US stocks surged on Monday, bouncing back from Friday’s rout after President Trump played down the escalating US trade standoff with China, saying it “will all be fine!”

The Dow Jones Industrial Average (^DJI) jumped 1%, or over 400 points. The S&P 500 (^GSPC) and the Nasdaq Composite (^IXIC) gained nearly 1.1% and 1.5%, respectively, coming off their worst day since April.

Stocks are set to recoup some of Friday’s hefty losses after Trump dialed back his threat from Friday to impose an additional 100% tariff on Chinese goods from Nov. 1. That move reignited fears of a full-on US-China trade war and triggered a Wall Street selloff that erased roughly $2 trillion in US stocks’ value.

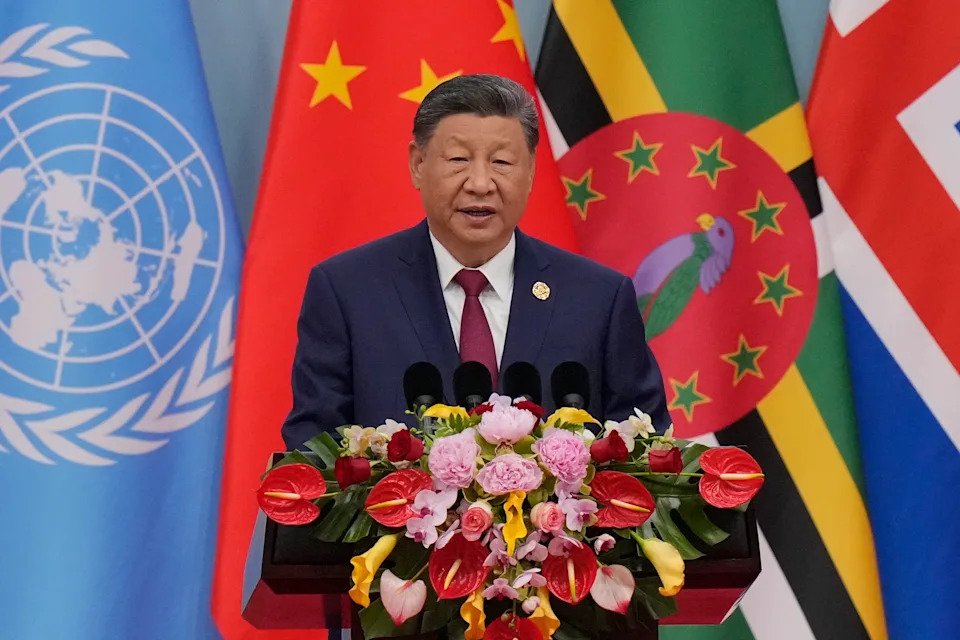

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment,” Trump wrote on Truth Social on Sunday. “He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it.”

While Trump’s comments aimed to calm jitters, they also kept up the pressure on Beijing to unwind its recent tightening in trade curbs by stressing the potential for economic damage. Meanwhile, China’s export growth topped forecasts in September, as it strengthened trade with countries other than the US.

Beyond trade headlines, AI demand optimism was boosted by OpenAI’s partnership with Broadcom (AVGO), the latest in a string of AI deals. Broadcom shares jumped 6%.

Meanwhile, Wall Street is bracing for uncertainty in coming days as the US government shutdown stretches into its second full week. The consumer inflation report due on Wednesday has had its release pushed back to Oct. 24.

Other scheduled data ranging from retail sales to wholesale inflation is likely to be delayed, leaving the market and the Federal Reserve flying blind on the US economic landscape. That turns the spotlight on Fed Chair Jerome Powell’s speech on Tuesday, covering the economic outlook and monetary policy.

At the same time, earnings season kicks off with results from the biggest Wall Street banks. JPMorgan Chase (JPM), Goldman Sachs (GS), Wells Fargo (WFC), and Citigroup (C) are set to report on Tuesday, followed by Bank of America (BAC), and Morgan Stanley (MS) on Wednesday. Analysts expect profits at the six major banks to climb 6% from the third quarter of last year, according to Bloomberg data.

LIVE 11 updates

-

Broadcom stock jumps 6% on OpenAI partnership

Broadcom (AVGO) stock jumped 6% at the open on Monday after the company said it will build 10 gigawatts of custom AI chips for OpenAI (OPAI.PVT). Shares climbed as much as 12% in premarket trading.

To put that figure in perspective, Meta’s (META) massive $10 billion data center in Louisiana, spanning 4 million square feet, is set to deploy around two gigawatts of computing power — a feat that’s already on track to strain the state’s power infrastructure.

