The Dow Jones (DJIA) is in negative territory on Tuesday, shrugging off a producer price index (PPI) update that pointed to cooling inflation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

August’s PPI fell by 0.1% month-over-month, well below the consensus estimate for a 0.3% rise. It rose by 2.6% on a yearly basis, also below the estimate of 3.3%. Last month, PPI ticked higher by 0.9% month-over-month, marking the largest rise in over three years. However, July’s PPI was revised down to 0.7% today.

August’s core PPI, which excludes volatile food and energy prices, fell by 0.1% month-over-month while rising 2.8% year-over-year. Economists were expecting increases of 0.3% and 3.5%, respectively.

“Just out: No Inflation!!! ‘Too Late’ must lower the RATE, BIG, right now. Powell is a total disaster, who doesn’t have a clue!!!” Trump said in a Truth Social post following the inflation data. The Fed has maintained rates since December 2024, much to Trump’s ire. However, the central bank is widely expected to lower rates by at least 25 bps during the September 16-17 Federal Open Market Committee (FOMC) meeting.

On the tariff front, Trump has asked the European Union to impose 100% tariffs on China and India as punishment for the two countries’ purchases of Russian oil and in order to exert pressure on Russia to end its war against Ukraine. A U.S. official added that the U.S. was ready to “mirror” the tariffs, if imposed.

The Dow Jones is down by 0.55% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is catching a sympathy bid from Oracle (ORCL) after the company said that its AI cloud revenue would grow by 77% to $18 billion this year and then to $32 billion in 2026. The unexpected guidance has boosted optimism across the AI space.

Meanwhile, Apple (AAPL) is deep in the red, despite debuting its new lineup of iPhones yesterday. Apple also revealed its first-ever iPhone Air model. Magnificent 7 peer Amazon (AMZN) is trading lower as well, despite the e-commerce retailer inking an advertising deal with Netflix (NFLX).

Elsewhere, all of the stocks in the healthcare and communication services groups are falling, contributing to the downside in the Dow Jones.

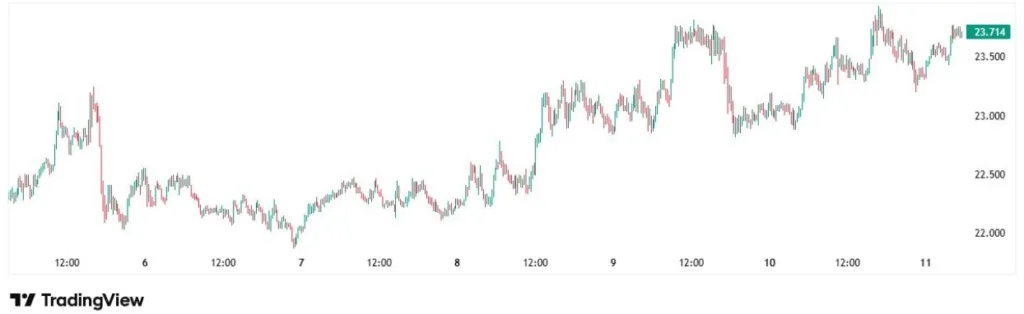

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $499.66, implying upside of 9.66% from current prices. The 31 stocks in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.