US stocks rose on Friday as President Trump eased worries of further trade escalation with China, while regional bank stocks began to recover from significant losses amid investor jitters over bad loans and US credit quality.

The Dow Jones Industrial Average (^DJI) gained more than 0.5%, while the S&P 500 (^GSPC) rose around 0.5%. The tech-heavy Nasdaq Composite (^IXIC) also gained about 0.5%.

All three major averages closed out the week with gains.

Trump on Friday said talks with China were going well and his meeting with Chinese leader XI Jinping would go forward. The remarks followed earlier comments in which he said the 100% tariffs he has threatened to add to existing duties on Chinese goods from Nov. 1 would not be a “sustainable” level for each side’s economy.

Meanwhile, US regional bank stocks turned positive after a slew of upbeat earnings updates on Friday from those lenders, including Truist Financial Corp., (TFC), Huntington Bancshares (HBAN), and Fifth Third Bancorp (FITB).

Wall Street jitters had grown Thursday after two US regional lenders disclosed problems with loans, allegedly linked to fraud. Those troubles deepened concerns sparked by JPMorgan (JPM) CEO Jamie Dimon’s “cockroach” warning, seen as further signs of cracks in the creditworthiness of US borrowers.

Stocks’ back-and-forth Friday capped a turbulent week for markets, plagued by the rising US-China trade tensions as well as the prospect of a prolonged US federal shutdown.

The shutdown is dragging on, now tied for the third longest in history, with some lawmakers now worried the stoppage could extend into November and even past Thanksgiving. Federal workers’ paychecks remain suspended as Trump threatens to block back pay and the courts consider his effort to fire thousands.

LIVE 22 updates

-

Stocks notch weekly wins as Trump downplays China tariff threats, regional bank fears ease

Stocks closed out the week with wins on Friday amid easing concerns over China-US trade and the stability of regional banks.

The Dow Jones Industrial Average (^DJI) rose 0.5%, while the S&P 500 (^GSPC) also gained 0.5%. The tech-heavy Nasdaq Composite (^IXIC) jumped 0.5% for all three major averages to close out a volatile week with a 5-day gain.

Meanwhile, gold futures (GC=F) eased 1.5% on Friday but still notched their biggest weekly gain since 2020

-

Markets rise as regional bank concerns ease

The stock market was on pace to close in green territory on Friday after a choppy session, as fears about worsening credit conditions eased. A new round of regional bank earnings provided some relief following a Thursday rout that had spooked Wall Street.

A key index tracking US regional bank stocks, the KBW Nasdaq Regional Banking (^KRX), rose more than 1.5% after falling sharply on Thursday by 6% — its worst single-day pullback since the height of the tariff turmoil last April.

Yahoo Finance’s David Hollerith reports:

Read more here.

-

Auto loan delinquencies are soaring, with consumers hit by high car prices

Yahoo Finance’s Emma Ockerman reports:

Read more here.

-

Oil on pace for third weekly loss amid concerns of oversupply

Oil was on pace for its third week of losses on Friday as traders grew increasingly concerns about oversupply.

West Texas Intermediate (CL=F) traded below $57 per barrel while Brent futures (BZ=F) hovered near $61, their lowest level since May. WTI and Brent were on pace to close out the week down more than 2.5%.

Back-and-forth tariff sparring between the US and China, and a recent de-escalation of tensions in the Middle East have weighed on the energy markets over the past week.

President Trump said he had a “productive” call with Russian President Vladimir Putin ahead of an upcoming meeting with Ukrainian President Zelensky, adding that he and Putin plan a second summit in Budapest.

Any progress toward ending the war could unlock more Russian crude onto global markets, intensifying supply concerns.

-

Oracle stock sinks over 7% after Envoy Air confirms security breach

Oracle (ORCL) stock sank over 7% on Friday after American Airlines’ regional carrier Envoy Air confirmed that Oracle’s E-Business Suite applications were involved in targeted extortion attempts by hackers in recent days.

A spokesperson at the Texas-based Envoy Air said it was investigating the incident, per Reuters.

Earlier this month, executives at AlphGoogle (GOOG) and Harvard University reported similar breaches of Oracle apps by a hacker group known as Cl0p. At the time, Google said that more than 100 companies were likely involved in the attack and that “mass amounts of customer data” were stolen.

The decline in Oracle shares followed the stock’s rally on Thursday after executives provided a rosier outlook for AI infrastructure deal gross margins. Executives stated that a data center project could yield margins of 35% over several years, contradicting a report from The Information last week that Oracle’s AI cloud deals had margins of around 14%. The difference may be due to large upfront costs versus lifetime returns, analysts noted.

-

Gold on pace for biggest week since 2020 as precious metal goes ‘parabolic’

Yahoo Finance’s Ines Ferré reports:

-

Tech stocks set to end week mixed

Big Tech stocks were set to end a chaotic week for the market on varying notes.

