China’s demographic trends in 2024 reveal a complex picture of population decline, aging, and regional divergence. Investors can gain strategic insights by analyzing demographic shifts at the provincial and city levels. This article highlights where opportunities are emerging based on labor force dynamics, migration, and consumer profiles.

China’s demographic landscape in 2024 continues to evolve, marked by a third consecutive year of population decline and accelerating aging. Although the national birth rate experienced a modest rebound, deep-rooted structural challenges persist—raising long-term concerns for labor supply, healthcare systems, and sustainable economic growth.

At the provincial and city levels, demographic patterns diverge significantly, offering investors a nuanced view of regional development trajectories. These variations help pinpoint where demand is growing, talent is concentrating, and market potential is emerging.

Beyond headline population figures, deeper demographic indicators—such as age structure, educational attainment, and migration flows—offer actionable insights for businesses. These metrics inform strategic decisions on workforce planning, consumer targeting, and sectoral opportunities.

This article presents a comprehensive analysis of China’s demographic shifts by province and major city, with a focus on 2024 data and standout trends in key megacities. It explores why understanding these regional dynamics is essential for investors seeking to navigate China’s evolving economic landscape.

Start exploring

China demographic overview

According to the National Bureau of Statistics (NBS), China’s total population stood at approximately 1.408 billion at the end of 2024, a drop of 1.39 million from the prior year. Births staged a modest rebound in 2024, with 9.54 million babies born, up 520,000 from 2023. This raised the national crude birth rate to 6.77 per thousand people (from 6.39 in 2023).

Demographic Breakdown of China’s 31 Mainland Provinces, 2024

China’s population is also aging rapidly, with about 22 percent of Chinese (310 million people) aged 60 or above in 2024, up from 296 million (21 percent) in 2023. This greying of society, alongside a shrinking pool of women of childbearing age, means experts widely expect further population decline in the coming years, posing challenges for economic growth and increasing pressure on healthcare and pension systems.

Breakdown of Population Age by Province, 2024

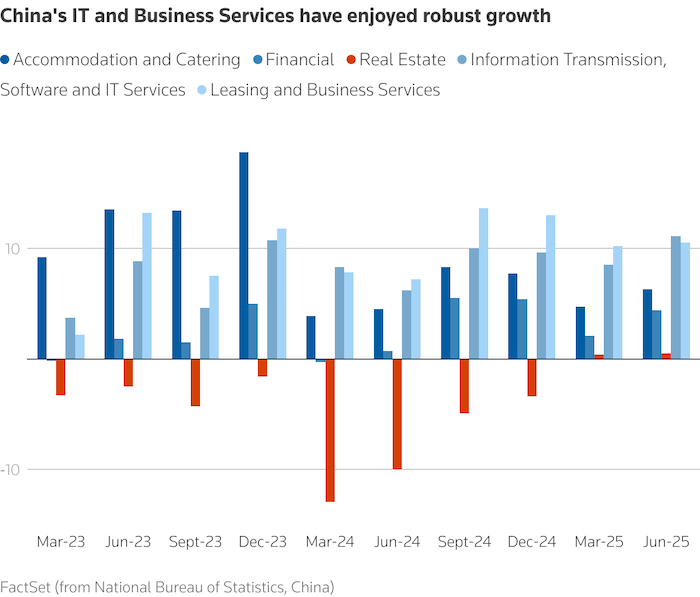

On the other hand, urbanization accelerated in 2024 despite the population dip. The number of people living in cities rose by 10.83 million (to 943.3 million), while the rural population fell by a similar amount. China’s urbanization rate hit 67 percent by the end of 2024. This reflects continued migration of people from rural and inland areas to cities, a trend that is concentrating population and economic activity in major urban hubs.

Population gains in 2024 were largely localized in economically vibrant provinces and city regions, whereas less developed or economically stagnant areas saw declines. It also indicates that China’s population growth will not only rely on natural growth, but also on population migration, which reflects cities’ ability to attract people, and the regional development environment. The following sections break down these provincial and city-level dynamics in detail, highlighting population size, birth rates, and migration/talent flows across China’s regions.

