Fed is widely expected to keep interest rates unchanged 4.25–4.50%. Markets have priced in over a 97% chance of a hold, making the decision a foregone conclusion. However, the markets would watch out for any dovish signals from the Fed, which could put pressure on the Dollar, particularly if policy language starts to point more clearly toward a September cut.

Key to the announcement will be whether dovish members like Governors Christopher Waller and Michelle Bowman begin to shift their rhetoric into formal dissent— casting votes for an immediate cut. If additional policymakers join them, markets will likely interpret it as confirmation that a policy pivot is nearing. Fed Chair Jerome Powell’s tone in the post-meeting press conference will also be crucial in guiding expectations into the fall.

Currently, futures markets see a roughly 65% chance of a rate cut in September. Any softening in Powell’s stance or language around tariff uncertainty and inflation could raise those odds.

Economic data released ahead of the Fed will help set the stage. A 2.4% annualized Q2 GDP print is expected, following Q1’s surprising -0.5% contraction. However, this strength is largely technical, driven by a reversal in imports following tariff-related stockpiling in Q1, rather than an underlying surge in domestic activity.

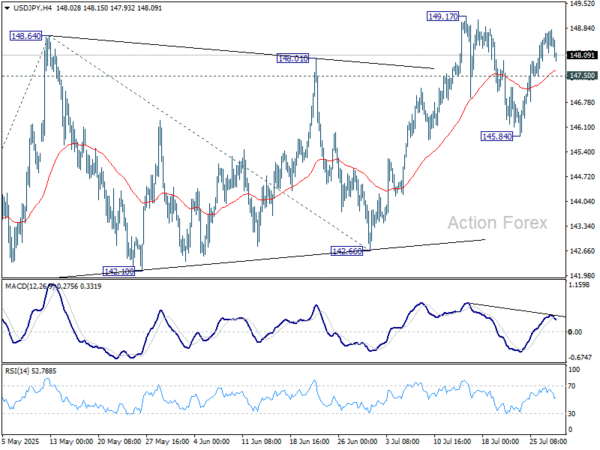

Technically, USD/JPY’s rebound from 145.84 lost momentum ahead of 149.17 resistance. Intraday bias is turned neutral first. On the upside, firm break of 149.17 will resume whole rally from 139.87 and target 100% projection of 139.87 to 148.64 from 142.66 at 151.43, which is close to 151.22 fibonacci level. Nevertheless, break of 147.50 minor support will extend the corrective pattern from 149.17 with another falling leg towards 145.84 first.