Written by the Market Insights Team

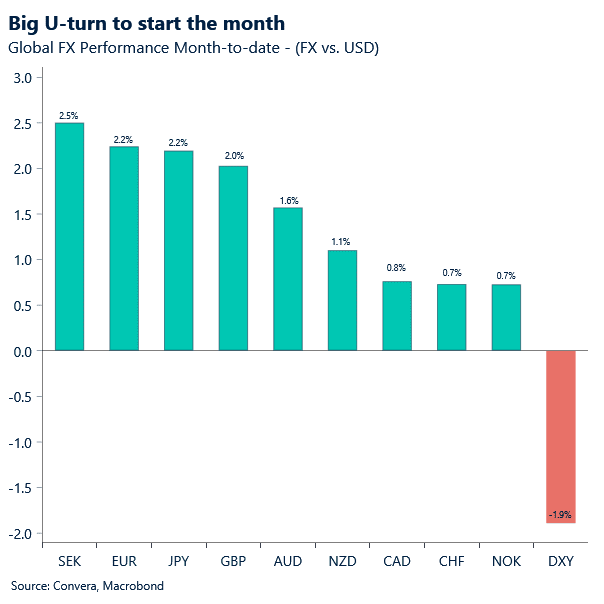

Dollar down almost 2% already in August

George Vessey – Lead FX & Macro Strategist

The mood in financial markets has turned notably upbeat in late summer, with easing uncertainty around US trade policy and rising expectations of Federal Reserve (Fed) rate cuts supporting investor appetite for risk.

The US dollar has come under pressure as markets increasingly price in a more dovish Fed, especially amid signs of labour market softness that make a September rate cut and at least one more this year appear likely. The dollar index has slumped almost 2% so far this month, erasing a large portion of its July gains.

Strengthening the case for a dovish Fed (and weaker dollar) is President Trump’s appointment of Stephen Miran as a temporary Fed governor. Stephen Miran drew headlines earlier this year for proposing a “Mar-a-Lago Accord” to weaken the dollar and boost US exports. While the administration hasn’t formally embraced the idea, his appointment signals clear discomfort with dollar strength. Though his FOMC voting power is limited – just three meetings unless reappointed – Miran’s stance firmly aligns with the dovish camp.

Meanwhile, reports that Fed Governor Christopher Waller is emerging as the leading candidate for the next Chair have been welcomed by markets, suggesting that leadership continuity may help anchor expectations. Still, with Miran’s appointment reinforcing the perception that a weaker dollar aligns more closely with the administration’s goals, political optics may continue to exert downward pressure on the currency regardless of near-term economic data.

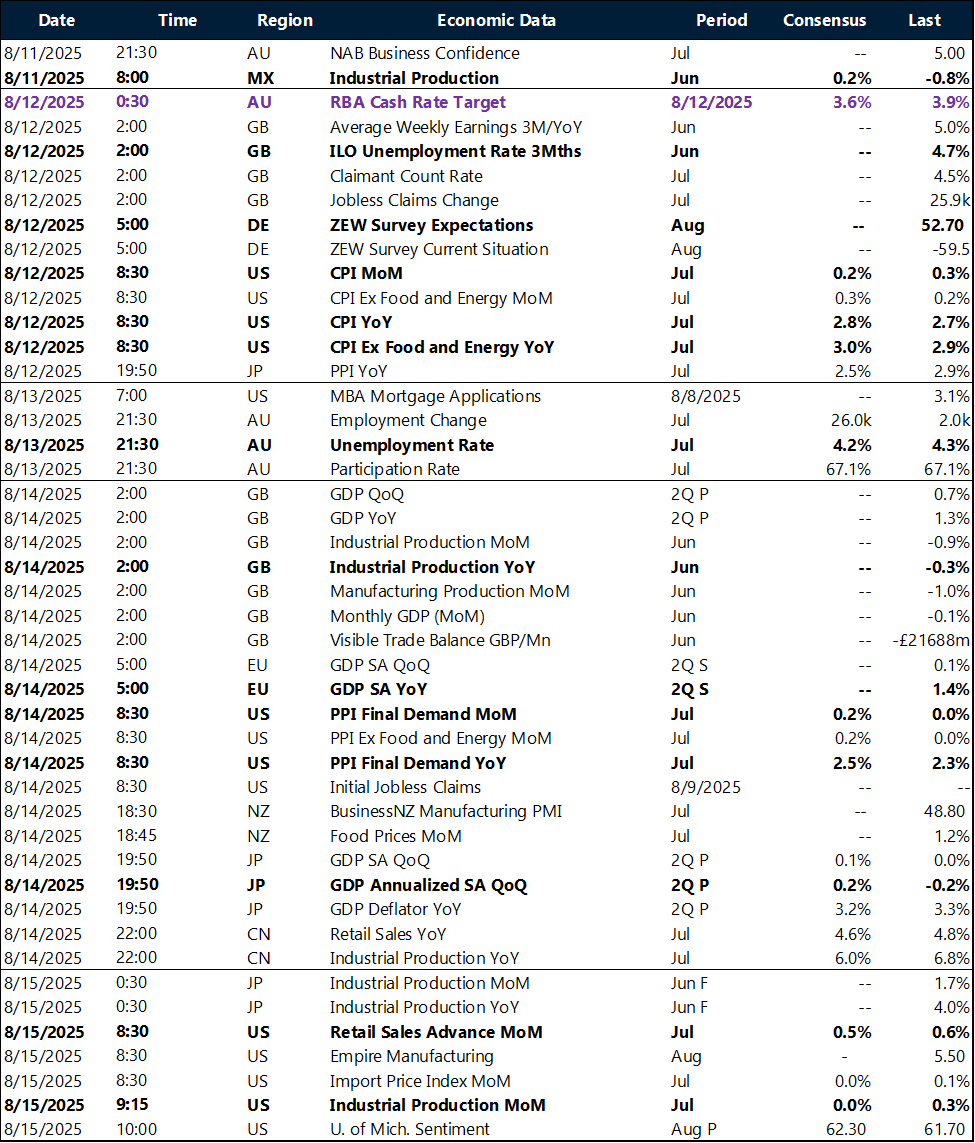

Looking ahead, the focus will shift to US inflation data, which could further shape expectations for Fed action. The data carries added weight following Trump’s recent criticisms of data reliability, raising questions about how the Fed might respond to any surprises. Thus, we think each data release now carries outsized weight. With two inflation prints and one jobs report left before the September Fed meeting, every figure will test the market’s conviction in near-term rate cuts.

Job market cools

Kevin Ford – FX & Macro Strategist

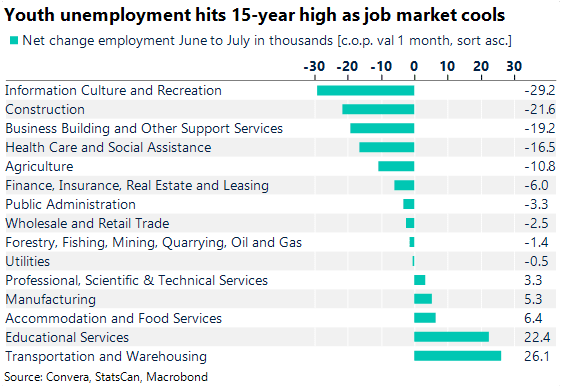

The latest labor market data indicates a cooling trend, with employment declining by 41,000 jobs in July, driven primarily by losses in full-time work and concentrated among youth. While the headline unemployment rate remained flat, the figures reveal a bifurcated landscape where some sectors are feeling the direct effects of economic uncertainty. A notable insight is the specific anxiety felt by workers in industries reliant on U.S. exports. A significant portion of these employees reported less confidence in their employment prospects and were more likely to cite tariff-related uncertainty as a primary concern compared to their peers in other industries, suggesting that geopolitical trade tensions are acting as a tangible headwind on worker sentiment even if not yet on a broad scale.

Despite this concentrated unease, the overall labor market has not yet shown widespread fallout from the trade tensions. The layoff rate held steady, signaling that while some workers are worried, a wave of mass job cuts tied to tariffs has not materialized. Instead, the broader employment decline appears rooted in other factors, including a challenging environment for young workers, whose unemployment rate hit its highest level since 2010. Additionally, specific industry-level contractions in information, culture, and recreation, as well as construction, underscore a more generalized softness in the economy, rather than a singular impact from the trade war.