Provincial population trends

China’s provinces experienced wide variation in demographic fortunes in 2024. According to data released by NBS, eight of the country’s 31 provincial-level regions managed to grow their permanent resident populations last year. In three regions, the population was essentially stable, and 20 regions saw population declines.

Population changes at the provincial level, 2024

Provinces with population growth

The eight provinces that grew in 2024 present three growth patterns:

Migration inflows: Guangdong and Zhejiang

Guangdong is China’s most populous province, with an added 740,000 people in 2024, reaching 127.8 million residents. This was the largest increase nationwide and extended Guangdong’s 18-year streak as China’s top population province. A substantial portion of Guangdong’s gain comes from migration into its booming Pearl River Delta cities like Shenzhen and Guangzhou, alongside a relatively high birth rate. Guangdong reported 1.13 million newborns in 2024, up 100,000 from the year before, and is the only province with over 1 million births for the 7th year running. Its birth rate of 8.89 per thousand is among China’s highest for a major province, aided by traditional family culture in areas like Chaoshan that encourage larger families.

Zhejiang province likewise saw strong migrant inflows, with its population rising by 430,000 to 66.7 million in 2024. Zhejiang’s entire increase was largely due to migration, as deaths slightly exceeded births in the province last year. Zhejiang’s wealthy cities, such as Hangzhou and Ningbo, are talent magnets that accounted for over 60 percent of the province’s growth.

Xinjiang in China’s far west also fits this model, though it was traditionally a net exporter of people. Xinjiang’s development under the Belt and Road Initiative (BRI) and growing trade hubs have started to draw migrants and investment, contributing to a population uptick in 2024.

Return migration: Anhui, Fujian, and Shaanxi

These provinces historically saw heavy out-migration but are now experiencing population rebounds as their economies improve. These regions have ramped up industrialization and job creation, reducing the incentive for residents to leave.

Anhui, a province in central China, has integrated into the Yangtze River Delta economy and built new industries like electric vehicles and electronics, which helped it attract a net inflow of 157,000 people from other provinces in 2024. Much of this is returning migration, as people come back home as local opportunities grow. However, because these provinces still have relatively low birth rates and aging populations, their overall growth remains modest.

Fujian’s population grew by about 100,000 in 2024, while Anhui and Shaanxi each increased by fewer than 20,000 people. Although the growth seems flat, it still marks a turnaround as a decade ago these areas were losing people. According to an analysis, the faster economic growth and urban development have curbed outflows and even spurred some residents to return, bolstering population figures. Therefore, it is reasonable to predict that these provinces will see a trend of economic development alongside population growth.

Natural growth in less developed regions: Xizang (Tibet) and Hainan

The third growth model is seen in these provinces where birth rates remain higher than death rates, even if net migration is negative. For instance, remote Tibet historically has a high fertility rate where many young and rural residents are concentrated, which, until recently, kept its population growing. However, migration patterns can offset natural growth; Tibet’s population actually fell slightly in 2022 despite a high natural increase, due to people moving out for better opportunities.

Hainan, an island province that is positioning itself as a free-trade port and a popular retirement and tourism destination, could be attracting both working-age migrants and seniors. Although the natural growth rates remain low, the attraction is gaining a small number of inward migrants, which promotes population growth. The investors can consider further developing health care, elder care, and financial services that target seniors and tourists.

Provinces with stable or declining populations

Outside of the above, the majority of China’s provinces saw flat or negative population change in 2024. These provinces can be grouped into three distinct regional categories, each with its own characteristics:

Northeast China’s population contraction

The three northeastern provinces, Liaoning, Jilin, and Heilongjiang, have grappled with decades of industrial decline and youth outflow. They now have some of China’s lowest fertility rates on top of rapidly aging communities. These provinces’ birth rates are estimated at around four per thousand or lower. Meanwhile, deaths in the northeast are high, yielding a deeply negative natural population change. Combined with people leaving for jobs in the south, the northeast’s population is tumbling. Over the past decade, Liaoning, Jilin, and Heilongjiang together lost more than 12 million residents.

