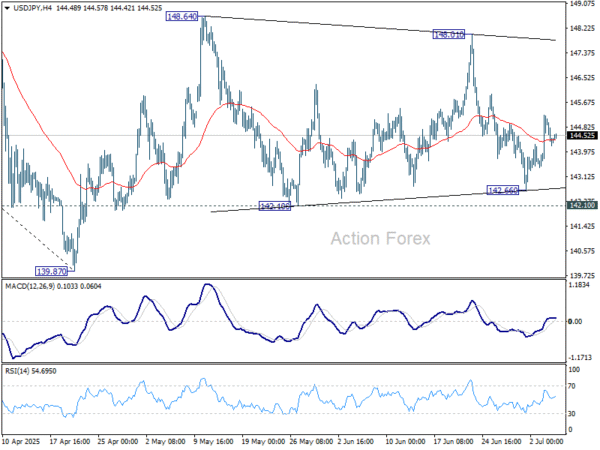

Shareholders of SoundHound AI (SOUN -1.42%) were riding high in 2024 after the stock posted an incredible 836% gain for the year. But 2025 is a different story. SoundHound stock is down 55% from the all-time high it reached late last year.

The rise and fall of SoundHound stock has a common denominator: Nvidia. In early 2024, Nvidia revealed that it had recently invested in some promising artificial intelligence (AI) stocks, including SoundHound AI. Shares skyrocketed because investors believed this validated the small company’s technology.

Image source: Getty Images.

In early 2025, the opposite happened when Nvidia revealed that it had sold its stake in the company.

Buying or selling a stock based on another investor’s actions — in this case, Nvidia’s — can be a bad idea. It’s important for investors to have their own investment thesis, or a structured argument for why the stock will go up over the long term. With this in mind, I want to explore the investment thesis for SoundHound AI stock today.

Why are investors buying SoundHound stock?

SoundHound AI offers voice-assistant technology to automotive companies, restaurants, and other industries. It’s considered a first-mover in the space, leaning on two decades of experience. But its revenue growth wasn’t catalyzed until the relatively recent AI revolution. Now, its revenue is skyrocketing with full-year revenue growth of 85% in 2024 and stunning 151% year-over-year growth in the first quarter of 2025.

Bullish investors are salivating over those numbers, particularly because of the total addressable market. According to management, the company has a $140 billion market opportunity. For perspective, it commands far less than 1% of its theoretical market as of this writing.

Data by YCharts.

In other words, SoundHound is growing at a head-turning rate, and the runway ahead of it appears to be massive. This combination could lead to many years of growth — a huge factor for stocks that perform well in the long run — which is why investors are excited about the company.

They’re also excited by the prospects of SoundHound’s profits. Management believes it will achieve profitability by the end of this year based on adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). That’s a big step forward when thinking about long-term viability for any business.

To be clear, SoundHound isn’t profitable yet — it has a massive trailing 12-month net loss of $188 million. But with $246 million in cash and no debt, the company is on solid financial footing as it moves toward breakeven.

Put simply, SoundHound stock could be a winning investment because it’s a fast-growing business in a massive industry, and its financials are trending in the right direction.

This might not be a stock for everyone

So SoundHound believes its market opportunity is over $140 billion. Management also believes the company has a competitive advantage in the space because it’s known as “white-label.” Whereas bigger companies might have similar voice-technology solutions on the market, these companies usually like to slap their branding on it. In contrast, SoundHound works behind the scenes, keeping its customers’ branding front and center.

To play the devil’s advocate, I’m not sure this is actually a competitive advantage for SoundHound. Auto manufacturers, for example, have no problem putting other branding in their vehicles, including SiriusXM satellite radio and JBL speakers.

SoundHound also boasts a big head start in the AI voice-assistant space. But massive progress in AI could be cutting into its lead. On the Q1 earnings call, management admitted that the boom in generative AI applications has increased competition in recent years.

Moreover, competition will likely be coming from tech giants in the next few years. SoundHound’s technology plays into the nascent agentic AI trend — AI that can make more autonomous decisions on a user’s behalf. All of the big players are working to address this holistically, and a head-on collision with SoundHound seems likely.

For example, Alphabet is a leading AI company, and its Android Auto product is getting some attention from auto manufacturers such as Ford and General Motors.

Keep expectations realistic

The takeaway isn’t that SoundHound stock is doomed. On the contrary, the business is doing quite well.

The takeaway is that investors should remember the path to SoundHound’s $140 billion market opportunity won’t be free from competition. If anything, competition will only intensify.

For investors who believe SoundHound has what it takes to challenge the biggest tech players in the world, the stock may be a cautious buy in light of the 55% plunge from its peak.

But personally, I’d wait on the sidelines to see how competition develops over the next year. I’m not worried about missing the train, so to speak. If the market opportunity is truly as big as SoundHound believes it is, this story still has a long time to play out, allowing patient investors to evaluate the company’s competitive position.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.