China has signaled that it is willing to resume trade talks with the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Officials in Beijing also accused the administration of U.S. President Donald Trump of creating “panic” over China’s control of rare earth metals, minerals, and magnets. However, Beijing also appears to be ratcheting down the current tensions by saying that it is open to trade talks to resolve its dispute with the U.S. that has threatened to cause an all-out trade war between the world’s two biggest economies.

“The US interpretation seriously distorts and exaggerates China’s measures, deliberately creating unnecessary misunderstanding and panic,” said a Chinese Ministry of Commerce spokesperson, according to local media reports.

Back from the Brink

Beijing last week announced sweeping controls on rare earth exports to the U.S. ahead of an expected meeting between Trump and President Xi Jinping in South Korea later in October. Trump responded by imposing 100% tariffs on all Chinese imports into the U.S. starting on Nov. 1.

The situation has roiled global financial markets, sending them down over the past week. However, U.S. government officials also appear to be toning down the rhetoric in an effort to resume trade talks with China and ease market concerns. U.S. Trade Representative Jamieson Greer said in a recent interview that Trump wants to work with Beijing and that he is still planning to meet with President Xi in coming weeks.

Is the SPDR S&P 500 ETF Trust a Buy?

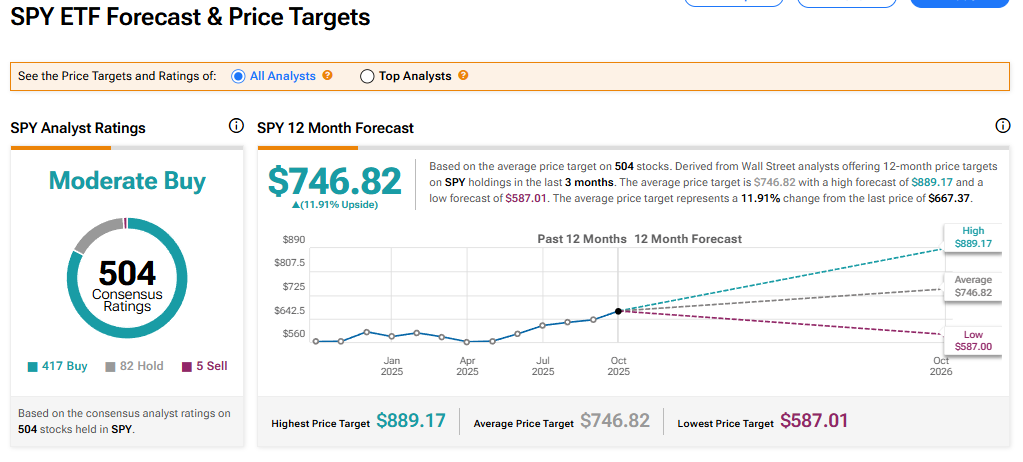

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 82 Hold, and five Sell recommendations issued in the last three months. The average SPY price target of $746.82 implies 11.91% upside from current levels.

![[News] Microsoft Reportedly Moving Most Laptop and Server Production Outside China as Early as 2026](https://koala-by.com/wp-content/uploads/2025/10/Microsoft-20250909-624x458.jpg)