Central and Western provinces with out-migration

Large interior provinces such as Henan, Hunan, Sichuan, and Hubei all continued to lose population in 2024. Henan, historically China’s third most populous province, had 762,000 births in 2024, with the birth rate at 7.78 per thousand. However, Henan has a big elderly base, with many left-behind rural elderly, and high outbound migration of youth to the coasts, so its deaths and departures probably outnumbered those births.

Similarly, Hunan, Jiangxi, and Guangxi, which are central and southern provinces, have moderate fertility but still tend to send migrants to richer provinces, contributing to a flat or shrinking population. Even Sichuan, China’s fifth most populous province, recorded population decline in recent years, and despite growth in its capital, Chengdu, likely saw another slight dip in 2024 due to low births and migration to cities elsewhere.

High-income coastal provinces

Shandong, China’s second most populous province, with around 101 million people, has seen its birth rate fall sharply to 6.42 per thousand in 2024, well below replacement level. Shandong registered 649,000 births and has relatively fewer people moving out compared to inland provinces. But with an enormous elderly population, it may have had more deaths than births, likely resulting in a slight population drop or stagnation in 2024.

Jiangsu province, with a population of around 85 million in 2024, was reported as stable, but it has extremely low fertility and some out-migration of labor to nearby Shanghai or Zhejiang. Therefore, Jiangsu’s “stability” may be seen as an inflection toward decline.

Last but not least, Shanghai and Beijing, as the two largest megacities in China, also saw negligible growth or a slight decline in resident population since 2022. Although the migration gains remain high and job opportunities are attractive and continue to be a main pull factor of inward migration, the natural birth rate is low, easily offset by the high inward migration. because any migration gains are offset by very low birth rates and, in Shanghai’s case, people relocating outward. These two cities will be discussed in detail in the following article.

Major cities’ demographic dynamics

Beijing

As the nation’s capital, it managed to hold its population essentially flat amid China’s wider declines. By the end of 2023, Beijing’s resident population was about 21.858 million, up only 15,000 from the year prior. This negligible growth reflects deliberate policy; Beijing has imposed strict population controls in recent years to cap its size. Indeed, the 2024 data show Beijing’s population “stability” is noteworthy compared to many regions losing people. High living costs and hukou (household registration) limits also naturally slow Beijing’s growth.

However, Beijing’s demographic composition is shifting. The capital is highly urbanized with an 88 percent urbanization rate and has one of the country’s most educated populations, with 56.6 percent of residents aged 15 and older holding a college degree or higher. It remains a magnet for top talent in academia, tech, and government.

The flip side is the low birth rate and aging population. Beijing faces a “dual challenge” of declining births alongside a growing elderly cohort. Children under 14 now make up only 12 percent of Beijing’s population, while seniors aged 60+ account for 22.6 percent. The city’s dependency ratio has climbed steeply from 20.9 percent in 2010 to 38.7 percent in 2023, indicating much heavier pension and healthcare burdens on the workforce population.

For investors, the workforce in Beijing is highly skilled, powering Beijing’s status as a leading innovation hub. In 2022, Beijing had over 546,000 research and development (R&D) personnel, with an R&D personnel density far above the national average. The city contributed disproportionately to China’s tech output, which is ranking number two in patents per capita. Yet, market growth in Beijing may be constrained by its slow population growth and aging trend. Sectors catering to youth, especially upper-tail education products and caring schools, as well as healthcare, biotech, and elderly services, all see rising demand. The local government is cognizant of these issues, as a recent Beijing population report emphasized the need to “attract and retain talent” to sustain the city’s competitiveness, including through innovation ecosystems, better education, and more family-friendly policies.

Shanghai

Shanghai is China’s financial capital; its total resident population dropped to 24.80 million at the end of 2024, a decline of roughly 72,000 people from 2023. This marked Shanghai’s first population drop in decades in recent data, highlighting a demographic downturn in China’s most populous city. The causes are twofold:

First, Shanghai’s birth rates have plummeted to some of the lowest levels in the world. In 2024, Shanghai’s crude birth rate was 4.75 per thousand, far below the national average of 6.77 per thousand. This means a Shanghai woman would bear on average 0.6 children in her lifetime, only 28 percent of the replacement level needed to sustain the population. In fact, Shanghai’s high living costs, intense work pressure, delayed marriage, and a culture that long prioritized small families have all led to this “rock-bottom” birth rate.

