June 25 2025 | Industry News

From recovery to boom: The latest China Trading Desk survey outlines how China’s travel surge is redefining global tourism

As China progresses through mid-2025, the outbound travel market continues to chart a strong recovery trajectory, evolving with renewed confidence and discernible shifts in consumer priorities. That is according to China Trading Desk (CTD) and its latest China Outbound Travel Sentiment Survey for Q2 2025.

The survey reflects this ongoing transformation, capturing the “nuanced behaviors and motivations of a market steadily returning to pre-pandemic vibrancy”.

Chinese outbound travelers are displaying high intent, high spend, and digitally mediated shopping behaviors. The return of volume is no longer the story – the rewiring of decision-making, brand discovery, and purchase triggers is.

China Outbound Travel Sentiment Survey for Q2 2025 highlights

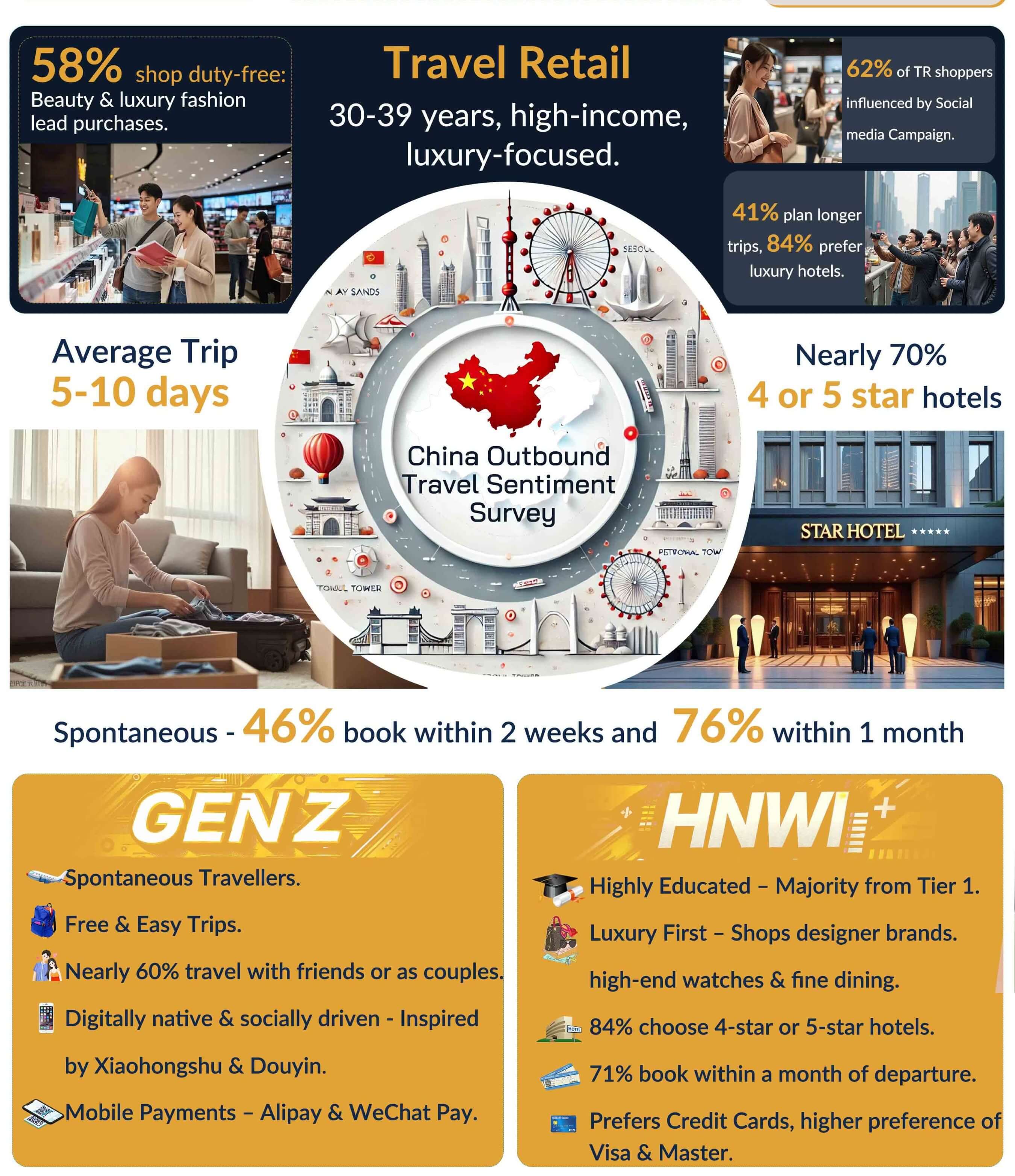

Highlights of the report include how 76% book international trips within one month, yet 78% conduct pre-trip product research. 49% budget over ¥25,000 per trip, but value perception and product validation drive conversion.

The report also indicates that social discovery via Xiaohongshu and Douyin is now the first retail touchpoint.

Flexibility and Spontaneity

One of the most striking developments in Q2, according to the CTD insights, is the reaffirmation of short-term travel planning, with 76% of Chinese travelers booking trips less than a month in advance. This continues the trend observed since early 2024 and highlights a sustained appetite for flexibility and spontaneity.

However, as the survey points out, juxtaposed with this is the deepening of travel intention, with nearly 69% of respondents planning to travel abroad one to two times in the coming year, a consistently high figure quarter after quarter.

The dominance of regional favorites such as Singapore, Japan, South Korea, and Thailand remains unchallenged. However, the rise of younger, tech-savvy, and largely female travelers—especially from Tier 1 cities including Beijing, Shanghai, Guangzhou and Shenzhen—continues to redefine how and why destinations are chosen.

Supported by digital fluency and social platform influence (notably Xiaohongshu and Douyin), this favors ‘Free & Easy’ travel experiences, with 46% of those surveyed citing it as their preferred mode. “Their reliance on peer reviews, short-form video, and real-time discovery calls for brands to double down on mobile-first, UGC-rich strategies,” the survey states.

Subramania Bhatt: “The Chinese traveler is returning, but not as you once knew them”

New frontier of outbound travel potential

Meanwhile, the 44% of respondents who have yet to travel internationally represent a fresh frontier of outbound travel potential. This group, largely cautious but aspirational, “underscores the importance of trust, simplicity, and value-conscious experiences in campaign design, particularly for brands in duty-free and travel retail sectors”.

The survey continues: “Budgeting behavior also tells an optimistic story. Nearly half (49%) of Chinese travelers now plan to spend over 25,000 RMB per trip, consistent with Q1 and Q4 2024, signaling sustained demand for quality-led, experience-rich travel, even amidst broader economic uncertainty.”

Subramania Bhatt, CEO and Founder of China Trading Desk, commented, “The Q2 report distils critical shifts into actionable guidance, empowering marketers, retailers, and destination leaders to anticipate emerging expectations. By decoding the cultural drivers, economic considerations, and digital behaviors that define the 2025 Chinese traveler, we can move beyond reactive strategies and design experiences that resonate at every touchpoint.

“As China progresses through mid-2025, the outbound travel market continues to chart a confident, recalibrated trajectory, evolving with renewed confidence and discernible shifts in consumer priorities. The Chinese traveler is returning, but not as you once knew them.”

Behavioral and Retail Trends

Chinese travelers are adopting an ‘impulse meets intent’ approach. Bookings are shorter and research is deeper.

While spontaneity continues – with three in four travelers booking on short notice – the decision to purchase is anything but random. At least 79% plan what to buy before departure, with mobile-led discovery and short-form content guiding both product selection and brand preference.

Travelers remain aspirational but increasingly rational:

- 67 – 68% prefer 4-star and above accommodation

- 25% look for duty-free discounts compared to domestic prices

- Shoppers expect bundled value, curated exclusivity, and justification to spend.

Shopper Personas & Motivational Drivers

Four Distinct Shopper Personas

The survey reveals four distinct shopper personas:

- Spontaneous Gen Z Explorer – Mobile-first, deal-seeking, highly influenced by XHS/Douyin

- Family-oriented Frequent Traveler – Value-driven, books in advance, multi-generational appeal

- Luxury-Seeking HNWI – High spend, low patience, seeks exclusivity and time efficiency

- Cautious First-Time Traveler – Peer-led, price-sensitive, prefers structured retail experiences.

The Five Economies – She, Value, Emotional, Silver and Confidence – remain, but there is a noticeable shift in emphasis:

- Confidence Economy grows: 44% of outbound travelers are first-timers

- Silver Economy matures: Health-focused, low social media usage, high trust need

- Value Economy sharpens: Travelers compare pricing, seek ‘smart buys’ across brands and platforms

Duty-Free & Travel Retail Specific Findings

Pre-departure digital is the new ‘front door’ for Chinese travelers. Shoppers are influenced weeks before travel by influencer content, shopping guides, and platform-native search.

78% prefer to compare prices via app or social review, with Beauty, Skincare, Wellness and exclusive editions leading the wish list.

The survey notes that airport shopping must evolve for the new, self-guided traveler, and the duty free and travel retail sector must respond to:

- Scan-to-learn QR touchpoints, short-form content integration

- Trust-building signage and product storytelling

- ‘First-timer bundles’ and simplified purchase flows.

Cross-Channel Implications

Retail is now omnichannel in behavior, if not in infrastructure. Travelers plan via digital (XHS, Douyin), compare via OTA and WeChat, and execute purchases in-store. The purchase, however, is shaped far earlier.

The CTD survey underlines that the DF&TR experience “begins on the feed, not the floor”.

What Brands Should Do Now

- Pre-engage digitally: Treat content as retail; seed early, especially on Douyin and Xiaohongshu

- Localize the offer: Price clarity, brand familiarity, and contextual gifting matter

- Design for trust: Authenticity, Mandarin signage, and simplified in-store navigation win over first-time and cautious travelers

- Invest in ‘digital pre-boarding’: Shift influencer strategies upstream to shape basket decisions.

“At China Trading Desk, we believe the future of duty-free lies not only in location, but in timing, influence, and trust,” Bhatt added. “The traveler journey has moved upstream – decisions are now made in the feed, not at the shelf. The brands that win in 2025 will be those that meet the Chinese traveler earlier, more authentically, and with greater relevance.”

REGION Asia International