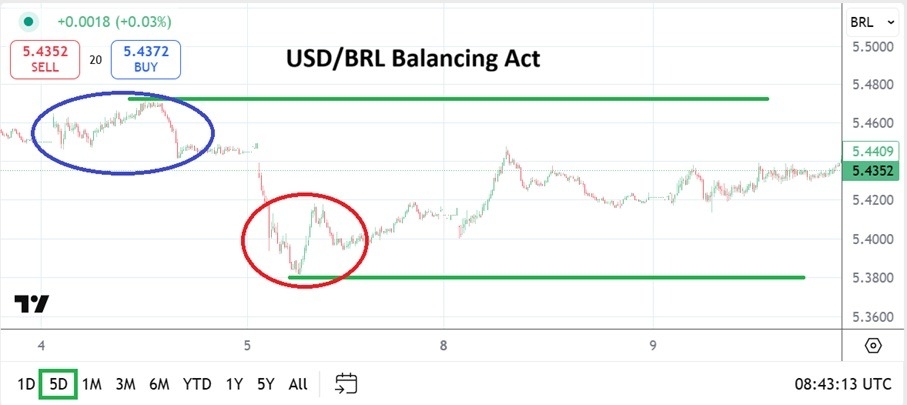

The USD/BRL closed around the 5.4352 ratio yesterday, this after moving to a high around 5.4500 on Monday and seeing a low of nearly 5.3800 on early Friday before the weekend.

Speculators continue to experience a rather tight trading range in the USD/BRL which many might find attractive if they are confident enough about their technical perceptions. The USD/BRL continues to loosely correlate to the broad market as it shows the ability to incrementally move lower. However, support levels also continue to create a rather well-defined supportive price realm.

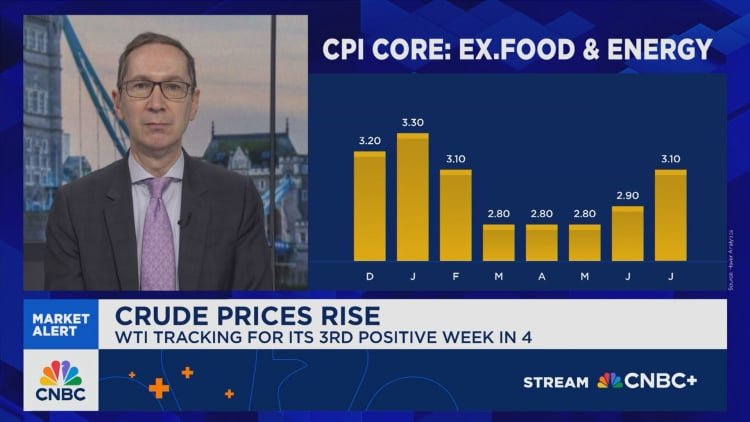

The U.S will release PPI inflation data today and tomorrow the CPI numbers will be published. The price index reports from the U.S will affect Forex including the USD/BRL. There is a lot of noise in the financial markets at this time in both the U.S and Brazil. The White House continues to debate and challenge economic data in the U.S, and in Brazil political issues regarding the past government’s leadership and current officials in power is making news. However financial institutions seemingly continue to focus on mid-term outlook via interest rate potentials in Forex.

Speculative Technical Perceptions and Range

While the past handful of days has certainly provided reversals in the USD/BRL, the currency pair continues to hover in a realm in which technical perspectives are important. The USD/BRL, yes, has moved lower since the end of July when a rate around 5.6375 was being seen. The existing range between 5.3800 to 5.5000 has dominated market action in the USD/BRL since the first week of August.

Financial institutions are clearly looking at the U.S Fed and positioning for an interest rate cut next week on the 17th of September. This cut has already been factored into Forex. Day traders need to keep that in mind as they try to figure out the next moves on the Forex chess board. Some analysts believe the Fed should cut by 50 basis points next week. However, that is unlikely because the Fed may say it needs to remain careful. Which sets the table for the FOMC Statement outlook regarding October.

Impetus Awaited on Today and Next Week in the USD/BRL

Today’s inflation numbers via the Producer Price Index will cause volatility for the USD/BRL. Traders should be careful of early gaps when the USD/BRL opens.

- If the inflation number meets expectations Forex may remain relatively calm. But if the PPI result is weaker it could spur on USD/BRL selling.

- If the inflation statistic comes in higher than anticipated the USD/BRL could see some buying.

- However, tomorrow the CPI numbers from the U.S will be published.

- This fact may keep financial institutions rather conservative today as they wait for tomorrow’s data.

- Yet, big surprises from any of the inflation reports would cause price velocity in the USD/BRL and broad Forex market.

Brazilian Real Short Term Outlook:

Current Resistance: 5.4460

Current Support: 5.4290

High Target: 5.4670

Low Target: 5.3980

Want to trade our daily forex analysis and predictions? Here are the best brokers in Brazil to check out.