Nvidia (NVDA) was on track for a weekly loss of less than 1% — despite a recent upgrade from analysts at HSBC (HSBC) and an upbeat earnings report from its manufacturer TSMC (TSM) — as investors have increasingly worried about an AI bubble and as its customer OpenAI (OPAI.PVT) has inked deals with its rivals.

Amazon (AMZN) was set to lose 1.6% for the five trading sessions through Friday, while Microsoft (MSFT) was on track to end the week roughly flat.

Meanwhile, Alphabet (GOOG, GOOGL) shares were eyeing a 6% gain after launching a new Gemini Enterprise offering last week. JPMorgan also noted this week that Google’s new changes to how it displays text ads could result in better monetization of its Search business.

Broadcom (AVGO) was also set for a 6.5% gain as it signed a deal with OpenAI this week to build custom chips for the ChatGPT developer.

Tesla (TSLA) was on track for a 5% gain as the EV maker is set to report quarterly results next week.

-

Treasury yields rebound as credit fears ease

Treasury yields rose on Friday as regional bank earnings alleviated concerns about credit stress that prompted a flight to safe-haven assets the day before.

The 10-year Treasury yield (^TNX) climbed 3 basis points to above 4% on Friday morning. On Thursday, the 10-year yield fell to levels not seen since a major drop in April and, before that, the end of 2024.

Meanwhile, the 30-year yield (^TYX) ticked up 2 basis points to 4.61%. The 5-year yield rose 4 basis points to 3.59%

-

Micron falls amid report that chipmaker will exit China server chips business

Micron (MU) stock fell as much as 2.8% Friday as Reuters reported that the chipmaker plans to stop supplying memory chips for servers to data centers in China.

Micron’s China business suffered after it failed to recover from a 2023 ban from the country’s government on its products, Reuters said.

Micron did not immediately respond to Yahoo Finance’s request for comment.

The stock pared initial losses in late morning trading.

-

State data shows US jobless claims fell last week, Bloomberg reports

An analysis of state-level data suggests that initial US jobless claims fell last week, Bloomberg reported Friday.

Applications for US unemployment benefits fell to 215,000 during the week that ended Oct. 11 from 234,000 the previous week, according to Bloomberg.

A government shutdown has prevented the release of critical federal economic data closely watched by Wall Street and policymakers, including weekly updates on initial applications for US unemployment benefits. Data related to US employment is a key factor in investor bets on the Federal Reserve’s path to interest rate cuts.

Easing unemployment would complicate investors’ growing confidence that the central bank will cut rates in both October and December.

-

Stocks wobble at the open

US stocks wavered Friday at the open.

The Dow Jones Industrial Average (^DJI) added more than 0.1%, while the S&P 500 (^GSPC) fell around 0.1%. The tech-heavy Nasdaq Composite (^IXIC) dropped nearly 0.5%.

The moves come as President Trump attempted to ease fears of greater escalation of the US trade dispute with China. Stocks had fallen during Thursday’s trading session as regional bank stocks took a hit from investor concerns over bad loans and US credit quality.

-

Regional bank stocks recover as earnings soothe some credit concerns

Regional banks largely projected steadiness in their third quarter earnings reports on Friday, helping to ease credit jitters after Zions Bank (ZION) reported a $50 million charge-off and Western Alliance (WAL) filed a lawsuit alleging fraud by a borrower.

The S&P Regional Banking ETF (KRE) rose 2% in premarket trading after falling 6% on Thursday as regional banks across the board took a hit.

On Friday, attention shifted to a handful of regional banks and financial institutions reporting their quarterly results. Truist (TFC), Comerica (CMA), and Fifth Third (FITB) reported a rise in net income.

While Truist noted that loans 90 days or more past due ticked up 1 basis point and Fifth Third raised its provisions for loan losses, Comerica executives stated that their economic forecast had modestly improved.

Shares of those three banks rose 1% to 2% in premarket trading. Zion (ZION) climbed 4% after a 13% rout on Thursday. Western Alliance gained 3% after falling 10% the previous day.

-

Trump says threatened high tariffs on China ‘not sustainable,’ helping fuel recovery

President Trump on Friday said threatened high tariffs on Chinese goods were “not sustainable,” easing fears of further trade escalation between the countries.

“But that’s what the number is,” he said during an interview with Fox Business. “It’s probably not [sustainable] — you know, it could stand, but they forced me to do that.”

Those comments helped fuel a recovery in stock futures. Futures on all three indexes recovered from steep before-the-bell losses.

Trump also suggested a long-planned meeting with Xi Jinping was still on track, saying he planned to meet with China’s leader in two weeks.

-

American Express CEO to Yahoo Finance on banking stress: Not seeing it at our company

With the concerning news from banks like Zions (ZION) yesterday on loan blow-ups — which comes on the heels of the situations at Tricolor and First Brands — it’s good to see contagion not spreading to a company in American Express (AXP).