“By building our own chip, we can embed what we’ve learned from creating frontier models and products directly into the hardware, unlocking new levels of capability and intelligence,” OpenAI president Greg Brockman said.

OpenAI’s deal with Broadcom is the latest of its recent partnerships with chipmakers. The ChatGPT-maker is also working with Nvidia (NVDA) to deploy at least 10 gigawatts of computing power to train and run OpenAI’s models, a collaboration connected to Nvidia’s $100 billion investment in the AI company. OpenAI also recently announced a multibillion-dollar deal with Advanced Micro Devices (AMD) to receive more than 6 gigawatts of its AI chips.

The massive figures in terms of computing power highlight Big Tech’s AI ambitions, even as they are already straining the US power grid. Not to mention, OpenAI has yet to turn a profit, and its ability to meet its revenue targets remains in question.

-

Stocks surge at the open

The tech-heavy Nasdaq Composite (^IXIC) led a rebound in stocks Monday at the open.

The Nasdaq jumped nearly 1.8%, while the S&P 500 (^GSPC) and the Dow Jones Industrial Average (^DJI) added 0.9% and 1.25%, respectively.

Stocks jumped as Trump dialed back his tariff threat on China and as AI demand hopes were boosted by OpenAI’s deal with Broadcom (AVGO).

The moves come after stocks saw their worst day since April on Friday.

-

Tech and chip stocks rise as investors hope for easing US-China tensions

Tech and chip stocks rebounded ahead of the opening bell on Monday after President Trump struck a more pacifying chord with China, stating, “it will all be fine!”

Shares of chipmakers were under pressure on Friday after tensions between the two countries heated up again and Trump promised to impose 100% tariffs on Chinese goods.

Advanced Micro Devices (AMD) and Marvel (MRVL) rose 3%. On Semiconductor (ON), Micron (MU), and Taiwan Semiconductor (TSM) gained over 4%. Qualcomm (QCOM) rose 2%.

Nvidia (NVDA) also rallied in premarket trading, along with all of the “Magnificent Seven” stocks. Shares of the $4 trillion company were up 3% on Monday morning.

Meanwhile, Chinese stocks tumbled. Hong Kong’s Hang Seng index (^HSI) closed 1.5% lower, as Chinese tech stocks such as Alibaba (BABA) and Tencent (TCEHY) slid.

-

Bloom Energy stock soars over 28% on $5 billion Brookfield investment to build AI factories

Brookfield Asset Management (BAM) announced Monday it’s investing up to $5 billion in fuel cell manufacturer Bloom Energy (BE) to develop artificial intelligence data centers, which sent Bloom Energy’s stock soaring over 29% in premarket trading.

The two companies said the strategic partnership will focus on building AI factories, including one in Europe, which is expected to be announced by the end of the year. Bloom Energy’s other partnerships include ones with American Electric Power (AEP), Equinix (EQIX), and Oracle (ORCL).

Shares of Brookfield Asset Management were 1.7% higher ahead of the opening bell.

-

JPMorgan pledges $10 billion to US companies ‘essential to national security’

Yahoo Finance’s David Hollerith reports:

-

TSMC rises as Q3 profit expected to soar 28% on AI spending boom

TSMC’s stock rose 4% before the bell after analysts forecast that the chipmakers profit for the third-quarter is set to soar by 28%.

Bloomberg News reports:

-

Good morning. Here’s what’s happening today.

-

Premarket trending tickers: MP Materials, TSMC and Warner Bros

Here’s a look at some of the top stocks trending in premarket trading:

MP Materials (MP) stock rose 11% in premarket trading on Monday following fresh trade tensions between the US and China after Beijing’s export restrictions on rare earths fueled bets on alternative suppliers.

TSMC (TSM) stock rose 5% in premarket trading on Monday after analysts forecast that the chipmaker is set to report a new profit of $13.55 billion for the three months through Sept. 30, according to an LSEG SmartEstimate compiled from 20 analysts.

Warner Bros (WBD) stock rose 2% before the bell. David Ellison, the CEO of Paramount Skydance, may make a bid to buy all of Warner before the media giant splits, according to the WSJ.

-

Wall Street’s biggest banks are riding high as earnings season begins

The six biggest US banks will kick off Q3 earnings season this week amid lofty expectations for a 6% rise in profit, writes Yahoo Finance’s David Hollerith.

He reports:

-

Oil prices bounce back following easing of US-China trade fears

Oil prices rose following comments from Trump that allowed investors to lower their hackles, following fears of an inflammatory tit-for-tat tariff exchange between the US and China.

Bloomberg reports: