US stock futures held steady on Tuesday after another record-setting day, as Wall Street waited for the first speech from Chair Jerome Powell since the Federal Reserve started cutting interest rates again.

Dow Jones Industrial Average futures (YM=F) nudged up 0.2%. Meanwhile, contracts on the S&P 500 (ES=F) and the tech-heavy Nasdaq 100 (NQ=F) both hovered near the flat line.

Stocks jumped on Monday to clinch a third straight day of record-high closes, lifted by optimism that the AI trade and further Fed policy easing will continue to fuel the rally.

On the Fed-watching side, Powell is scheduled to deliver a speech on monetary policy later Tuesday, in high focus after policymakers last week lowered rates for the first time in 2025.

His comments will set the stage for the release on Friday of the Fed’s preferred inflation gauge, the Personal Consumption Expenditures index. Wall Street will look for signs that already sticky inflation isn’t heating up, which could dent high expectations for two more rate reductions this year.

In the meantime, updates on US manufacturing and services activity in September are on Tuesday’s docket, while Fed official Michelle Bowman is expected to speak.

Gold (GC=F) also climbed to another fresh record high as optimism for Fed rate cuts grows.

On the tech side, the spotlight is on Micron Technology’s (MU) quarterly earnings due after the bell. The chipmaker’s results will be watched for updates on AI-driven demand and revenue guidance, with analysts expecting an almost 40% jump in sales.

On Monday, the Nasdaq (^IXIC) led gains as Nvidia stock surged (NVDA) stock thanks to an $100 billion OpenAI (OPAI.PVT) deal.

LIVE 6 updates

-

Kenvue stock rebounds after Trump links Tylenol use to autism

Kenvue (KVUE) stock rebounded on Tuesday morning after President Trump linked the use of its pain-relieving drug Tylenol to autism but didn’t offer new scientific evidence to support that claim.

Shares rose 4.8% in premarket trading after dropping over 7% on Monday.

In a press conference on Monday, Trump connected incidences of autism with women taking Tylenol while pregnant, which drew criticism from doctors and scientists who say that studies have not found a causal relationship between the two.

“Overall, we see limited judicial risk following today’s announcement, but there could be some impact on Tylenol consumption due to negative headlines,” Citi analysts wrote in a note following the press conference.

Kenvue stock has been under pressure since reports surfaced that the Trump administration would release a report on Tylenol usage and autism. Tylenol makes up about 15% of Kenvue’s US sales.

-

It’s not just 2025 optimism that’s lifting the stock market

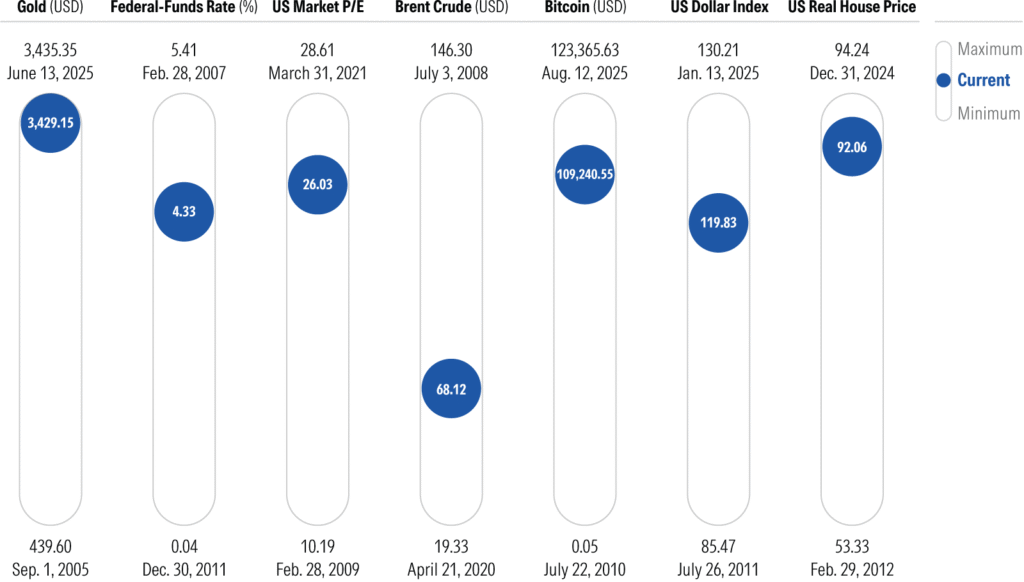

The S&P 500’s (^GSPC) has made impressive returns in a year of economic tumult and historical parallels that hint at overextension, notes Yahoo Finance’s Hamza Shaban in today’s Morning Brief.

He reports:

-

US-China talks for ‘huge’ Boeing order now in final stages

An order of 500 Boeing (BA) aircraft for China, which has been years in the making, is in the final stages of negotiations and is seen as the potential centerpiece of a US-China trade deal.

US Ambassador to China David Perdue did not offer any details on the size of the order but said, “This is a huge order.”

Shares of Boeing moved up over 2% in premarket trading on the sign that President Trump’s plane diplomacy could deliver another deal.

Bloomberg News reports:

-

Good morning. Here’s what’s happening today.

-

Premarket trending tickers: Kenvue, Boeing and Micron

Here’s a look at some of the top stocks trending in premarket trading:

Kenvue Inc (KVUE) stock rebounded and rose 5% in premarket trading on Tuesday after President Trump linked its popular pain medication Tylenol to autism risk during pregnancy.

Boeing (BA) stock rose 2% in premarket trading following news that the US and China were close to finalizing a deal for 500 aircrafts that some say could be the “centerpiece of a trade agreement.“

Micron Technology, Inc. (MU) stock rose 1% before the bell on Tuesday. The company will report its fourth-quarter earnings on Tuesday afternoon and Wall Street analysts are expecting continued strength and growing demand.

-

Gold pushes to new record as gold ETFs reach three year high

Gold (GC=F) hit a new record high as traders were unfazed by comments from Fed officials about forthcoming monetary policy.

Bloomberg reports: