Markets spent the past week navigating a narrow path between relief and reality. Relief came from headline trade developments that bought more time for diplomacy. Reality showed up in the form of fresh price pressures and unresolved global tensions. The contrast defined how investors approached risk, producing a complex mix of resilience and unease.

On the surface, equity markets offered plenty for the bulls. Major indices in the US and Japan reached fresh highs, fueled by optimism that worst-case trade scenarios could be postponed. Gains were not limited to tech or narrow groups; instead, breadth across sectors and geographies hinted at deeper undercurrents of confidence.

But confidence has limits, and last week exposed them. Price data out of the United States suggested that tariff pass-through effects are already embedding themselves in inflation. This leaves policymakers in a difficult position: acknowledge the risks and hold steady, or push ahead with easing to reassure growth. Neither choice is without cost, and traders know it.

Japan added its own twist. Growth came in stronger than expected, bolstering the case for further monetary adjustment. Investors welcomed the momentum but quickly recognized the tension it created for the yen. A stronger economy that invites tighter policy should support the currency, yet robust global risk appetite continues to suppress its safe-haven appeal.

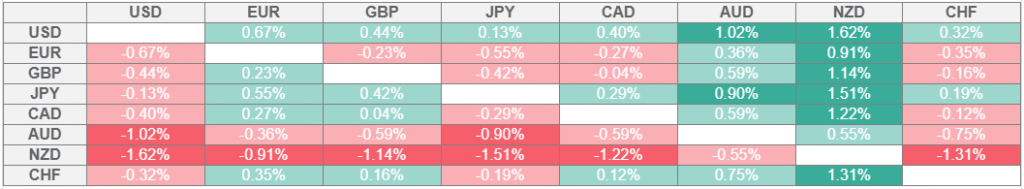

In the currency markets, the weekly scoreboard told its own story. Sterling emerged as the clear leader, backed by firm data, while euro and yen followed closely. At the bottom, Kiwi, Loonie, and Aussie reflected a mix of weak domestic signals and external headwinds, particularly from China. Dollar and Swiss Franc, meanwhile, drifted somewhere between strength and hesitation.

US Stocks Push Higher, Dollar Stays Fragile Ahead of Long Term Channel Support

Risk appetite held up well last week, with Wall Street finishing higher even as fresh inflation worries clouded the Fed’s outlook. DOW led the pack, advancing 1.74% as cyclical sectors outperformed. S&P 500 gained 0.94%, while NASDAQ managed a more modest 0.81%, signaling that broader market strength extended beyond technology.

The positive tone owed much to the extension of the US-China tariff truce by another 90 days. This bought time for negotiators and gave markets a reprieve from escalation risks. In the same vein, US President Donald Trump’s summit with Russian President Vladimir Putin in Alaska, while failing to yield progress on Ukraine, removed another source of immediate tension. Trump made clear he would not sanction China over its Russian oil imports “for now,” easing fears of a fresh flashpoint in US-China relations.

On the negative side, however, inflation jitters resurfaced. July’s CPI data was largely in line with forecasts, rising 2.7% year-on-year, but core inflation ticked up to 3.1%. While not alarming in itself, the persistence of sticky services inflation raised eyebrows.

The bigger shock came from producer prices. The July PPI surged 0.9% month-on-month, the sharpest increase since mid-2022. The jump was broad-based, with final demand services climbing 1.1% and goods up 0.7%. The core PPI, excluding food, energy, and trade, rose 0.6%—its highest since March 2022. These figures signaled tariff pass-through effects are already feeding into price dynamics.

Fed officials took note. Chicago Fed President Austan Goolsbee said the CPI and PPI data “put in a note of unease,” warning that services inflation was “not obviously transitory.” St. Louis Fed’s Alberto Musalem added that tariff impacts could last two to three quarters, keeping price pressures elevated into 2026, limiting Fed’s flexibility in the coming months.

Even so, markets remain confident of a September cut. Futures now price a 92% chance of a 25bps reduction, while the odds of a jumbo 50bps cut—floated repeatedly by Treasury Secretary Scott Bessent—have effectively vanished. San Francisco Fed’s Mary Daly and others pushed back firmly on the idea of an aggressive move. Traders still expect two cuts this year, with 55% odds for the second cut in October and nearly 87% in December.

Technically, DOW finally broke to a fresh intraday record high. Sustained trading above 45,073.63 key resistance will confirm long term uptrend resumption. That would set the stage for 61.8% projection of 28,660.94 to 45,073.63 from 36,611.78 at 46,753.38. Near term outlook will stay bullish as 43,340.68 support holds, in case of a retreat.

As for Dollar Index, the key question remains unanswered. It’s now sitting very close to the long term channel support that started back in 2011. It’s an ideal area for Dollar Index to conclude the corrective down trend from 114.77 (2022 high).

