The talks come at a crucial time for both economies, with China grappling with deflation and trade uncertainty dampening sentiment among U.S. businesses and consumers, prompting investors to reassess the dollar’s safe-haven status.

Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer are expected to represent the U.S. at the trade talks, while vice premier He Lifeng would likely be present with the Chinese delegation.

“A deal to keep talking might be better than nothing, but unless we see a concrete breakthrough, the impact on sentiment is likely to remain muted,” said Charu Chanana, chief investment strategist at Saxo Markets.

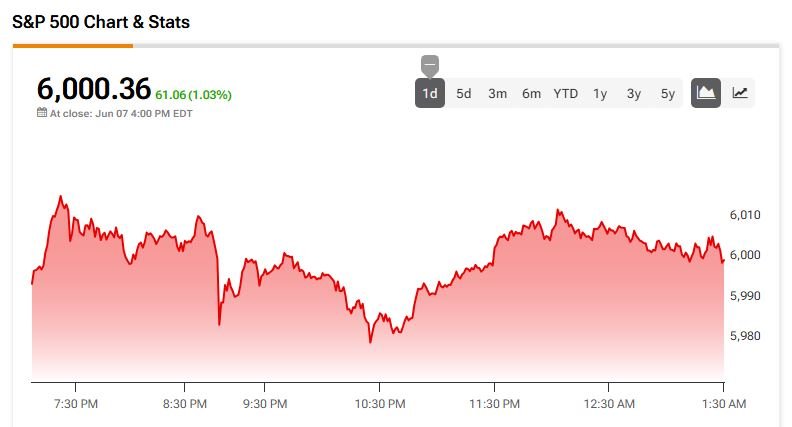

Friday’s upbeat U.S. jobs report yielded some relief for investors following other bleak economic data last week.

Live Events

The dollar advanced against major peers after the employment report, which cut weekly declines in the dollar index by more than half. However, it is still down by more than 8.6% for the year. On Monday, the yen firmed 0.10% at 144.750 per dollar, as data showed Japan’s economy contracted at a slower-than-expected pace in the January-March period. The Swiss franc was steady at 0.8221 per dollar by 0041 GMT. The euro was last flat at $1.1399, while the sterling fetched $1.3535.

The dollar index, which measures the U.S. currency against six others, was steady at 99.169. The yield on 10-year Treasury notes was flat in early Asia trading, after a more than 10 basis points jump on Friday.

New Zealand’s dollar last bought $0.6020, while the Australian dollar inched up 0.1% at $0.65 in light volumes as markets were closed for a public holiday.

An inflation report out of the U.S. for the month of May will be in the spotlight later in the week as investors and Federal Reserve policymakers look for evidence on the damage trade restrictive policies have had on the economy.

Fed officials are in a blackout period ahead of their policy meeting next week, but they have signalled that they are in no rush to cut interest rates and signs of better-than-feared economic resilience are likely to further cement their stance.

Interest rate futures indicate that investors are anticipating the central bank may cut borrowing costs by 25 basis points, with the earliest move expected in October this year, according to data compiled by LSEG.

“May is the first month where the impact of Trump’s 10% universal tariff on imports ex-USMCA is expected to show. The Fed will want a few months of inflation data in order to judge the tariff impact and most importantly, its persistence,” analysts at ANZ Bank said.

Elsewhere, China’s offshore yuan was last at 7.187 per dollar ahead of inflation and trade data.

![The display board at the Hana Bank dealing room in Jung District, central Seoul, shows the Kospi index and other indicators on June 9. [YONHAP]](https://koala-by.com/wp-content/uploads/2025/06/c2d16ac7-e806-4d27-be52-f60ba0825392.jpg)