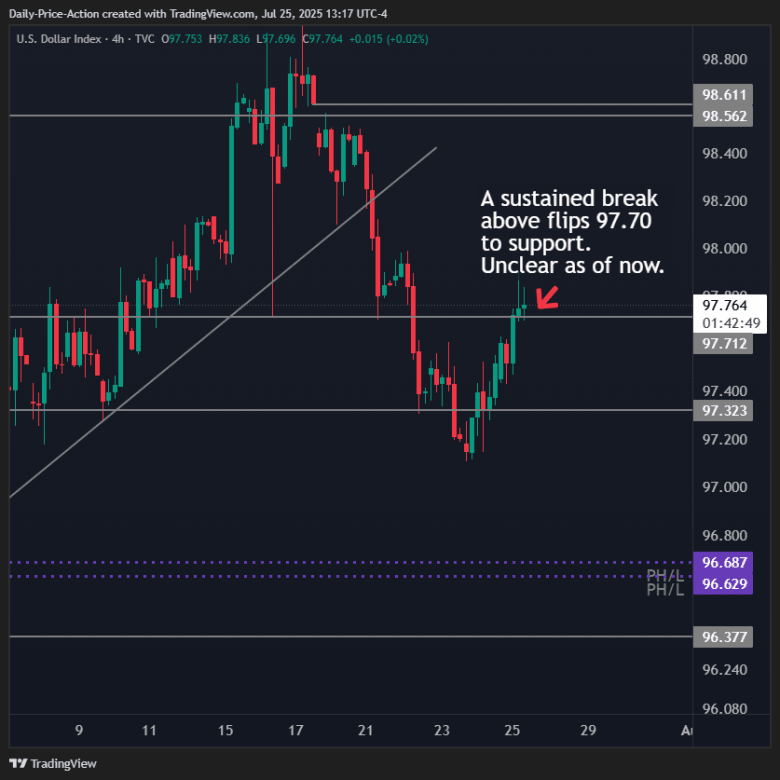

The rupee declined 12 paise to settle at 86.52 against the US dollar on Friday, dragged down by weak domestic equities, rising global crude oil prices, and sustained foreign fund outflows. The sharp slide in equity benchmarks and a stronger dollar overseas also pressured the local unit, forex traders said.At the interbank foreign exchange, the rupee opened at 86.59 and touched an intraday low of 86.63 before recovering slightly to end at 86.52. The currency had settled at 86.40 on Thursday, PTI reported.“Rupee weakened due to a surge in crude oil prices and weakness in domestic markets, which also fuelled FII withdrawals,” said Anuj Choudhary, Research Analyst at Mirae Asset Sharekhan. He noted that traders remained cautious ahead of the August 1 deadline for the US-India trade deal and geopolitical tensions between Thailand and Cambodia.Choudhary expects the rupee to trade with a mild negative bias in the near term, within a range of 86.30–86.90 per dollar, as investors track US durable goods orders data and upcoming monetary policy decisions from the Federal Reserve and Bank of Japan.The dollar index, which tracks the greenback’s strength against six major currencies, rose 0.33% to 97.44, boosted by favourable US employment data. Brent crude futures gained 0.42% to $69.47 per barrel, lifted by improving sentiment around global trade negotiations.Analysts said uncertainty surrounding the India-US trade agreement continues to weigh on the forex market. “If talks fail or face delays, Indian exporters could come under fresh pressure, worsening the rupee’s outlook,” said one currency dealer. However, a breakthrough in negotiations could bring relief to the currency.On the equities front, the Sensex plunged 721.08 points or 0.88% to 81,463.09, while the Nifty dropped 225.10 points or 0.90% to close at 24,837. Foreign institutional investors offloaded shares worth Rs 1,979.96 crore on a net basis, according to exchange data.Meanwhile, the Reserve Bank of India’s weekly data showed that India’s foreign exchange reserves declined by $1.183 billion to $695.489 billion for the week ended July 18.