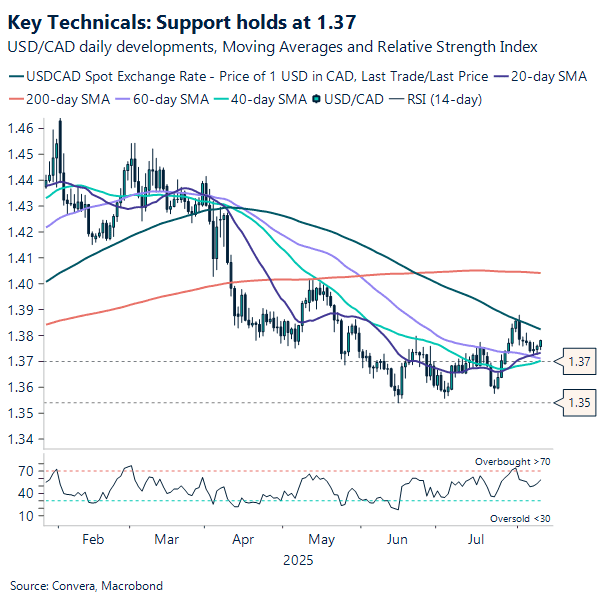

The USD/CAD pair traded mostly below 1.38 last week, with the US Dollar continuing its descent against major currencies as the probability of a September Fed rate cut surged. Domestically, trade data for June showed that a significant portion of US-Canada merchandise trade remains duty-free due to CUSMA exemptions, even as broader macro data points to a soft job market and stagnant growth during the second quarter. After the weaker than expected job report, the odds of a rate cut in September by the Bank of Canada have increased slightly to 38%. With a light domestic data calendar next week, all eyes will be on key US inflation reports, the CPI on Tuesday and PPI on Thursday, to gauge the potential impact of tariffs in goods inflation and how it might affect Fed’s policy trajectory. For the USD/CAD, the 1.37 level remains a critical support zone, marked by the convergence of the 20-, 40-, and 60-day moving averages. On the upside, the 100-day moving average at 1.383 serves as a key resistance level.

Pound’s rise built on fragile foundations

George Vessey – Lead FX & Macro Strategist

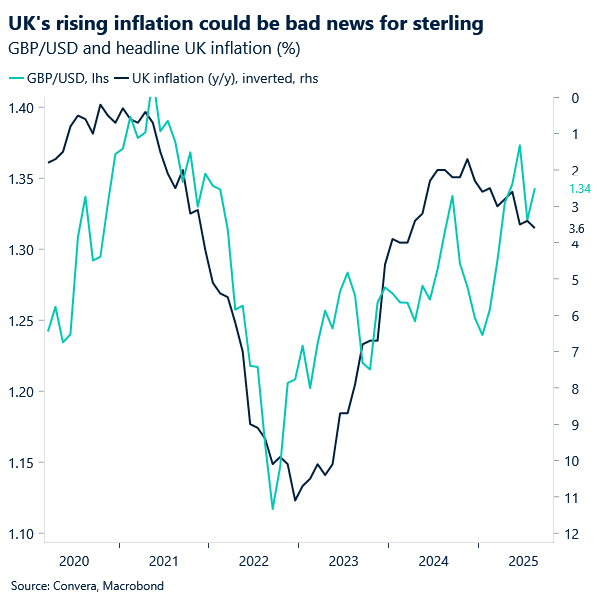

Sterling found modest support following the Bank of England’s hawkish rate cut last week, but the broader outlook remains fragile amid mounting stagflation risks. GBP/EUR has reclaimed the €1.15 level, with real rate differentials pointing to further upside—if not for the UK’s deteriorating macro backdrop. GBP/USD is edging toward $1.35, extending gains from the $1.3142 low earlier this month, though momentum still hinges on sustained dollar weakness.

The pound’s outperformance last week was partly driven by strong global risk appetite, which typically benefits high-beta currencies like GBP. The BoE’s decision to cut rates came as expected, but its updated forecasts – showing inflation at 4% in September – cast doubt on further easing this year. With growth slowing and inflation proving sticky, stagflation risks are rising. Historically, UK inflation has shown a negative correlation with GBP/USD. Plus, with public finances under strain, structural headwinds for the currency are intensifying.

This week’s UK payroll data is expected to show employment declines in eight of the past nine months, yet redundancies remain flat and hiring surveys suggest little movement. The labour market picture is murky, adding to uncertainty around the BoE’s next steps and the pound’s resilience.

Sentiment and structural tailwinds for euro

George Vessey – Lead FX & Macro Strategist

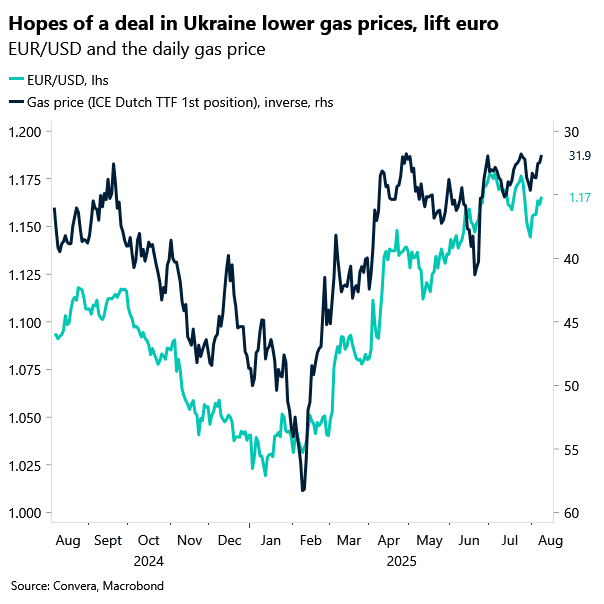

The euro has staged a strong rebound in August, climbing over 2% against the US dollar and reversing much of July’s decline. While a move toward $1.20 was previously expected later this year, the recent surge in bullish sentiment suggests that milestone could be reached sooner. Key drivers include falling energy prices – partly due to optimism around a potential Russia-Ukraine truce – and a growing belief that the Fed will ease policy more aggressively, narrowing the rate outlook gap between the Eurozone and the US.

Despite a string of disappointing Eurozone data, sentiment indicators are flashing more positive signals. Germany’s ZEW Economic Sentiment Index has recovered sharply in 2025, pointing to renewed optimism among analysts about the country’s economic trajectory. This improvement reflects growing confidence in manufacturing prospects, the rollout of fiscal support, and hopes for easing trade tensions. The ZEW index has historically correlated with EUR/USD performance, making it a key metric to watch this week. As forward-looking indicators brighten, investors appear more willing to favour the euro, even in the face of soft current data.

Geopolitical developments are also shaping the euro’s outlook. President Trump is expected to meet Russian President Putin soon to discuss the Ukraine conflict. While expectations for a breakthrough remain low, the geopolitical risk premium that supported oil prices earlier this year has largely faded. Traders are also shifting focus away from Iranian tensions and Houthi disruptions and toward weakening global demand – clouded by Trump’s escalating trade war.

For Europe, lower energy prices are typically supportive of the euro, improving its terms of trade as a net importer. Thus, alongside monetary policy divergence, with geopolitical tensions easing, the euro may continue to benefit from both sentiment and structural tailwinds.

Dollar soft on rate cut expectations

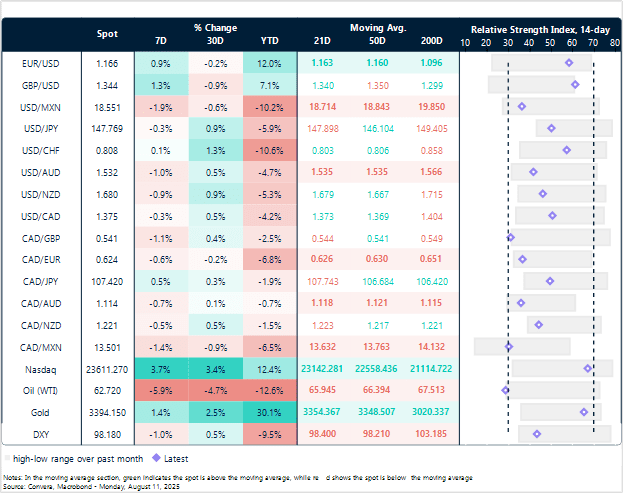

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: August 11-15

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.ve a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer