The Coinbase logo is displayed on a mobile phone screen with stock market percentages in the background.

Idrees Abbas | Sopa Images | Lightrocket | Getty Images

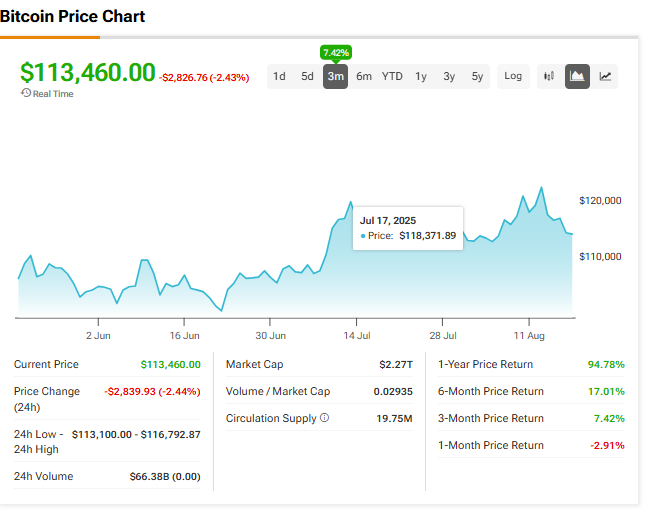

Crypto stocks suffered on Tuesday as investors fled tech stocks and riskier corners of the market.

Among crypto exchanges, Coinbase and eToro fell more than 5% each, while Robinhood and Bullish both dropped more than 6%. Crypto financial services firm Galaxy Digital dropped 11%. In the burgeoning sector of crypto treasury firms, Strategy lost 7%, SharpLink Gaming slid 8%, Bitmine Immersion slumped 12% and DeFi Development tumbled 15%. Stablecoin issuer Circle lost 5%.

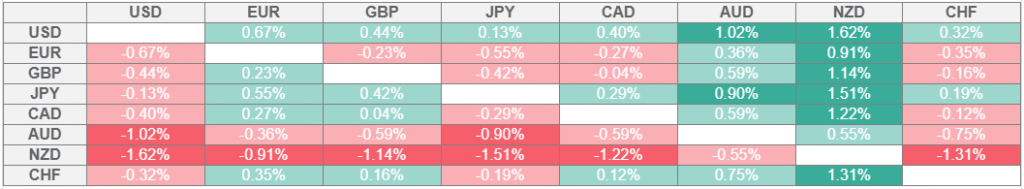

Meanwhile, the price of bitcoin pulled back nearly 3% to just over $113,000. Ether was down more than 4% to the $4,100 level, according to Coin Metrics.

Bitcoin over the past day

Investors appeared to rotate out of tech names on Tuesday. The sector had seen a boost last week as traders weighed the prospect of more interest rate cuts. Also, bitcoin touched an intraday all-time high near $125,000 last week.

On Tuesday, the Nasdaq Composite was down more than 1%, weighed down by declines in Nvidia and other tech heavyweights.

The crypto market tends to be vulnerable to moves in tech stocks due to their growth-oriented investor base, narrative-driven price action, speculative nature and tendency to thrive in low-interest rate environments.

This week, investors are watching the Federal Reserve’s annual economic symposium in Jackson Hole, Wyo. for clues around what could happen at the central bank’s remaining policy meetings this year. If Fed Chair Jerome Powell signals more dovish policy could be ahead, crypto may bounce.

“With Powell speaking at Jackson Hole, we typically see profit-taking ahead of his remarks,” said Satraj Bambra, CEO of hybrid exchange Rails. “Any time there’s communication uncertainty from the Fed, you can generally expect some profit-taking as traders de-risk their positions.”

Crypto stocks have had a solid run in recent months — thanks to the addition of Coinbase in the benchmark S&P 500 index, the successful IPO of Circle and the GENIUS Act stablecoin framework becoming law. However, investors expect a pullback in August and through the September Fed meeting, where they hope to see central bank policymakers implement rate cuts.