US stocks came back from significant losses Friday as President Trump eased worries of further trade escalation with China, while regional bank stocks also recovered amid investor jitters over bad loans and US credit quality.

Dow Jones Industrial Average futures (YM=F) gained roughly 0.2%, while those on the S&P 500 (ES=F) hovered around the flatline. Contracts on the tech-heavy Nasdaq 100 (NQ=F) pared steeper losses, down 0.2%.

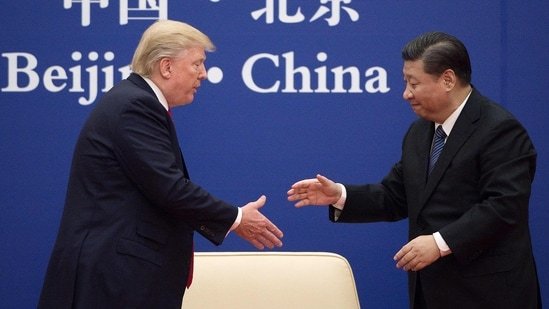

Trump on Friday said the 100% tariffs he has threatened to add to existing duties on Chinese goods from Nov. 1 would not be a “sustainable” level for each side’s economy. He confirmed plans to meet with Chinese leader Xi Jinping later this month but said, “We’ll see what happens.”

Meanwhile, US regional bank stocks turned positive after a slew of positive earnings updates on Friday from those lenders, including Truist Financial Corp., (TFC), Huntington Bancshares (HBAN), and Fifth Third Bancorp (FITB).

Wall Street jitters had grown Thursday after two US regional lenders disclosed problems with loans, allegedly linked to fraud. Those troubles deepened concerns sparked by JPMorgan (JPM) CEO Jamie Dimon’s “cockroach” warning, seen as further signs of cracks in the creditworthiness of US borrowers.

The stock gyrations cap a turbulent week for markets, plagued by the rising US-China trade tensions and the prospect of a prolonged US federal shutdown.

The shutdown is dragging on, now tied for the third longest in history, with some lawmakers now worried the stoppage could extend into November and even past Thanksgiving. Federal workers’ paychecks remain suspended as Trump threatens to block back pay and the courts consider his effort to fire thousands. .

LIVE 10 updates

-

Trump says threatened high tariffs on China ‘not sustainable,’ helping fuel recovery

President Trump on Friday said threatened high tariffs on Chinese goods were “not sustainable,” easing fears of further trade escalation between the countries.

“But that’s what the number is,” he said during an interview with Fox Business. “It’s probably not [sustainable] — you know, it could stand, but they forced me to do that.”

Those comments helped fuel a recovery in stock futures. Futures on all three indexes recovered from steep before-the-bell losses.

Trump also suggested a long-planned meeting with Xi Jinping was still on track, saying he planned to meet with China’s leader in two weeks.

-

American Express CEO to Yahoo Finance on banking stress: Not seeing it at our company

With the concerning news from banks like Zions (ZION) yesterday on loan blow-ups — which comes on the heels of the situations at Tricolor and First Brands — it’s good to see contagion not spreading to a company in American Express (AXP).

What CEO Steve Squeri just told me by phone:

“I don’t see any blowback. If you look at what these banks were reporting, [it] was big one-time losses. And we don’t do that. What would be concerning to me would be the delinquency rate getting out of control, because that’s a leading indicator of people potentially going into default. And we’re at 1.3% across our business globally, and the gap to our competitors continues to widen from a delinquency perspective. So I can worry about what I can see.”

-

America’s wealthiest shoppers are boosting spending — and the US economy — while lower earners pull back

Americans making over $100,000 a year are boosting the US economy, with industries ranging from travel and the auto industry to packaged foods and even dollar stores feeling the shift, writes Yahoo Finance’s Brooke DiPalma.

She reports:

-

Good morning. Here’s what’s happening today.

Please note some economic data may not be available due to the government shutdown.

Economic data: Housing starts (September); Building permits, (September preliminary reading); Housing starts (September); Import price index (September); Import price index (September) Export price index (September); Export price index (September); Industrial production (September); Manufacturing production (September); Capacity utilization (September)

Earnings calendar: American Express (AXP), Truist (TFC), State Street (STT), Ally Financial (ALLY), Comerica (CMA)

Here are some of the biggest stories you may have missed overnight and early this morning:

Wall Street credit worries intensify after Dimon’s ‘cockroach’ warning

AI can’t justify its massive buildout — but doesn’t have to, yet

Tariffs help trim US deficit in first drop since COVID era

Bitcoin continues to slide after historic crypto wipeout

Rich shoppers drive US spending as lower earners cut back

Novo, Lilly fall as Trump promises cut in Ozempic’s price

US bank stock losses deepen in wait for earnings

-

Bitcoin struggles after historic crypto wipeout

Bloomberg reports:

-

Dollar set for worst week since July on Fed bets, bank woes

The dollar is set to have its worst week since July, falling for a fourth day, amid dovish signals from the Fed and new worries over US regional banks.

Bloomberg News reports:

-

Bank stocks’ rout deepens as investors brace for earnings

US bank stocks extended their losses in premarket, after a sharp sell-off in regional lenders on Thursday. Those declines were led by Zions and Western Alliance, which flagged problems with loans allegedly linked to fraud.

Shares of Bank of America (BAC) and Citigroup (C) slid about 2%, while Morgan Stanley (MS and Wells Fargo (WFC) saw slighter falls in early trading on Friday morning.

Bloomberg reports:

-

Premarket trending tickers: MP Materials, Wolfspeed and EssilorLuxottica

Here’s a look at some of the top stocks trending in premarket trading:

MP Materials (MP) stock fell 3% in premarket trading on Friday. The rare earths company has found itself caught up in the US-China trade tensions, as China imposed restrictions on its rare earths, forcing the US to diversify its suppliers.

Wolfspeed (WOLF) stock fell 4% before the bell. The chipmaker announced on Thursday that it would discuss its fiscal 2026 first quarter results on Wednesday, October 29, 2025, at 5:00 p.m. ET.

Shares in Ray-Ban maker EssilorLuxottica (EL.PA) hit rose on Friday, surging over 10% after the eyewear giant’s record quarter showed sales of its Ray-Ban Meta (META) smart glasses gaining momentum.

-

Gold climbs to record on bank woes, Fed bets, and trade tensions

Gold (GC=F) rose again today, hitting another record. The safe-haven asset was boosted by concerns about credit quality in the economy, bets that the Federal Reserve will press on with monetary easin and heightened US-China relations.

Bloomberg News reports:

-

Trump says price of Ozempic will soon be ‘much lower.’ Novo, Lilly shares fall.

Shares in Novo Nordisk (NVO, NOVO-B.CO) and Eli Lilly (LLY) slid after President Trump said on Thursday that the price of Ozempic would soon fall to just $150 a month.

Novo, which makes the best-selling weight-loss drug, saw its stock fall over 4% in US premarket and over 6% in Copenhagen. The Danish pharma’s shares have lost almost 60% in the past 12 months amid questions about whether it can maintain its prominence in the weightloss market.

At the same time, shares of Lilly retreated over 4% before the bell.

Bloomberg reports: