The finding is based on a 6 per cent conversion ratio of excess deposits estimated at between 8 trillion and 10 trillion yuan and the experience of the US economy emerging from its own pandemic restrictions in 2021, according to a report published by the Swiss bank on Wednesday.

Cyclical stocks from software developers to brokerages and companies engaged in consumer services stand to benefit most from retail buying, it said.

“Our studies of overseas markets suggest many countries experienced a material pickup in household deposits during Covid lockdowns, and when these economies reopened and consumer confidence improved, deposit growth slowed as consumers increased spending and invested in riskier assets,” analysts led by James Wang wrote in the report.

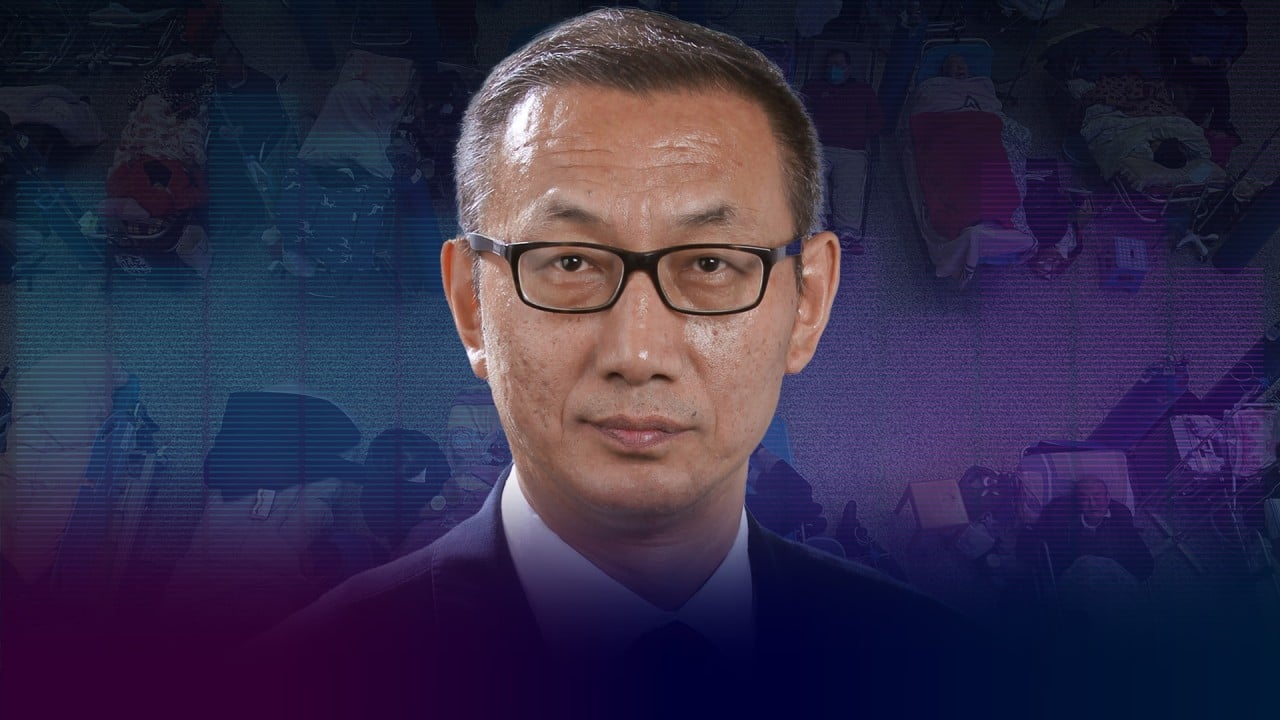

29:55

China’s Covid crisis: What went wrong and how bad is it? | Talking Post with Yonden Lhatoo

China’s Covid crisis: What went wrong and how bad is it? | Talking Post with Yonden Lhatoo

The UBS call may instil some confidence in the bulls betting a rally in Chinese stocks that started in November, when all pandemic curbs were scrapped, has further to run.

After a 20 per cent gain through the end of January, China’s onshore stocks, also known as A shares, have lost some momentum because of a lack of key economic data pointing to a sustained recovery and in the run-up to the annual legislative meeting that will elect new government leaders in the coming weeks.

Visited 1 times, 1 visit(s) today