What CEO Steve Squeri just told me by phone:

“I don’t see any blowback. If you look at what these banks were reporting, [it] was big one-time losses. And we don’t do that. What would be concerning to me would be the delinquency rate getting out of control, because that’s a leading indicator of people potentially going into default. And we’re at 1.3% across our business globally, and the gap to our competitors continues to widen from a delinquency perspective. So I can worry about what I can see.”

-

America’s wealthiest shoppers are boosting spending — and the US economy — while lower earners pull back

Americans making over $100,000 a year are boosting the US economy, with industries ranging from travel and the auto industry to packaged foods and even dollar stores feeling the shift, writes Yahoo Finance’s Brooke DiPalma.

She reports:

-

Good morning. Here’s what’s happening today.

Please note some economic data may not be available due to the government shutdown.

Economic data: Housing starts (September); Building permits, (September preliminary reading); Housing starts (September); Import price index (September); Import price index (September) Export price index (September); Export price index (September); Industrial production (September); Manufacturing production (September); Capacity utilization (September)

Earnings calendar: American Express (AXP), Truist (TFC), State Street (STT), Ally Financial (ALLY), Comerica (CMA)

Here are some of the biggest stories you may have missed overnight and early this morning:

Wall Street credit worries intensify after Dimon’s ‘cockroach’ warning

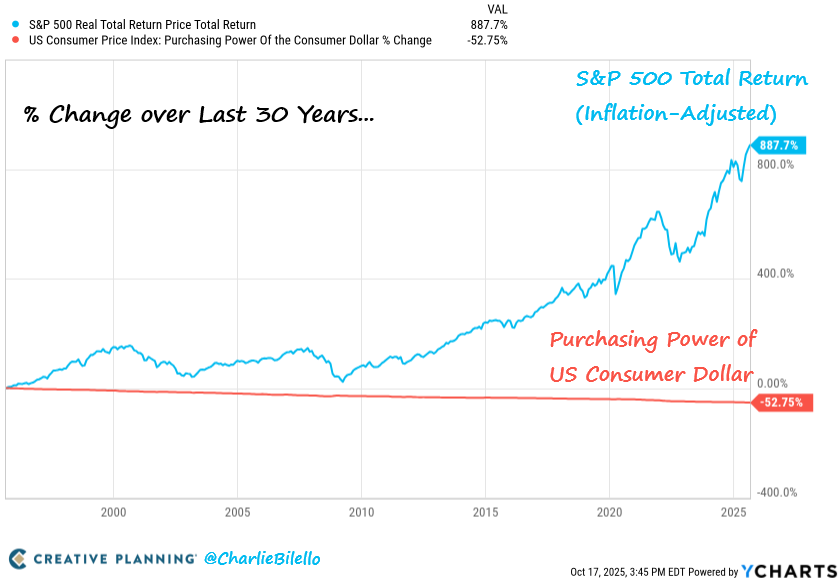

AI can’t justify its massive buildout — but doesn’t have to, yet

Tariffs help trim US deficit in first drop since COVID era

Bitcoin continues to slide after historic crypto wipeout

Rich shoppers drive US spending as lower earners cut back

Novo, Lilly fall as Trump promises cut in Ozempic’s price

US bank stock losses deepen in wait for earnings

-

Bitcoin struggles after historic crypto wipeout

Bloomberg reports:

-

Dollar set for worst week since July on Fed bets, bank woes

The dollar is set to have its worst week since July, falling for a fourth day, amid dovish signals from the Fed and new worries over US regional banks.

Bloomberg News reports:

-

Bank stocks’ rout deepens as investors brace for earnings

US bank stocks extended their losses in premarket, after a sharp sell-off in regional lenders on Thursday. Those declines were led by Zions and Western Alliance, which flagged problems with loans allegedly linked to fraud.

Shares of Bank of America (BAC) and Citigroup (C) slid about 2%, while Morgan Stanley (MS and Wells Fargo (WFC) saw slighter falls in early trading on Friday morning.

Bloomberg reports:

-

Premarket trending tickers: MP Materials, Wolfspeed and EssilorLuxottica

Here’s a look at some of the top stocks trending in premarket trading:

MP Materials (MP) stock fell 3% in premarket trading on Friday. The rare earths company has found itself caught up in the US-China trade tensions, as China imposed restrictions on its rare earths, forcing the US to diversify its suppliers.

Wolfspeed (WOLF) stock fell 4% before the bell. The chipmaker announced on Thursday that it would discuss its fiscal 2026 first quarter results on Wednesday, October 29, 2025, at 5:00 p.m. ET.

Shares in Ray-Ban maker EssilorLuxottica (EL.PA) hit rose on Friday, surging over 10% after the eyewear giant’s record quarter showed sales of its Ray-Ban Meta (META) smart glasses gaining momentum.