A strategic shift in gold custody

The People’s Bank of China (PBOC) is promoting a plan to attract central banks—particularly from friendly or non-aligned nations—to purchase gold and store it in custodian warehouses connected to the SGE’s International Board. This board, launched in 2014, was designed to open China’s market to foreign participants under PBOC oversight. Unlike relocating existing holdings, the initiative focuses on new purchases, reducing resistance from countries wary of moving their current stockpiles from traditional centers.

The SGE, founded in 2002, has become the world’s largest physical gold exchange, handling 54,000 tons in 2023—around 75% of global volume. This dominance gives Beijing a strong platform to expand custody services.

Why now? Geopolitics and de-dollarization

The timing reflects geopolitical and financial shifts. The freezing of $300 billion in Russian reserves in 2022 highlighted vulnerabilities in Western custody, prompting central banks to diversify. In 2022 alone, official sector gold purchases hit 1,037 tons, the highest since 1967.

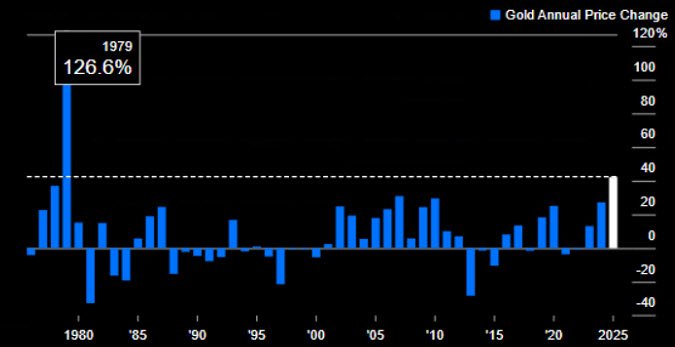

Gold’s surge to nearly $3,790 per ounce in September 2025, almost double in two years, underscores its rising importance. For Beijing, offering custody services strengthens efforts to reduce dollar dependence and promote yuan internationalization, while creating deeper bilateral financial ties with partner nations.

Source: Bloomberg

China’s position in gold markets

China has been systematically building its reserves and infrastructure:

Reserves: 2,235 tons as of 2024, ranking fifth globally, though still less than half of the Bank of England’s holdings.

FX share: Gold makes up only 4.9% of China’s reserves, suggesting room for growth.

Market: China consumed 943 tons of gold in 2023, the world’s largest consumer market.

Infrastructure: The SGE expanded to Hong Kong in 2025, and China operates over 20 major refineries with a combined capacity above 2,000 tons annually.

London vs. Shanghai: Custody competition

London remains the undisputed leader, with the Bank of England safeguarding more than 5,000 tons of global reserves and the London Bullion Market Association overseeing 90% of global OTC gold trading. Trust, liquidity, and centuries of established standards are London’s main strengths.

By contrast, China’s appeal lies in geopolitics: offering sanctuary from sanctions risk. While some central banks may hesitate over liquidity concerns, others—particularly emerging markets—see strategic value in diversifying custody.

Global Financial Implications

China’s initiative could reshape the monetary system:

Reserve diversification: More central banks shifting toward gold reduces reliance on dollar assets.

Market impact: Stronger demand could push gold beyond current records, with forecasts like Goldman Sachs suggesting $5,000 an ounce if even 1% of Treasury holdings move into gold.

Multipolar finance: Custody services complement CIPS (China’s SWIFT alternative) and the digital yuan, expanding Beijing’s role in parallel financial networks.

Benefits and risks for participants

Benefits:

Diversification away from dollar-centric assets.

Protection from Western sanctions.

Strengthened bilateral economic ties with China.

Risks:

- Reduced liquidity compared to London.

- Political pressure from Western allies.

- Questions over legal safeguards and asset access in China.

The bigger picture

China’s gold custody plan is more than a financial offering—it’s a geopolitical strategy. By adding physical gold to its financial toolkit alongside digital payment systems and currency internationalization, Beijing is steadily building an alternative financial ecosystem. For countries seeking security from sanctions and