By William Collins, consultant in stock markets – Eurasia Business News, September 11, 2025. Article no 1780

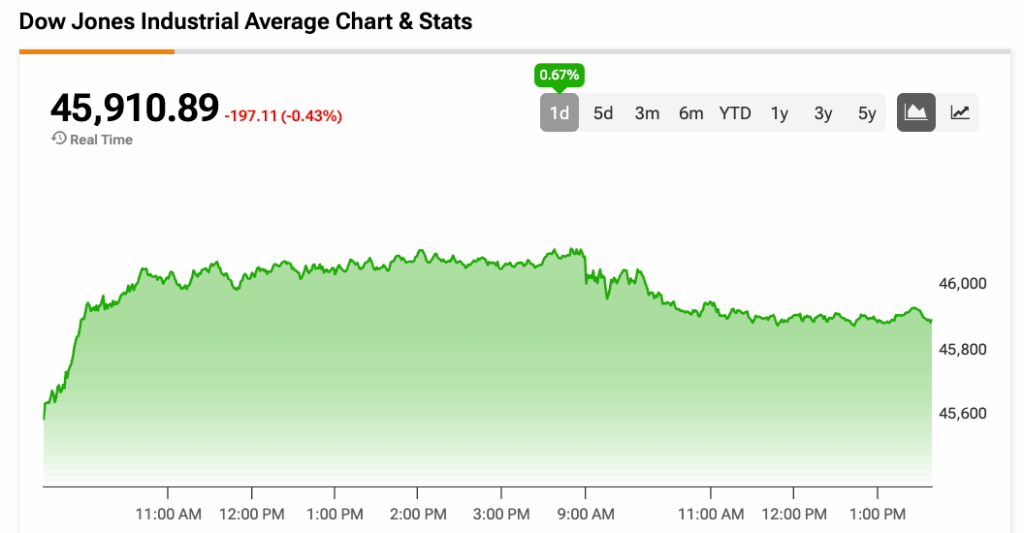

The Dow Jones Industrial Average slipped by about 0.59% or 273.8 points, closing around 45,834 points after reaching a high near 46,077 during the day. This marked a slight decline following record highs earlier in the week.

The Nasdaq Composite gained approximately 0.44% or 98 points, closing near 22,141 points and hitting new record levels, supported by strong tech sector performance and optimism around artificial intelligence trading.

The S&P 500 was mostly steady with a very slight dip of about 0.05% or 3.5 points, holding near 6,584 to 6,590 points, close to record highs.

Read also : Tax Management strategies for Digital Nomads

Meanwhile, gold prices hit new record highs on the day, trading near $3,680 per ounce, driven by market uncertainties and anticipation of the Federal Reserve’s upcoming policy decisions. Gold price hit a daily high near $3,695.5 and a low around $3,667.3. This marked a slight increase of about 0.19% compared to the previous close.

In futures markets, U.S. gold for December delivery settled near $3,686.40 to $3,688.10 per ounce on the same day, holding close to recent record highs and supported by expectations of Federal Reserve rate cuts and geopolitical uncertainties.

Read also : Gold : Build Your Wealth and Freedom

Silver prices stood at about $42.83 per ounce, with a daily range between $41.895 and $43.04, showing an increase of approximately 1.62% compared to the previous close.

Oil prices rallied after the U.K. targeted Russia with new sanctions on crude shipments, as well as on defense suppliers.

Bitcoin price was around $116,076.66, with a daily low of about $114,806 and a high near $116,742. It showed a gain of approximately 0.49% for the day, supported by positive market sentiment around potential Federal Reserve rate cuts.

Ethereum price was about $4,707.99, with a low near $4,454 and a high close to $4,734. Ethereum rose roughly 5.54% during the day, reflecting strong interest and momentum in the crypto market overall.

Americans’ confidence in the economy is waning, while long-term inflation expectations have risen, a preliminary September estimate from the University of Michigan showed Friday. “Consumers perceive risks to their pocketbooks,” said Joanne Hsu, director of the surveys.

The Index of Consumer Sentiment in the US was down in September by about 5% from August. It was below the 20-year average. The index is derived from surveys that ask Americans about their current financial situation and their expectations for the future. A higher index value suggests that consumers are confident, while a lower value indicates caution or pessimism.

Our community already has 160,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1781