But so far, price actions from 96.37 short term bottom did little to warrant that Dollar Index is setting up bullish trend reversal. For now, while another near term bounce could be seen, outlook will stay bearish as long as 101.97 resistance zone holds, (38.2% retracement of 110.17 to 96.37 at 101.64). Break of 96.37 to resume larger down trend is still in favor.

Japan’s Resilience Lifts Nikkei to Record; Yen Stuck in Cross-Currents

Japanese equities also delivered a strong performance last week, with Nikkei 225 closing at a new record weekly high. In the background, risk appetite was bolstered by two major external drivers: the extension of the US–China tariff truce and the formal US–Japan trade deal reached on July 23.

Adding fuel to the rally was the latest Q2 GDP report, which beat expectations at 0.3% qoq growth. The headline result was particularly notable given the persistent drag from tariffs earlier in the year. Exports made a strong contribution with a 0.3 percentage-point boost. The data signals that Japan’s external sector has proven more resilient than feared, helping the economy extend its streak of growth to a fifth straight quarter.

BoJ, which recently upgraded its FY2025 growth outlook to 0.6%, may now find itself facing upside risk to its projections. Market chatter is increasingly shifting to the prospect of another rate hike before year-end, with October flagged as a realistic option. While the BoJ is unlikely to move in September, the stronger data has clearly made the policy debate more balanced.

Technically, with 42426.77 key resistance cleared, Nikkei should now be targeting 100% projection of 25661.89 to 42426.77 from 30792.74 at 47557.62 in the medium term. Near term outlook will stay bullish as long as 39850.52 support holds, in case of retreat.

For Yen, the picture is less straightforward. Rising odds of a BoJ hike should be supportive, but equity strength and risk-on flows are undermining safe-haven demand. For now, the latter appears to be dominating, keeping the currency under pressure even as policy expectations tilt hawkish.

Even against the Swiss Franc, where monetary policy divergence should favor Yen, the currency has failed to mount a convincing rebound. CHF/JPY’s pullback from 186.02 short term top is losing momentum as seen in 4H MACD. Even in case of another fall, downside could be contained by 38.2% retracement of 173.06 to 186.02 at 181.06, which is close to 55 D EMA (now at 181.26). Break of 183.60 resistance will bring retest of 186.02 high, with prospect of resuming larger up trend.

GBP/AUD Rises on UK Growth Beats, China Weakness Drags AUD

GBP/AUD was one of the standout movers in the FX market last week, climbing nearly 1% .

On the UK side, growth momentum surprised firmly to the upside. Q2 GDP expanded 0.3% qoq, above expectations, but the more striking signal came from June’s 0.4% mom surge. The pickup was broad-based across services, industrial and construction activity, countering fears of stagnation. Labor market data further supported the hawkish case for BoE, with unemployment steady at 4.7% and pay growth slowing only modestly. Together, the numbers reinforced the view that while BoE is in an easing cycle, it will proceed cautiously rather than aggressively.

In Australia, RBA cut rates by 25bps to 3.60% as widely expected. However, the tone of the accompanying forecasts was less dovish than markets had feared. Projections suggested room for only one more rate cut this year and two in 2026. In addition, the rebound in job creation reduced immediate pressure on the RBA to accelerate its easing cycle. While supportive in isolation, these positives for the Aussie Dollar were overshadowed elsewhere.

China’s economic data delivered a blow to regional sentiment. Industrial production, retail sales, and fixed-asset investment all slowed sharply, underscoring fragility in domestic demand. Given Australia’s heavy trade exposure to China, the releases dragged the Aussie lower despite a more balanced domestic backdrop.

Technically, the extended rebound in GBP/AUD last week suggests that corrective pattern from 2.1643 has completed with three waves down to 2.0420. Further rise is now in favor to 2.1034 resistance first. Firm break there will solidify the case of up trend resumption and target 2.1643 high next.

Looking longer-term, the uptrend from 1.5925 (2022 low) remains intact. On resumption, next medium term target is 61.8% projection of 1.8909 to 2.1643 from 2.0420 at 2.2110.

EUR/USD Weekly Outlook

EUR/USD edged higher to 1.1729 last week but retreated since then. Initial bias remains neutral this week for consolidations. Further rally is expected as long as 1.1589 support holds. Above 1.1729 will bring retest of 1.1829 high. On the downside, however, firm break of 1.1589 will turn bias to the downside, and extend the corrective pattern from 11829 with another fall.

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will remain the favored case as long as 1.1604 support holds.

In the long term picture, a long term bottom was in place already at 0.9534, on bullish convergence condition in M MACD. Further rise should be seen to 38.2% retracement of 1.6039 to 0.9534 at 1.2019. Rejection by 1.2019 will keep the price actions from 0.9534 as a corrective pattern. But sustained break of 1.2019 will suggest long term bullish trend reversal, and target 61.8% retracement at 1.3554.