U.S. stock markets rallied on Tuesday, with Dow Jones and Nasdaq breaking out, amid easing geopolitical concerns and renewed optimism over..

•

Last updated: Tuesday, June 24, 2025

Quick overview

- U.S. stock markets experienced a rally on Tuesday, with the Dow Jones and Nasdaq reaching new highs amid easing geopolitical concerns.

- Investor sentiment improved as fears of global conflict diminished and hopes for near-term rate cuts in the U.S. and Canada increased.

- Tech stocks led the gains, pushing the Nasdaq Composite to all-time highs and the S&P 500 close to February levels.

- Federal Reserve Chair Jerome Powell indicated that rate cuts could be justified if inflation and tariffs remain low, but may be delayed if inflation or labor market strength persists.

U.S. stock markets rallied on Tuesday, with Dow Jones and Nasdaq breaking out, amid easing geopolitical concerns and renewed optimism over potential rate cuts.

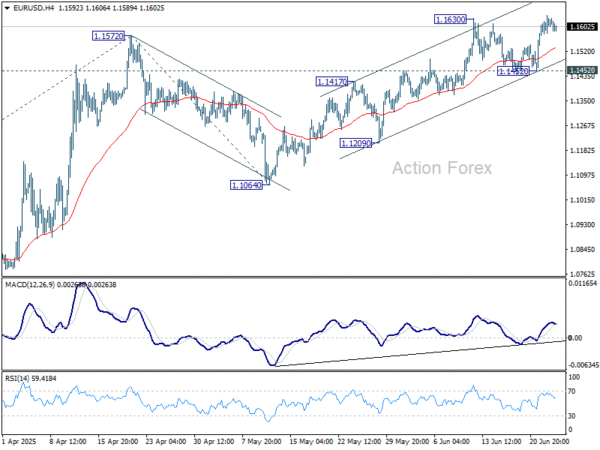

Tuesday’s rally confirmed a broad-based recovery in investor risk appetite, supported by easing fears around global conflict and rising hopes for near-term rate cuts in the U.S. and Canada. The strong close across all indices suggests markets may be pricing in a more stable macro backdrop — with potential for further upside if inflation data continues to moderate.

Markets extended gains for a second straight session amid improving sentiment over geopolitical risks and dovish central bank commentary. Tech stocks outperformed, lifting the Nasdaq Composite to new all-time highs and S&P 500 within striking distance of the February highs.

Dow Jones Chart Weekly – Pushing Above the 20 SMA

The Russell 2000 outperformed its recent trend, signaling a return of risk appetite in small-cap equities. The Dow Jones surged past the 43,000 mark as industrials and financials led broader gains. Buyers also pushed above the 20 weekly SMA (gray) which had capped the upside moves for 5 weeks, while Canada’s TSX also gained moderately, helped by a rebound in energy and materials stocks.

Key U.S. & Canadian Stock Market Closing Levels (Tuesday)

- S&P 500 finished at 6,092.18, rising +67.01 points or +1.11%

- Nasdaq Composite closed at 19,912.53, gaining +281.56 points or +1.43%

- Russell 2000 Index ended at 2,161.21, advancing +28.53 points or +1.34%

- Dow Jones Industrial Average (DJIA) jumped to 43,089.02, up +507.24 points or +1.19%

- Toronto S&P/TSX Composite Index wrapped up at 26,718.62, edging +109.26 points higher or +0.41%

FED’s Jerome Powell also testified at the Senate, and stated that an earlier rate decrease would be justified if inflation and tariffs turned out to be less than anticipated. However, any rate decreases may be postponed if inflation or the strength of the labor market continue.

Dow Jones Live Chart

DOW

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.