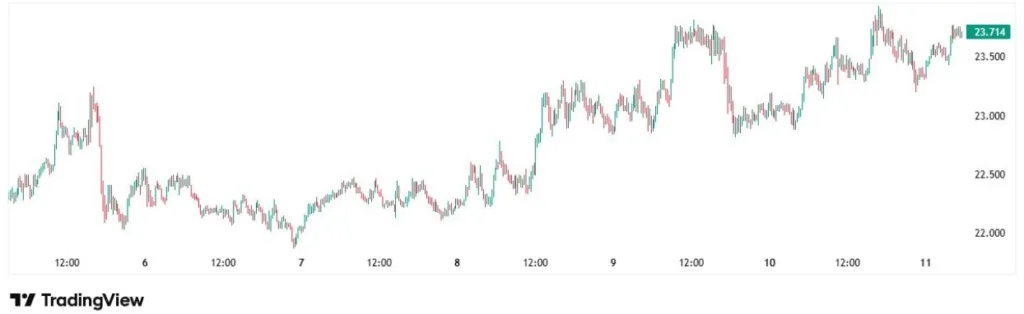

US stock futures trod water on Tuesday as investors waited for a revision to jobs numbers, seen as likely to show further labor-market weakness that could reset expectations for interest-rate cuts.

Dow Jones Industrial Average futures (YM=F) nudged up 0.1%, while those on the S&P 500 (ES=F) gained 0.2%. Contracts on the tech-heavy Nasdaq 100 (NQ=F) also put on roughly 0.2%, after stocks rose on Monday to stay in record-high territory.

Markets are treading cautiously on Tuesday as a revised look at US employment looms, with the regular update taking higher economic and political prominence than usual. Economists predict the Bureau of Labor Statistics will slash about 700,000 jobs from the level of employment for the year to March 2025.

The data lands as debate reigns over how the Federal Reserve will react after a slew of indications that the labor market is slowing down. Those signs have convinced traders that an interest-rate cut is coming when Fed policymakers meet next week. Now the question has shifted to how large the reduction might be, and whether that will be a boon for stocks.

Reports on inflation crucial to Fed thinking are due later in the week, with the latest reading of the producer price index (PPI) on Wednesday and the consumer price index (CPI) on Thursday. The CPI and PPI readings will shine light on whether rising prices could become a significant stumbling block to deep or sustained rate cuts.

Also in focus is Apple’s (AAPL) annual fall event, where the tech giant is expected to showcase devices including the iPhone 17 and iPhone Air, as well as new watches and heart rate-tracking AirPods. Experts question whether the smartphone updates can generate enough consumer interest to drive up sales, especially following a tariff-fueled buying frenzy earlier this year.

Elsewhere on the corporate front, shares of Tourmaline Bio (TRML) and Nebius (NBIS) both jumped over 50% in premarket trading on deal news, with Swiss pharma giant Novartis (NVS, NOVN.SW) and Big Tech Microsoft (MSFT) respectively.

Oracle (ORCL) and GameStop (GME) are set to report earnings after the bell.

LIVE 8 updates

-

Goldman Sachs Tech Conference Takeaways: Day 1

Day 1 is in the books for me at the big Goldman Sachs tech and media conference in San Francisco — I’m prepping as we speak for a super-busy Day 2.

A couple of worthwhile takeaways from my convos:

Some key live chats on Yahoo Finance coming up today:

Tune in here! More convos with Salesforce CEO Marc Benioff, CoreWeave CEO Michael Intrator, and Affirm CEO Max Levchin will be dropping Wednesday morning on Yahoo Finance.

-

Good morning. Here’s what’s happening today.

-

The Fed still has the power to juice the market

There’s a lot of market noise in the Federal Reserve’s quiet period ahead of its policy meeting next week, Yahoo Finance’s Hamza Shaban notes in today’s Morning Brief.

He reports:

-

Why Wall Street and Washington will be closely watching today’s jobs revisions

A revised look at America’s jobs landscape over the last year is coming Tuesday morning, with a number that is widely expected to rip through economic and political circles.

Yahoo Finance’s Ben Werschkul reports:

-

Premarket trending tickers: Nebius, Fox and Dell

Here’s a look at some of the top stocks trending in premarket trading:

Nebius Group (NBIS) stock rose 50% before the bell on Tuesday after announcing it had signed a AI deal with Microsoft (MSFT) worth $17.4 billion on Monday.

Fox (FOX) shares fell 4% premarket following the Murdoch family reaching a deal that will see Rupert Murdoch’s eldest son Lachlan Murdoch take control of the family media empire that includes Fox News and the Wall Street Journal.

Dell (DELL) shares fell 1% before the bell following the departure of the tech company’s CFO, Yvonne McGill.

-

Tourmaline stock surges after $1.4B Novartis deal

Tourmaline Bio (TRML) shares soared over 50% in premarket after Novartis (NVS, NOVN.SW) said it is buying the US company in a $1.4 billion deal.

The Swiss pharma giant will pay $48 a share for Tourmaline, with the deal expected to close in the fourth quarter.

Novartis stock slipped slightly on Wall Street and in Switzerland.

Reuters reports:

-

Apple’s annual Phone event is happening today. Here’s what to expect.

Apple (AAPL) opens the doors to its annual fall event at its Cupertino, Calif., headquarters, where the company is expected to debut its latest iPhone and Apple Watch lineups later Tuesday.

Yahoo Finance’s Daniel Howley lays out what to expect at the show:

-

Gold touches new record overnight

Gold (GC=F) reached a new record overnight Monday into early Tuesday morning, buoyed by optimism over a rate cut at the Fed’s meeting next week.

Bloomberg reports: