Business reporter, BBC News

Getty Images

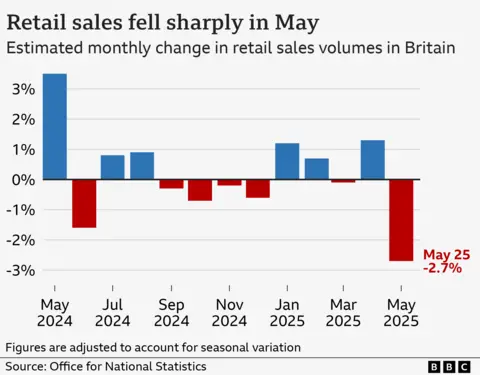

Getty ImagesA “dismal” month for supermarkets led to retail sales falling in May at the fastest pace for more than a year, official figures show.

Sales volumes dropped 2.7% in May, the biggest monthly fall since December 2023, according to the Office for National Statistics (ONS).

Food retailers saw lower sales of alcohol and tobacco as households cut back, while clothing and household goods stores reported “slow trading”, the ONS said.

Separate figures on the UK economy showed that government borrowing rose last month, hitting the second highest level for May since monthly records began in 1993.

Borrowing – the difference between spending and tax income – was £17.7bn, up £0.7bn from May last year.

The ONS said revenue from income tax and National Insurance contributions rose, but spending saw a bigger increase, partly due to inflation-linked uplifts to many benefits.

Consumers cutting back

May’s fall in retail sales followed a 1.3% rise in April, when demand was boosted by sunny weather.

ONS senior statistician Hannah Finselbach said the weak performance in May was “mainly due to a dismal month for food retailers, especially supermarkets, following strong sales in April”.

“Feedback suggested reduced purchases for alcohol and tobacco with customers choosing to make cutbacks.”

The ONS also said demand for DIY goods had fallen last month, as stores reported that consumers had completed home projects earlier than usual this year because of the good weather.

Sales volumes in the three months to May were still up by 0.8% compared to the previous three months, which is seen as a better guide to underlying trends.

However, Paul Dales, chief UK economist at Capital Economics, said the data added to “other evidence that the burst of economic growth” in the early part of the year “is over”.

The UK’s economy grew by 0.7% in the first three months of the year, but latest figures show it contracted by 0.3% in April.

He said some of May’s decline in retail sales was due to the boost in April from the warm weather fading, but “the ONS also said retailers noted inflation was prompting consumers to cut back”.

Jacqueline Windsor, head of retail at PwC UK, said: “The fact that retail sales fell back in May was not a surprise given the unusually strong performance the previous month.

“However, it does underline the fragility of consumers’ spending power and the retail sector in the current economic climate.”

The latest figures on the public finances show that the government has now borrowed £37.7bn in the first two months of the financial year.

That is less than the £40.7bn that the government’s independent forecaster, the Office for Budget Responsibility, had predicted at the time of the Spring Statement in March.

Responding to the latest data, Darren Jones, Chief Secretary to the Treasury, said the government had “stabilised the economy and the public finances; now we need to ensure that the British economy delivers for working people”.

Thomas Pugh, an economist at tax and consulting firm RSM UK, said the fact that borrowing this year was below the OBR’s forecast would give Chancellor Rachel Reeves “something to cheer”.

However, he added that a combination of an underperforming economy, higher borrowing costs and U-turns on welfare spending meant the chancellor “will probably have to announce some top-up tax increases after the summer” if she is to meet her self-imposed rules on spending and borrowing.