- The Dow Jones backslid around 180 points on Wednesday.

- Market sentiment buoyancy is facing fresh challenges on multiple fronts.

- The AI tech rally has pushed key companies deep into overvalued territory, steepening pullback volatility.

The Dow Jones Industrial Average (DJIA) followed the broader market lower on Wednesday, shedding 270 points at its lowest. Investors are taking profits and trimming their exposure to the AI-fueled tech rally ahead of the latest US employment figures and inflation data.

The Dow Jones has eased lower for the second day in a row after punching in fresh all-time highs this week, punching a small hole through the 46,700 level before slipping back into recent technical territory around 46,150. The Dow is still trading deep into bull country, a full 6.5% above its 200-day Exponential Moving Average (EMA) near 43,350.

AI investment: An ouroboros of shuffling cash

AI tech rally darling Nvidia (NVDA) fell another 1% on Wednesday, extending its recent decline as investors grow increasingly concerned about the insular investment scaffold that the AI industry has built itself around. Mega partnerships between tech giants, such as Nvidia’s recent $100 billion stake in OpenAI and recent investment announcement with Intel (INTC) show that plenty of investment capital is sloshing around the AI tank, but real bottom-line revenues for the AI industry remain elusive after several years of ever-climbing valuations.

Wednesday was a meager affair on the economic data docket. US New Home Sales Change rebounded to its strongest level since late 2022, clocking in at 20.5 versus its previous contraction of 1.8, but the mid-tier figure is still within its long-term range. The latest 5-year Treasury auction saw yields slip back to 3.7% from 3.724%, but the figure still remains elevated from recent lows near 3.75% as investors remain uneasy about the US government barreling into another budget crisis. The Trump administration is struggling to avert a government funding shutdown with President Donald Trump canceling key budget meetings with US elected officials.

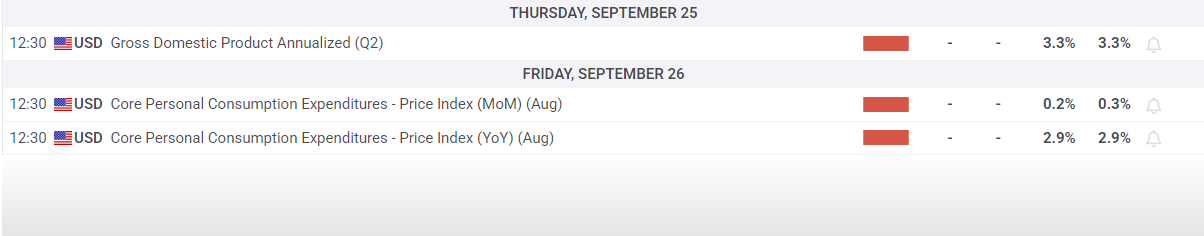

The US is releasing its latest Personal Consumption Expenditures Price Index (PCE) inflation report this Friday. Investors will be paying close attention to find out if enough businesses are absorbing some of the costs to prevent rapidly passing too much of the tariff expenses directly onto consumers.

Read more stock news: Lithium Americas stock consolidates near $6.00 following 100% rally

Dow Jones daily chart

Nvidia FAQs

Nvidia is the leading fabless designer of graphics processing units or GPUs. These sophisticated devices allow computers to better process graphics for display interfaces by accelerating computer memory and RAM. This is especially true in the world of video games, where Nvidia graphics cards became a mainstay of the industry. Additionally, Nvidia is well-known as the creator of its CUDA API that allows developers to create software for a number of industries using its parallel computing platform. Nvidia chips are leading products in the data center, supercomputing and artificial intelligence industries. The company is also viewed as one of the inventors of the system-on-a-chip design.

Current CEO Jensen Huang founded Nvidia with Chris Malachowsky and Curtis Priem in 1993. All three founders were semiconductor engineers, who had previously worked at AMD, Sun Microsystems, IBM and Hewlett-Packard. The team set out to build more proficient GPUs than currently existed in the market and largely succeeded by late 1990s. The company was founded with $40,000 but secured $20 million in funding from Sequoia Capital venture fund early on. Nvidia went public in 1999 under the ticker NVDA. Nvidia became a leading designer of chips to the data center, PC, automotive and mobile markets through its close relationship with Taiwan Semiconductor.

In 2022, Nvidia released its ninth-generation data center GPU called the H100. This GPU is specifically designed with the needs of artificial intelligence applications in mind. For instance, OpenAI’s ChatGPT and GPT-4 large language models (LLMs) rely on the H100’s high efficiency in parallel processing to execute a high number of commands quickly. The chip is said to speed up networks by six times Nvidia’s previous A100 chip and is based on the new Hopper architecture. The H100 chip contains 80 billion transistors. Nvidia’s market cap reached $1 trillion in May 2023 largely on the promise of its H100 chip becoming the “picks and shovels” of the coming AI revolution. In June 2024, Nvidia’s market capitalization crossed the $3 trillion mark.

Long-time CEO Jense Huang has a cult following in Silicon Valley and on Wall Street due to his strict loyalty and determination to build Nvidia into one of the world’s leading companies. Nvidia neary fell apart on several occasions, but each time Huang bet everything on a new technology that turned out to be the ticket to the company’s success. Huang is seen as a visionary in Silicon Valley, and his company is at the forefront of most major breakthroughs in computer processing. Huang is known for his enthusiastic keynote addresses at annual Nvidia GTC conferences, as well as his love of black leather jackets and Denny’s, the fast food chain where the company was founded.