Second, Shanghai is experiencing an exodus of non-native migrant workers, which has accelerated its population decline. Shanghai’s population is composed of roughly 15 million registered local hukou holders and the rest migrants without local hukou. By 2024, the number of migrants living in Shanghai fell under 10 million for the first time in recent memory, to 9.83 million. In the past four years (2020–2024), Shanghai’s non-native resident count cumulatively dropped by 640,000. These are significant outflows. Migrant workers, who once flocked to Shanghai for factory and service jobs, are now deterred by the city’s high housing costs, fewer manufacturing opportunities, and strict residency requirements. Some factories and low-end industries have moved to cheaper cities inland or to suburbs, cutting jobs.

The result is that Shanghai’s consumer base and labor force actually contracted in 2024. This has already had economic side effects, for instance, Shanghai’s total retail sales of consumer goods declined to RMB1.79 trillion (US$246 billion) in 2024.

Shenzhen

In contrast to Shanghai, Shenzhen, the tech boom city in Guangdong, continues to experience robust population growth driven by inward migrants. Seen as China’s “Silicon Valley,” Shenzhen has for decades been a magnet for young workers and entrepreneurs. Shenzhen’s permanent resident population reached 17.99 million at the end of 2024, a 1.12 percent growth from the previous year. This makes Shenzhen one of the fastest-growing major cities in China, bucking the national demographic malaise. 2024 was the second year in a row that Shenzhen led all cities in Guangdong province for population growth, outpacing even Guangzhou, the province’s capital. The influx has expanded Shenzhen’s labor pool and is cited by local officials as a driver of new markets, innovation, and human capital formation in the city.

Shenzhen’s demographic profile is unique as it is a migrant-majority city with many young professionals from all over China drawn by Shenzhen’s tech firms, factories, and start-up culture. Consequently, Shenzhen has fewer elderly residents proportionally and historically has had a higher birth rate than places like Shanghai. However, Shenzhen’s birth rate has also been declining as living costs rise as well, and young migrants often delay having children or return to their hometown to raise families.

For investors, Shenzhen represents a dynamic, expanding market and talent base. Its nearly 18 million residents have relatively higher disposable incomes and a culture open to new products and technologies. The continued inflow of skilled “tech migrants” and young graduates means strong demand in housing, consumer electronics, education, and other urban services. Indeed, cities like Shenzhen and Hangzhou are actively benefiting from China’s inter-regional “talent war”, siphoning ambitious workers from other provinces.

Hangzhou

Hangzhou, the capital of Zhejiang province, is a standout success case of demographic growth driven by digital transformation and targeted policy support. As of the end of 2024, the city’s population reached 12.62 million, growing by 102,000 from the previous year.

A key driver behind this demographic momentum is Hangzhou’s rise as a national center for technology, digital consumption, and innovation. Since around 2014, the city, home to tech giants like Alibaba, has aggressively prioritized the digital economy, aiming to become China’s top hub for internet services and tech-driven commerce. The results are tangible: in 2024, Hangzhou’s core digital industries contributed RMB630.5 billion (US$86.5 billion) to GDP, accounting for 28.8 percent of the city’s economy and growing 7.1 percent year-on-year, outpacing overall GDP growth. The city is also advancing strategic industrial clusters in smart IoT, biomedicine, high-end equipment, new materials, and green energy, all of which generate high-skilled jobs that draw in young professionals.

In addition, Hangzhou’s local government has implemented proactive talent-attraction policies. Programs like the “Spring Rain Plan” offer housing subsidies and employment support for university graduates and entrepreneurs, while the city provides generous resources for startup incubation and innovation funding.

For foreign investors, Hangzhou’s demographic vitality and policy foresight translate into a high-potential, innovation-friendly market. Its young, tech-savvy population with rising incomes creates ideal conditions for industries reliant on frontier knowledge and digital ecosystems, including e-commerce, fintech, and premium lifestyle products.

Why demographic shifts matter for foreign investors

While population size offers a useful starting point for assessing market potential, such as market size and consumption power, it is the composition and dynamics behind the numbers that truly matter to foreign investors. Provinces like Guangdong and Zhejiang, along with cities such as Shenzhen and Hangzhou, not only boast population growth but also attract a steady number of young and educated talent. These regions benefit from rising disposable incomes, innovation-driven industries, and increasingly sophisticated consumers, making them fertile ground for sectors like e-commerce, real estate, digital services, and consumer goods.

At the same time, China’s highly developed e-commerce ecosystem and advanced logistics infrastructure have begun to decouple population size from consumption power. Even in regions with slower population growth, consumers can access goods and services from distant economic hubs. For example, Shenzhen has become an attractive shopping destination for Hong Kong residents, supported by efficient cross-border platforms. More broadly, consumers in second- and third-tier cities, often facing lower living costs and less education competition, can now enjoy comparable access to premium goods and services thanks to nationwide digital integration. This trend is also supported by the expansion of high-speed rail and intercity transit systems, which enable people to live outside major urban centers while remaining economically connected to them.

For investors, these trends highlight the importance of going beyond headline population figures. Strategic decisions should account for regional differences in age structure, income levels, education attainment, and industrial specialization. A growing, young, and skilled population may present stronger long-term value than a merely large one. Cities building strong niche economies, like Hangzhou in digital tech or Hefei in semiconductors, may offer more targeted but high-potential markets. In short, understanding who the population is, how they live, and what they consume is far more critical than knowing just how many people are there. The following are some opportunities and factors reflected in the demographic picture that investors can consider when planning their businesses:

Labor force and talent pool expansion

China’s working-age population has begun shrinking, highlighting increasing pressure on the workforce and the need for higher labor productivity. While simultaneously, China’s highly educated population is increasing dramatically, over 1.3 million graduate students were enrolled in 2024, including approximately 153,300 doctorates, an 83 percent increase from 2017, and 927,600 Master’s degrees were awarded in 2023. Consequently, regions that can attract and retain this growing pool of skilled talent will gain a significant edge in frontier technology sectors, especially in AI, semiconductors, biotechnology, and robotics—areas where specific, advanced skills are at a premium.

For tech and innovation-driven investors, cities like Shenzhen, Hangzhou, and Beijing, as well as emerging hubs such as Chengdu and Xi’an, are particularly attractive due to their concentration of highly educated, younger professionals. These urban centers benefit not only from strong university systems and government support for innovation but also from the ongoing migration of skilled talent from other parts of the country. In 2024, population gains in Shenzhen and Hangzhou clearly reflected this trend, with both cities attracting large numbers of graduates and technical workers looking to participate in the digital economy, advanced manufacturing, and R&D-intensive sectors.

This matters because the demographic profile of a city or region directly informs the size, quality, and sustainability of its labor force. A growing, young, and educated population signals a healthy talent pipeline, making it easier for foreign companies to recruit locally, scale operations, and maintain long-term competitiveness.

Silver economy opportunities

China’s aging trend is national, but some regions are greying faster than others. This creates opportunities in healthcare, elder care, pharmaceuticals, and financial products for seniors, such as insurance and retirement planning. For instance, wealthy coastal provinces and cities often have both a high proportion of elderly and the financial resources to spend on quality elder care. Shanghai, Beijing, and Jiangsu are examples of areas with rapidly aging populations and relatively high per capita incomes, fertile ground for senior living facilities, medical devices, and services catering to retirees.

By 2025, over 300 million people in China will be over 60, and by 2035, that could exceed 400 million. Investors in the “silver economy” would do well to analyze which cities/provinces have the greatest concentrations of seniors and supportive local policies. For example, Hainan is positioning itself as a health and retirement destination; an investor in senior tourism or healthcare could benefit from Hainan’s growing popularity among retirees. Understanding regional age distribution helps target the right markets for such ventures.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.