CFOTO/Future Publishing via Getty Images

subscribers. Become an Insider

and start reading now.

Have an account? .

- Circle stock surged on its first day as a publicly traded company.

- The stock rose as much as 235% on Thursday, ultimately ending the session with a gain of 167%.

- Stablecoins are having a moment, with a bill aimed at boosting the space moving through Congress.

Stablecoin issuer Circle saw its stock soar well into the triple digits in its stock-market debut on Thursday.

Shares surged as much as 235% to an intraday high of $103.75. The stock pared the gains but still managed to end its first day of trading up 167%, closing at $82.84.

Circle’s IPO, underwritten by Wall Street giants like Goldman Sachs, JPMorgan, and Citigroup, is a fresh win for the stablecoin market.

The tokens, which are cryptocurrencies pegged to fiat money like the dollar and meant to hold their value on a 1:1 basis, are also in the spotlight in Washington, DC.

Stablecoins have received robust support from lawmakers and also have backing from President Donald Trump. World Liberty Financial, backed by Trump and his sons, launched the USD1 stablecoin in March of this year. The token is backed by short-term Treasurys, dollar deposits, and cash equivalents.

Meanwhile, the GENIUS Act, which passed a procedural vote in the Senate last month, aims to create a federal framework for the governance of stablecoins.

If passed, it could make it easier for issuers to mint stablecoins. Issuers would also need to regularly disclose their reserves and make sure tokens are backed 1:1 by liquid assets such as fiat currency or Treasurys.

Federal and state regulators would also be required to provide capital, liquidity, and risk management rules for issuers in their purview.

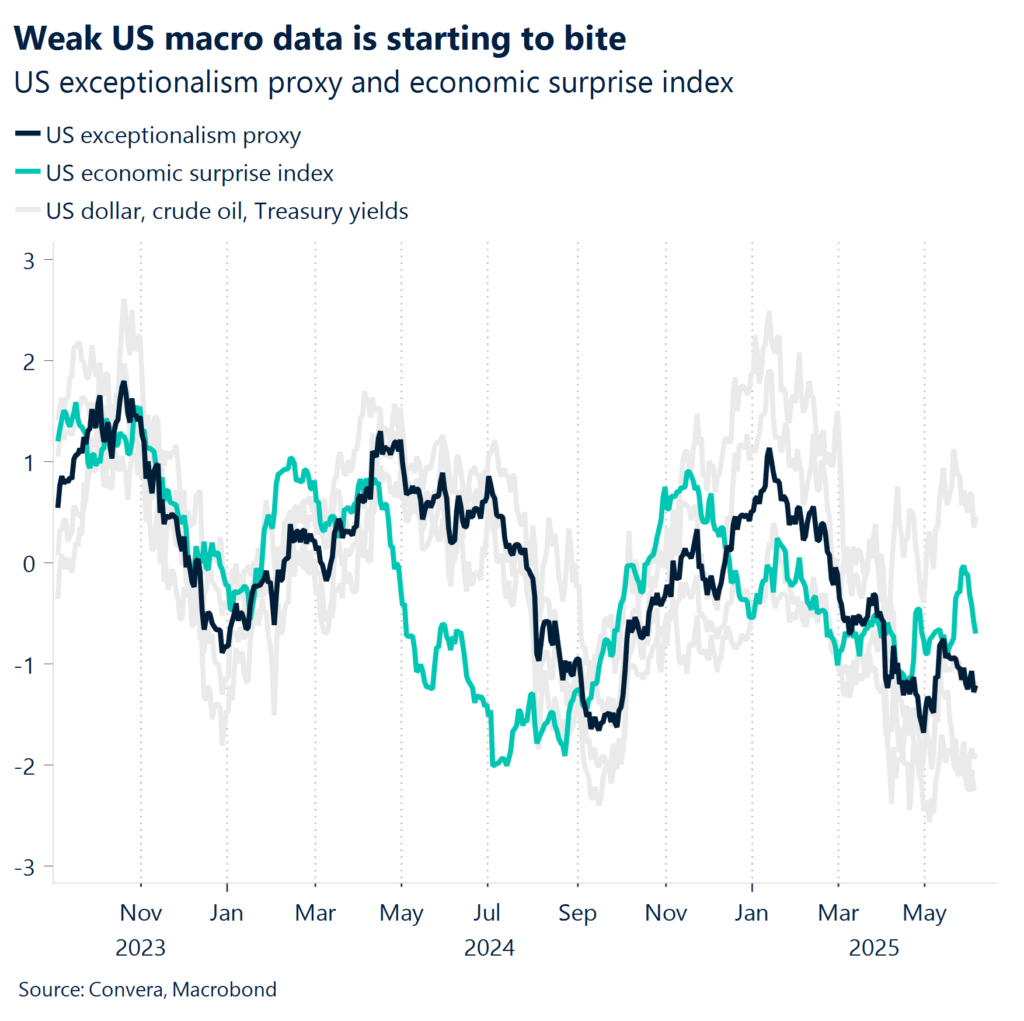

The rise of stablecoins could have far-reaching implications across the US financial system, especially the Treasury market. Bank of America analysts said recently that demand for Treasurys from stablecoin issuers could inject new volatility into the market for short-term government debt.