Spotware, the company behind leading trading platform cTrader, has announced the global rollout of free prop trial accounts – a new account type designed to empower proprietary trading firms with branded, time-limited demo access for competitions and lead conversion.

This new functionality is now available to all prop firms using cTrader, marking another milestone in Spotware’s commitment to innovation for the prop trading ecosystem.

A new way to engage traders

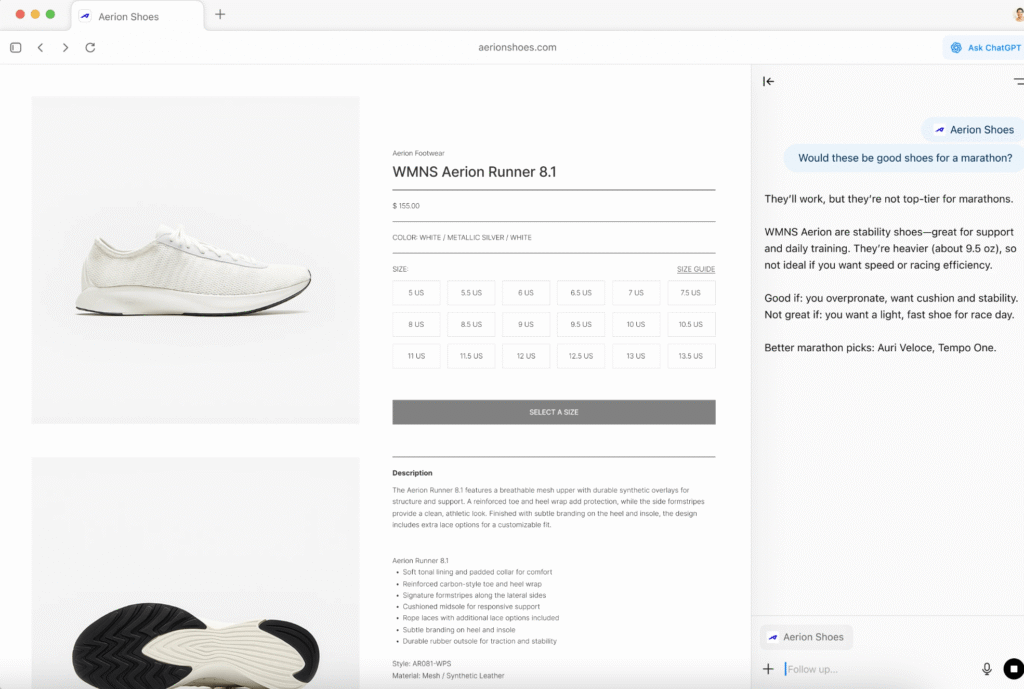

Free prop trial accounts allow proprietary firms to run free competitions, trials and recruitment funnels in a controlled demo environment. The account type carries a distinct FREE flag for transparency and tracking, and automatically expires upon completion, helping firms maintain clean sales funnels and full compliance with internal policies.

Firms can provide free prop trial accounts instantly via cTrader Admin or Manager API, with seamless integration across desktop, web and mobile platforms. Traders experience the full cTrader environment – advanced charting, risk management, order types and native algorithmic trading -without any entry fee or friction.

Driving growth through engagement

Free trials and trading competitions have become a cornerstone of growth for prop firms, offering traders a low-risk entry point while helping firms identify and convert high-potential leads. With cTrader’s free prop trial accounts, firms can now replicate this model quickly and at scale, complete with their own branding and built-in reporting.

Ilia Iarovitcyn, Chief Executive Officer, at Spotware added,

Ilia Iarovitcyn, Chief Executive Officer, at Spotware added,

“Free prop trial accounts give prop firms a powerful new way to showcase their trading environment and lower the entry barrier for prospective traders. This is about creating more opportunities for firms to convert prospects into long-term clients while offering traders the full cTrader experience.”

Early adopters lead the way

A number of industry leaders, including FTMO, Instant Funding, Vision Trade, have already adopted cTrader’s free prop trial accounts, using them to power free trials and competitions that engage thousands of traders worldwide.

Spotware said that their early success highlights how free prop trial accounts can accelerate recruitment and conversion pipelines while delivering a premium trading experience.

Get started

Free prop trial accounts are available today for all prop firms using cTrader.

- Existing cTrader clients: Contact your Customer Success Manager to enable free Prop trial accounts for your firm.

- New to cTrader? Book a meeting with our Sales Team to explore how cTrader can help you launch and scale your proprietary trading business.

About cTrader

cTrader is a multi-asset FX/CFD trading platform by Spotware, built on the Traders First™ principle to serve traders, brokers and prop firms with cutting-edge features and lightning-fast execution. With advanced native charts, built-in social trading and free cloud execution for trading algorithms, cTrader delivers a powerful, premium trading experience. As an Open Trading Platform™, 100+ third-party integrations via APIs and plugins are on offer. cTrader Store allows developers to monetise trading algorithms and reach over 8 million traders, while helping brokers grow through IB-focused solutions and seamless onboarding.