US stock futures fell on Monday as President Trump made a fresh tariff threat and confirmed that country-specific duties will kick in on Aug. 1, ramping up trade uncertainty as the end to his tariff pause looms.

Dow Jones Industrial Average futures (YM=F) slipped 0.2%, while S&P 500 futures (ES=F) backed off 0.2%. Contracts on the tech-heavy Nasdaq 100 (NQ=F) dropped 0.4% as Tesla (TSLA) stock sank amid worries about CEO Elon Musk’s plan to launch a political party.

Stocks are pulling back after a strong jobs report helped boost the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) to all-time closing highs on Thursday, before the early trading shutdown for the long Independence Day weekend.

With equities at record levels, investors are wary that any sharp turn in trade negotiations could trigger volatility.

Trump said late Sunday that any country aligning itself with the “Anti-American policies of BRICS” will face an additional 10% tariff. “There will be no exceptions to this policy,” he said in a post to social media. The warning came after BRICS — a group of countries including key US trading partners China and India — criticized Trump’s tariff policy at its summit at the weekend.

It ramped up already-high trade tensions as nations race to clinch tariff deals ahead of Trump’s self-imposed deadline of July 9, when his “pause” on steep April tariffs would go back into effect. Global markets have been bracing for that potential shock, with the US only having reached deals with the UK and Vietnam, as well as a framework toward an agreement with China.

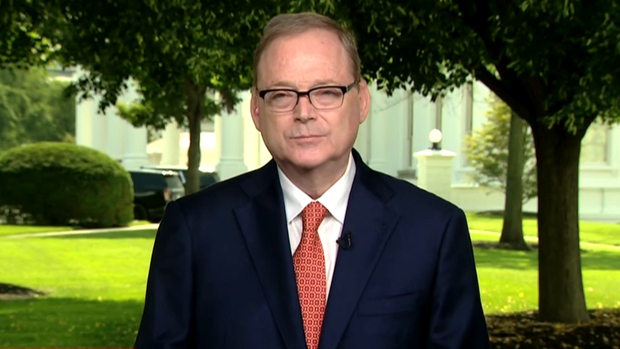

On Sunday, Treasury Secretary Scott Bessent and Trump confirmed that while letters will be sent out this week informing countries of their tariff rates, those duties would not go into effect until Aug. 1.

Read more: The latest on Trump’s tariffs.

“President Trump’s going to be sending letters to some of our trading partners saying that if you don’t move things along, then on Aug. 1 you will boomerang back to your April 2 tariff level. So I think we’re going to see a lot of deals very quickly,” Bessent told CNN’s “State of Union.”

Bessent hinted at several possible deals in the coming days, suggesting the focus this week is clarity with 18 major trading partners before setting duties for the 100-plus other countries that the administration has in its sights for trade taxation. Wall Street is waiting to see how trade talks between the European Union and Canada go, in addition to other key partners.

Earnings are coming back into the conversation this week, with Thursday seeing reports from Delta (DAL), Conagra Brands (CAG), Levi’s, (LEVI) and WD-40 (WDFC).

LIVE 3 updates

-

Metals fall as Trump stirs trade uncertainty with BRICS threat

Metals had a rough start to the week, with copper (HG=F) and other industrial metals extending losses after President Trump injected fresh uncertainty into his trade agenda with a warning to impose a 10% tariff on any country that supports what he called BRICS “anti-American” policies.

Trump posted on Truth Social saying: Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy. Thank you for your attention to this matter!

Trump’s threat caused metals fall on Monday.

Bloomberg News reports

-

The Tesla pounding

Tesla (TSLA) shares are getting run over right out of the gate post holiday weekend.

The stock is down 7% pre-market as president Trump and Elon Musk return to public battle. The general vibe from those I have chatted with is that Musk creating his own political party is the last thing Tesla shareholders want to see. Where is the board of directors here to get this guy under control?

However, lost in the sauce today is that the new tax and spending bill signed into law by Trump ends the EV tax credit on Sept. 30. That’s further bad news for Tesla argues William Blair analyst Jed Dorsheimer.

“The elimination of the corporate average fuel economy (CAFE) fines requires a reset in expectations. While the $7,500 tax credit is likely to affect demand, the combination of a demand headwind and over $2 billion in profit from regulatory credits at risk may be too much for investors to bear. Unlike the EV tax credit, we expect the reduction in regulatory credit revenue to result in a direct hit to profitability, prompting yet another prompting yet another acrossthe-board reset to Street models,” Dorsheimer says.

Tesla is our “stock of the day” on Yahoo Finance’s Opening Bid this morning. Tune in around 9:40am ET here to get some fire analysis!

-

Oil prices fall with OPEC+ increase causing fears of oversupply

Bloomberg reports:

Read more here.