategic reassessment from all stakeholders.

Key takeaways from this evolving scenario include the undeniable rise of China’s indigenous tech capabilities, fueled by massive state investment and strategic policy directives aimed at reducing reliance on Western technology. This has created a vibrant domestic tech sector, evidenced by the rally in Chinese tech stocks, but also poses significant challenges for foreign tech giants facing export controls and increasing competition. The fragmentation of global supply chains, particularly in critical areas like semiconductors, is a lasting consequence, leading to higher costs, increased complexity, and the necessity for redundant manufacturing capacities. The “new consumption” trends within China, coupled with policy efforts to stimulate domestic demand, present a silver lining for companies capable of adapting to local consumer preferences.

Moving forward, the market will likely be characterized by continued dual-track development: a robust and increasingly independent Chinese tech ecosystem alongside a global tech market grappling with the implications of decoupling. Investors should closely watch for further developments in US-China trade relations, the implementation details of China’s 15th Five-Year Plan, and the pace of indigenous technological breakthroughs in China. The ability of global tech companies to innovate, localize, and diversify their operations will be paramount to their success. Those that can effectively navigate regulatory complexities, adapt their product portfolios for different markets, and strategically partner with local entities will be better positioned to thrive in this new, fragmented reality.

This content is intended for informational purposes only and is not financial advice