US stocks continued to sell off before the bell on Friday as fears spread about regional banks’ exposure to bad loans and US credit quality, spurring an exodus by investors to safe havens.

Dow Jones Industrial Average futures (YM=F) fell roughly 0.8%, while those on the S&P 500 (ES=F) tumbled 1.1%. Contracts on the tech-heavy Nasdaq 100 (NQ=F) led the retreat, down 1.3%.

Stocks are set for a second day of losses after two US regional lenders disclosed problems with loans, allegedly linked to fraud. Those troubles deepened Wall Street jitters sparked by JPMorgan (JPM) CEO Jamie Dimon’s “cockroach” warning, seen as further signs of cracks in the creditworthiness of US borrowers.

A rush to safety picked up pace on Friday, with investors flocking to less-risky assets such as bonds and gold (GC=F). The 10-year Treasury yield (^TNX) fell further below the key 4% level, while gold rose to a fresh record above $4,300 an ounce.

The stock selloff caps a turbulent week for markets, plagued by rising US-China trade tensions and the prospect of a prolonged US federal shutdown.

In trade, China is imposing fresh export controls and sanctions amid escalating threats from President Trump to impose new tariffs. But a small bright spot emerged Thursday: The White House is preparing to ease tariffs on the auto industry as soon as Friday.

Meanwhile, the government shutdown is dragging on, with some lawmakers now worried the stoppage could extend into November and even past Thanksgiving. Federal workers’ paychecks remain suspended as Trump threatens to block back pay and the courts consider his effort to fire thousands.

Amid the headwinds, earnings season is in full swing following strong results from big banks. On Friday, the parade of results continues with American Express (AXP) reporting before the bell.

LIVE 4 updates

-

Bank stocks’ rout deepens as investors brace for earnings

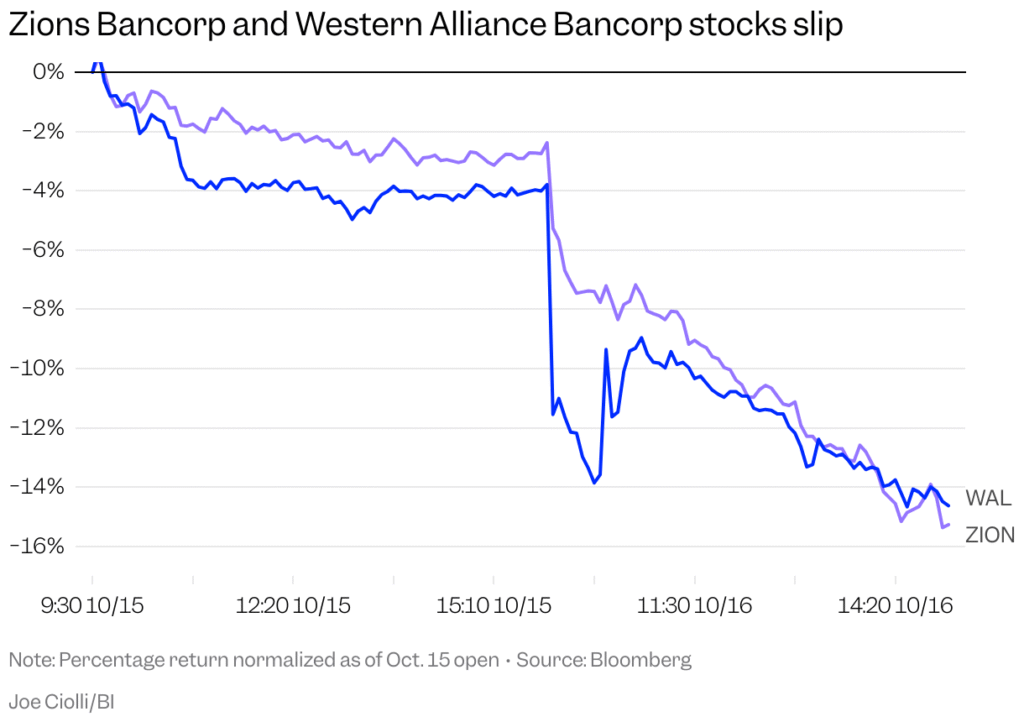

US bank stocks extended their losses in premarket, after a sharp sell-off in regional lenders on Thursday. Those declines were led by Zions and Western Alliance, which flagged problems with loans allegedly linked to fraud.

Shares of Bank of America (BAC) and Citigroup (C) slid about 2%, while Morgan Stanley (MS and Wells Fargo (WFC) saw slighter falls in early trading on Friday morning.

Bloomberg reports:

-

Premarket trending tickers: MP Materials, Wolfspeed and EssilorLuxottica

Here’s a look at some of the top stocks trending in premarket trading:

MP Materials (MP) stock fell 3% in premarket trading on Friday. The rare earths company has found itself caught up in the US-China trade tensions, as China imposed restrictions on its rare earths forcing the US to diversify its suppliers.

Wolfspeed (WOLF) stock fell 4% before the bell. The chipmaker announced on Thursday that it would discuss its fiscal 2026 first quarter results on Wednesday, October 29, 2025, at 5:00 pm Eastern Standard Time.

Shares in Ray-Ban maker EssilorLuxottica (EL.PA) hit rose on Friday, surging over 10% after the eyewear giant’s record quarter showed sales of its Ray-Ban Meta (META) smart glasses gaining momentum.

-

Gold climbs to record on bank woes, Fed Bets and trade tensions

Gold (GC=F) rose again today, hitting another record as the safe haven was boosted by concerns about credit quality in the economy, bets that the Federal Reserve will press on with monetary easing and heightened US-China relations.

Bloomberg News reports:

-

Trump says price of Ozempic will soon be ‘much lower’. Novo, Lilly shares fall.

Shares in Novo Nordisk (NVO, NOVO-B.CO) and Eli Lilly (LLY) slid after President Trump said on Thursday that the price of Ozempic would soon fall to just $150 a month.

Novo, which makes the best-selling weight-loss drug, saw its stock fall over 4% in US premarket and over 6% in Copenhagen. The Danish pharma’s shares have lost almost 60% in the past 12 months amid questions about whether it can maintain its prominence in the weightloss market.

At the same time, shares of Lilly retreated over 4% before the bell.

Bloomberg reports: