As the July 9 deadline for the end of the China-U.S. tariff pause speeds closer, the outlook for the trans-Pacific ocean trade is less than clear.

Although tariffs and other details are not known, President Donald Trump said that the U.S. has signed an agreement with China that will see a resumption of the latter’s trade in rare earth minerals in exchange for the U.S. ending some countermeasures.

The administration said it plans to finalize negotiations with its top 10 trade partners after July 4 and may unilaterally impose tariffs on other nations soon.

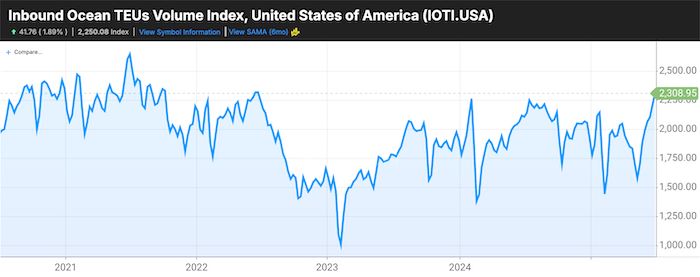

A tariff reduction on Chinese goods by the U.S. on May 12 led to a rebound in China-US container volumes, but this seems to be losing momentum, SONAR data partner and shipping analyst Freightos said in an update. Carriers, possibly anticipating a more prolonged demand surge, have increased capacity on the trans-Pacific, particularly to the U.S. West Coast, which now appears out of balance with demand.

While SONAR data shows loaded containers departing China for West Coast ports approaching record levels, freight rates have suffered a precipitous drop amid weeks of weakening demand.

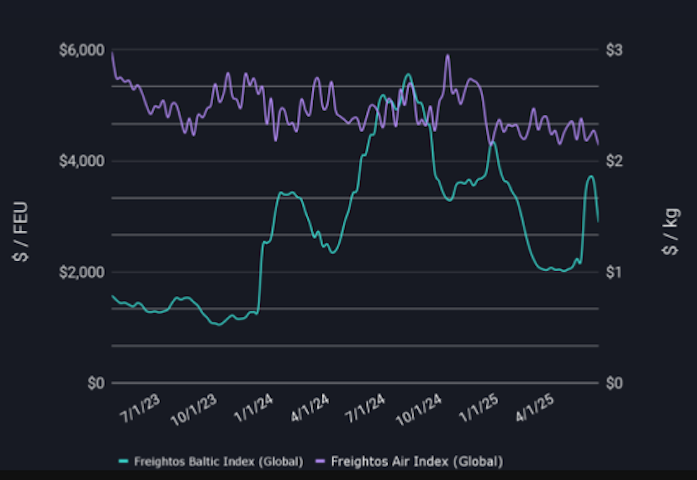

Freightos said that between late May and mid-June, rates for Asia to North America West Coast containers surged by over $3,000 per forty foot equivalent unit (FEU), or 115%, to $6,000. However, by the end of last week, a combination of demand and capacity issues caused a sharp decline in the average rate to $3,388 per FEU, which is 43% below June’s peak, though still 22% higher than late May.

East Coast rates saw a similar, though less dramatic, trend. They surged 80% from late May to mid-June, reaching approximately $7,200 per FEU but fell 15% to $6,116 by the end of the month. This significant drop in rates, occurring early in the typical peak season, has led carriers to consider reducing capacity.

Freightos Head of Research Judah Levine in a note said that even with these tariff-driven pressures that pushed rates up sharply in June, the peaks for both lanes were at least $1,000 per FEU lower than a year ago, and may indicate overall capacity growth in the container market.

Asia-Europe and Mediterranean rates both concluded June with a 25% month-on-month increase, reaching $2,969 and $4,222 respectively. Red Sea diversions initiated an earlier peak season on this lane, with port congestion and capacity shifts to the trans-Pacific contributing to rate increases in early and mid-June.

However, rates on both lanes cooled by month-end, suggesting market conditions may not support upcoming July general rate increases (GRIs) by carriers. Despite this, liner plans for significant capacity reductions — unusual for peak season — could still facilitate additional rate hikes. Similar to the trans-Pacific, current rates on these lanes are substantially lower than a year ago, indicating that increased capacity is exerting downward pressure on rates, even as carriers continue to avoid the Red Sea.

But other market sources say container rates out of China are even lower.

“Spot rates dropped to somewhere between $2,000 to $2,500 (depending upon carrier) and have hovered around $2,500 for two weeks now,” said consultant Jon Monroe in a LinkedIn post. “Rates have fallen fast, space out of China’s base ports is wide open, and so far, carriers haven’t flexed their capacity control muscle to put the squeeze on the market.”

Monroe added that carriers that recently jumped into the trans-Pacific are offering rates at or just below $2,000 to the West Coast.

“The gap between East Coast and West Coast rates has settled back to normal, at about $1,000,” Monroe said. ”Right now, everyone’s just sitting tight, waiting to see what Trump decides to do with tariffs.”

Find more articles by Stuart Chirls here.

Related coverage:

Why 44% fewer cancelled sailings could be [blanking] bad news for SoCal trucking

US maritime chief ‘not a big fan’ of ocean carriers’ ‘approach’ as agency reviews antitrust immunity

Drewry: No “lasting impact” from tariff break as ocean rates fall again

With Mideast shipping on high alert, Maersk re-opens Israel port

![[News] U.S. Reportedly Lifts Export Curbs on EDA Software to China](https://koala-by.com/wp-content/uploads/2025/07/synopsys-logo-624x351.jpg)