Apple (AAPL 1.79%) shares are down 18% in 2025 (as of June 6). This makes Apple the worst-performing “Magnificent Seven” constituent this year, besides Tesla. Investors are probably concerned about tariff uncertainty and the company’s slow progress with artificial intelligence (AI).

The stock is currently 21% below its peak. So, it has some work to do to get back to its former glory. Legendary investor Warren Buffett and his conglomerate, Berkshire Hathaway, have sold a sizable chunk of their shares in the past several quarters.

However, should you go against the Oracle of Omaha’s moves and buy the dip on Apple stock? I think the answer might surprise you.

Image source: Getty Images.

It’s easy to recognize the positive traits

I mention Buffett because many individual investors like to follow his buy and sell decisions. Clearly, when Berkshire first bought Apple in early 2016, they must’ve thought the tech giant was a high-quality enterprise. It’s not hard to see why.

Apple’s brand is arguably the most recognizable in the world. This position wasn’t created overnight. It took years and years of introducing truly exceptional products and services, that were well designed and incredibly easy to use, on a global scale. Apple is an icon, to say the least.

That brand has helped drive Apple’s pricing power. And this supports the company’s unrivaled financial position. Apple remains an unbelievably profitable business. It brought in $24.8 billion in net income in the latest fiscal quarter (Q2 2025 ended March 29).

Apple’s products and services are impressive on their own. However, it’s the combination of both of these aspects that creates the powerful ecosystem. Consumers are essentially locked in, which creates high barriers for them to switch to competing products. This favorable setup places Apple in an enviable position from a competitive perspective.

Even the best deal with issues

Despite Apple’s market cap of nearly $3.1 trillion, which might make some investors believe it’s immune to external challenges, this business is dealing with some notable issues recently. There are three that immediately come to mind.

The first problem is that Apple’s growth engine seems to be decaying. Net sales were up less than 7% between fiscal 2021 and fiscal 2024. And they’re up just over 4% through the first six months of fiscal 2025. According to management, there are likely over 2.4 billion active Apple devices across the globe. That number continues to rise with every passing quarter, but you get an idea of how ubiquitous these products are. Plus, the maturity of the iPhone, now almost two decades into its lifecycle, might lead to limited opportunities to further penetrate markets.

Critics can also call out Apple’s slow entrance into the AI race. For example, we won’t see an AI update to Siri until next year, a launch that was delayed. At the same time, it seems like other companies are moving rapidly to win the AI race.

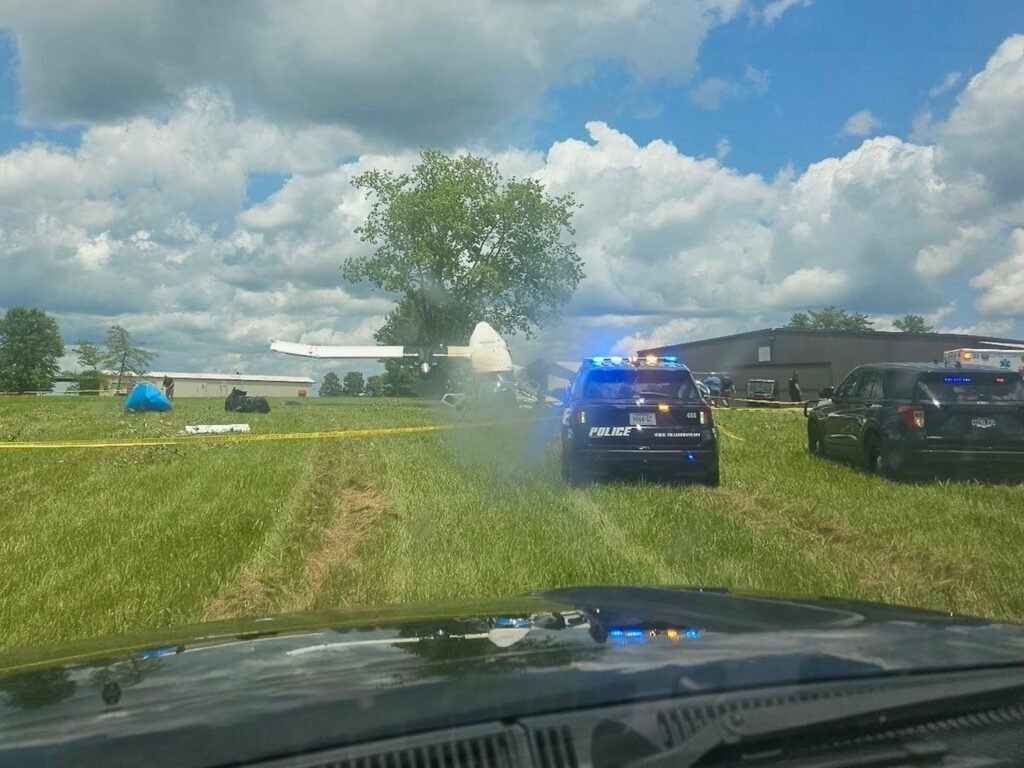

Lastly, Apple has been and could continue to be drastically impacted by the tariff situation. China, which has gotten the most attention from President Donald Trump during the ongoing trade tensions, has been a manufacturing powerhouse for Apple. The business is being forced to shift its supply chain around to minimize the impact. Apple CEO Tim Cook said that the situation makes it challenging to forecast near-term results.

There’s no margin of safety

Even though this stock trades 21% off its peak, investors aren’t really getting a bargain deal here. The price-to-earnings ratio is 32 right now. That’s not cheap for a company whose earnings per share are only expected to grow at a compound annual rate of 8.8% between fiscal 2024 and fiscal 2027.

In my view, there’s zero margin of safety. If you’re an investor who wants to generate market-beating returns over the next five years, I don’t think you should buy Apple today.

Neil Patel has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Tesla. The Motley Fool has a disclosure policy.